Aeva Investor Presentation Deck

Robust Growth Trajectory

• We sell perception solutions across four verticals

4D LIDAR System + Perception Software for Automotive, Industrial, and Security

Silicon Photonics Engine + Software algorithms for Consumer Electronics

• Sales to Automotive OEMs for production vehicles expected to commence in

2024E and include ADAS and Autonomous solutions for Passenger Vehicles,

Trucks and Technology / Mobility

●

Top 4 customers represent 50% of 2025E Automotive revenue

Customers across passenger vehicle, trucking, and mobility drive broad

adoption in Automotive and represent high-growth revenue opportunities

Collaborations with top Tier-1s including Denso and ZF significantly expand

Aeva's 4D LIDAR distribution reach to the world's top OEMs

Existing customer demand beyond automotive to deploy Aeva's 4D LIDAR for

production in:

Depth sensing and Biometric applications for consumer electronics

Autonomous navigation and safety function for industrial robotics

Next-generation security application

• Prior to series production which is expected to occur in 2024E, revenue is

primarily from:

Automotive development unit sales

Non-automotive development unit sales

NRE revenue

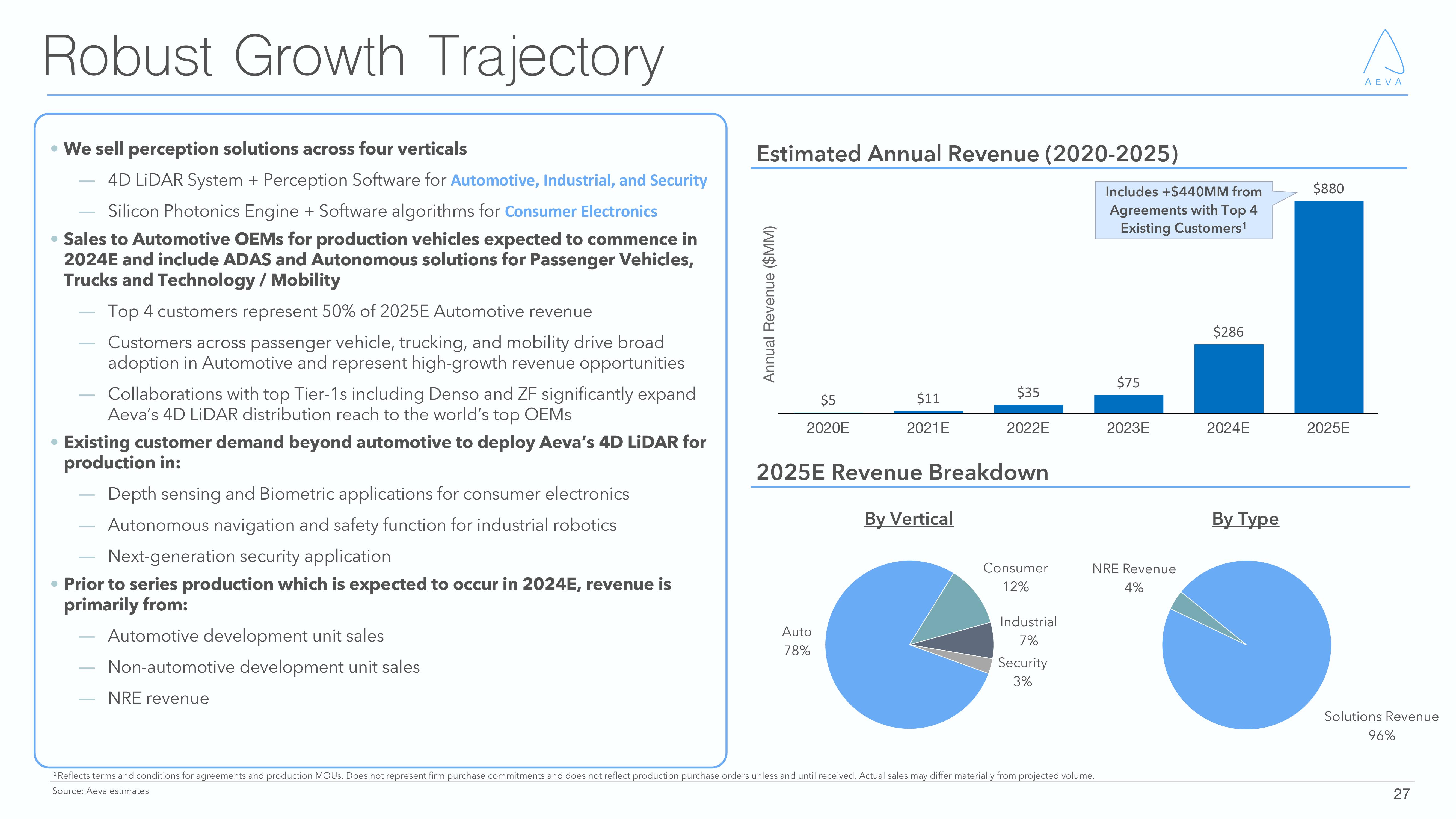

Estimated Annual Revenue (2020-2025)

Annual Revenue ($MM)

$5

2020E

$11

2021E

Auto

78%

$35

2022E

2025E Revenue Breakdown

By Vertical

Consumer

12%

Industrial

7%

Security

3%

Includes +$440MM from

Agreements with Top 4

Existing Customers¹

¹Reflects terms and conditions for agreements and production MOUS. Does not represent firm purchase commitments and does not reflect production purchase orders unless and until received. Actual sales may differ materially from projected volume.

Source: Aeva estimates

$75

2023E

NRE Revenue

4%

$286

2024E

By Type

$880

2025E

AEVA

Solutions Revenue

96%

27View entire presentation