Kore SPAC Presentation Deck

Valuation Benchmarking

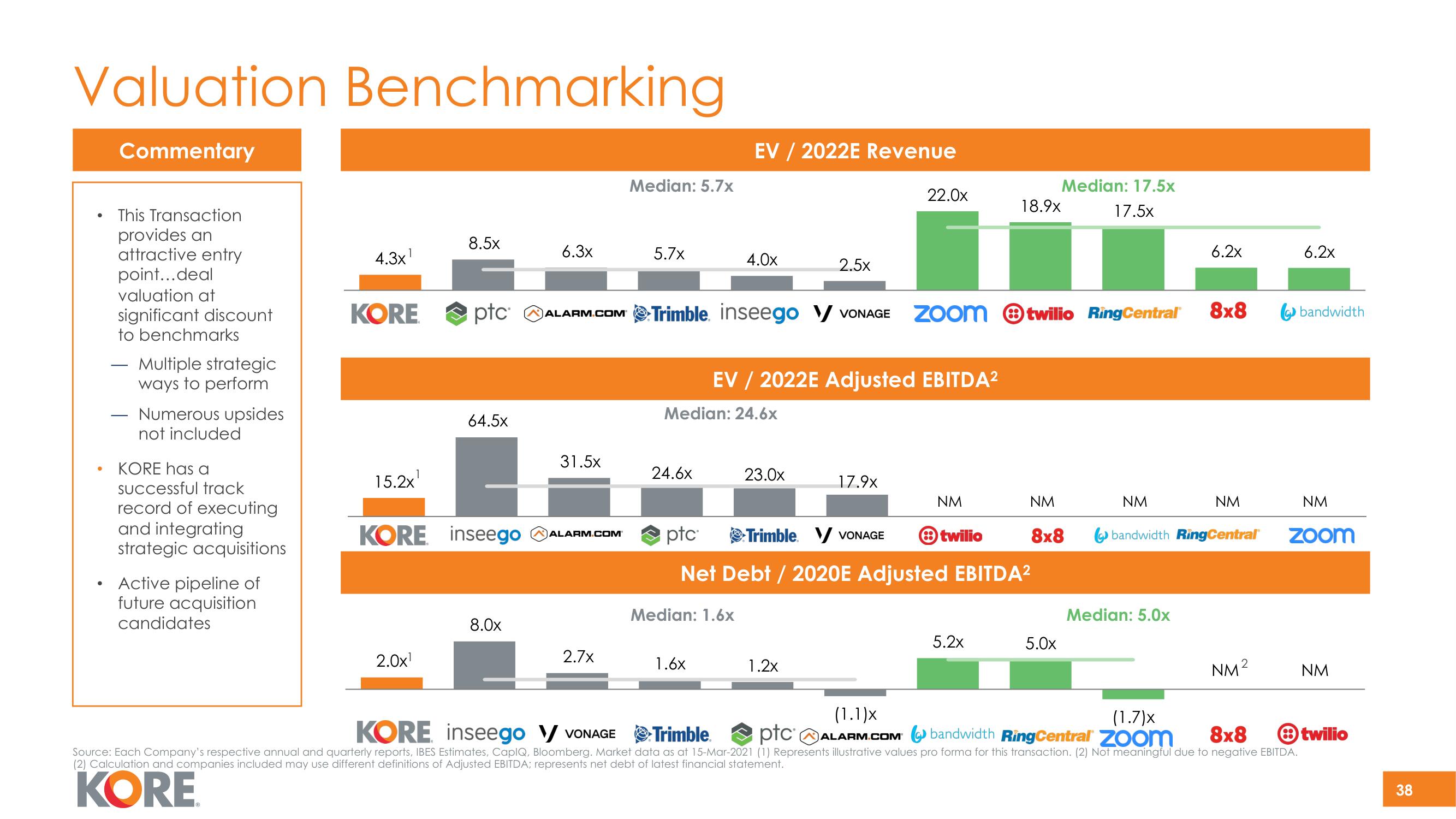

Commentary

This Transaction

provides an

attractive entry

point...deal

valuation at

significant discount

to benchmarks

Multiple strategic

ways to perform

Numerous upsides

not included

KORE has a

successful track

record of executing

and integrating

strategic acquisitions

Active pipeline of

future acquisition

candidates

4.3x¹

KORE ptc

15.2x¹

8.5x

2.0x¹

64.5×

KORE inseego

8.0x

6.3x

ALARM.COM

31.5x

ALARM.COM

2.7x

Median: 5.7x

5.7x

24.6x

EV / 2022E Revenue

4.0x

Median: 24.6x

Median: 1.6x

1.6x

Trimble inseego V VONAGE zoom twilio RingCentral® 8x8

EV / 2022E Adjusted EBITDA²

2.5x

23.0x

22.0x

1.2x

17.9x

NM

ptc

Trimble V VONAGE 8 twilio

Net Debt / 2020E Adjusted EBITDA²

18.9x

5.2x

NM

Median: 17.5x

17.5×

8x8

5.0x

NM

6.2x

Median: 5.0x

NM

bandwidth RingCentral

NM²

6.2x

(1.1)x

(1.7)x

KORE inseego V VONAGE Trimble

ptc ALARM.COM bandwidth RingCentral zoom

8x8

Source: Each Company's respective annual and quarterly reports, IBES Estimates, CapIQ, Bloomberg. Market data as at 15-Mar-2021 (1) Represents illustrative values pro forma for this transaction. (2) Not meaningful due to negative EBITDA.

(2) Calculation and companies included may use different definitions of Adjusted EBITDA; represents net debt of latest financial statement.

KORE

bandwidth

NM

zoom

NM

twilio

38View entire presentation