Engine No. 1 Activist Presentation Deck

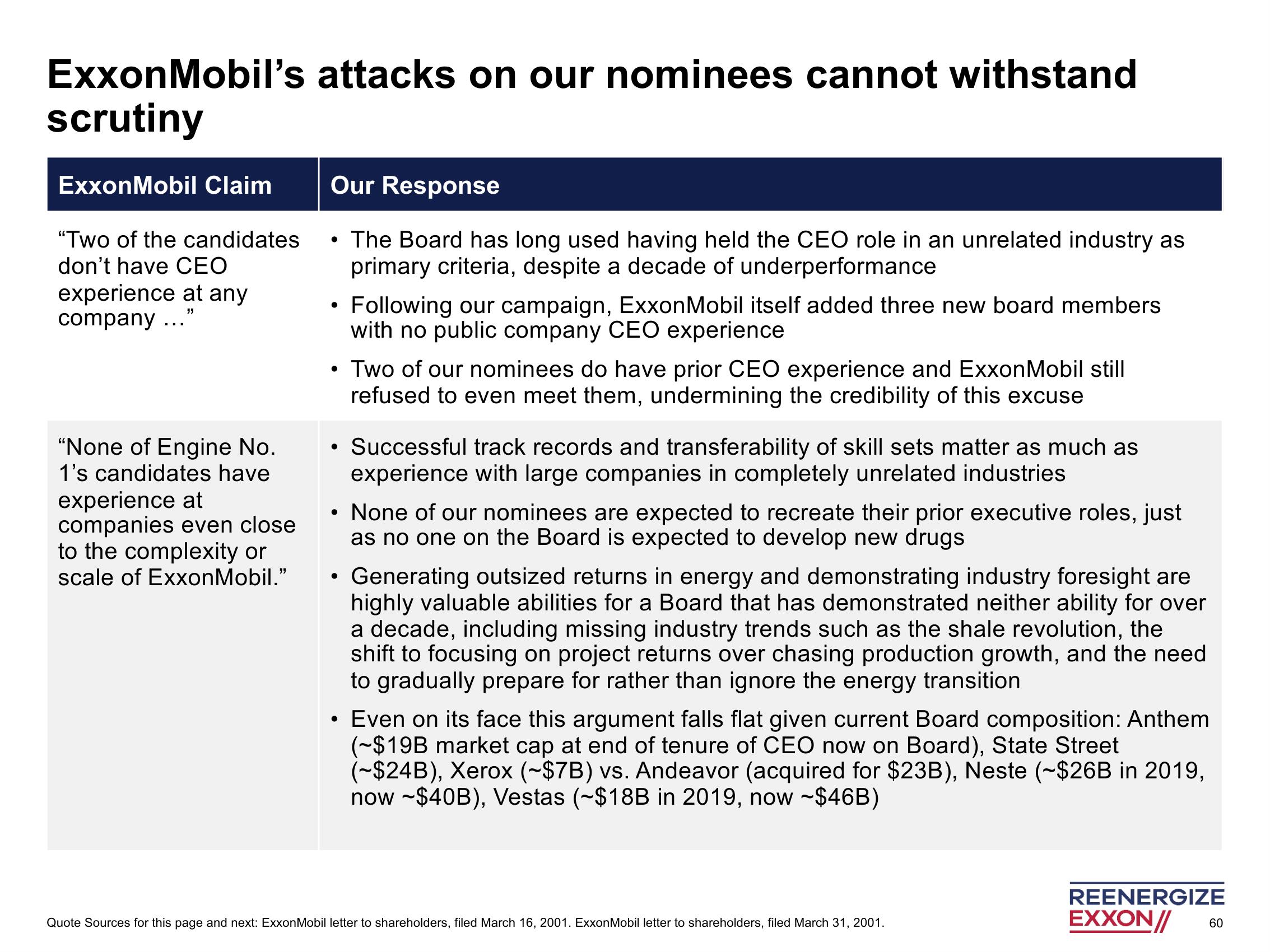

ExxonMobil's attacks on our nominees cannot withstand

scrutiny

ExxonMobil Claim

"Two of the candidates

don't have CEO

experience at any

company ..."

"None of Engine No.

1's candidates have

experience at

companies even close

to the complexity or

scale of ExxonMobil."

Our Response

The Board has long used having held the CEO role in an unrelated industry as

primary criteria, despite a decade of underperformance

• Following our campaign, ExxonMobil itself added three new board members

with no public company CEO experience

• Two of our nominees do have prior CEO experience and ExxonMobil still

refused to even meet them, undermining the credibility of this excuse

●

Successful track records and transferability of skill sets matter as much as

experience with large companies in completely unrelated industries

None of our nominees are expected to recreate their prior executive roles, just

as no one on the Board is expected to develop new drugs

Generating outsized returns in energy and demonstrating industry foresight are

highly valuable abilities for a Board that has demonstrated neither ability for over

a decade, including missing industry trends such as the shale revolution, the

shift to focusing on project returns over chasing production growth, and the need

to gradually prepare for rather than ignore the energy transition

Even on its face this argument falls flat given current Board composition: Anthem

(-$19B market cap at end of tenure of CEO now on Board), State Street

(~$24B), Xerox (~$7B) vs. Andeavor (acquired for $23B), Neste (~$26B in 2019,

now ~$40B), Vestas (~$18B in 2019, now -$46B)

Quote Sources for this page and next: ExxonMobil letter to shareholders, filed March 16, 2001. ExxonMobil letter to shareholders, filed March 31, 2001.

REENERGIZE

EXXON//

60View entire presentation