Maersk Investor Presentation Deck

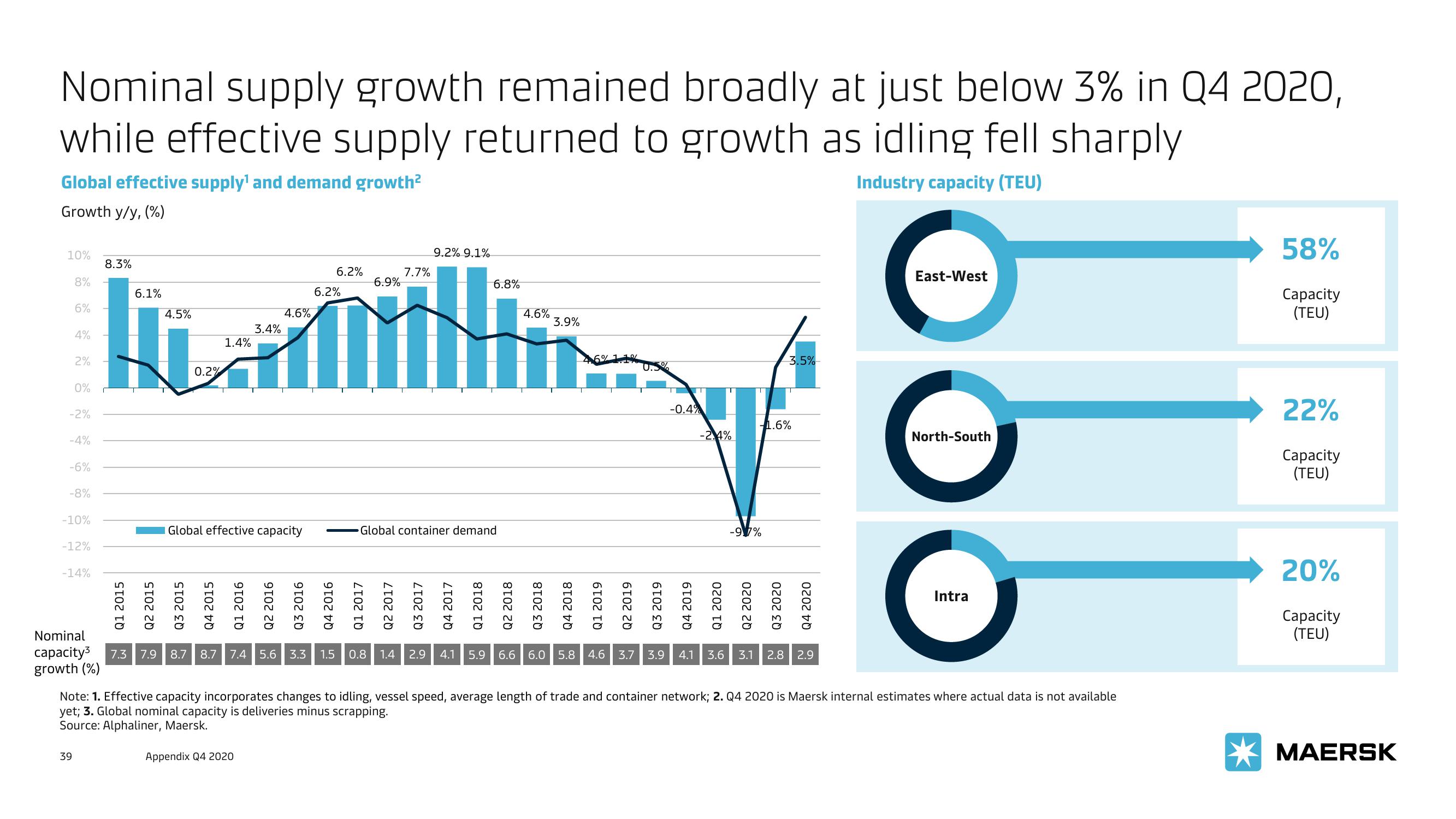

Nominal supply growth remained broadly at just below 3% in Q4 2020,

while effective supply returned to growth as idling fell sharply

Global effective supply¹ and demand growth²

Industry capacity (TEU)

Growth y/y, (%)

10%

8%

6%

4%

2%

0%

-2%

-4%

-6%

-8%

-10%

39

-12%

-14%

Nominal

capacity³

growth (%)

8.3%

Q1 2015

6.1%

Q2 2015

4.5%

0.2%

Q3 2015

1.4%

Q4 2015

Global effective capacity

3.4%

Q1 2016

Appendix Q4 2020

4.6%

Q2 2016

7.3 7.9 8.7 8.7 7.4 5.6 3.3

6.2%

6.2%

Q3 2016

Q4 2016

Q1 2017

1.5

6.9%

7.7%

Q2 2017

Global container demand

9.2% 9.1%

U

Q3 2017

Q4 2017

6.8%

Q1 2018

4.6%

Q2 2018

Q3 2018

3.9%

Q4 2018

Q1 2019

Q2 2019

0.5%

Q3 2019

0.8 1.4 2.9 4.1 5.9 6.6 6.0 5.8 4.6 3.7 3.9

T

-0.4%

Q4 2019

T

-2.4%

Q1 2020

T

Q2 2020

-9,7%

3.5%

-1.6%

Q3 2020

T

Q4 2020

4.1 3.6 3.1 2.8 2.9

East-West

DOO

North-South

Note: 1. Effective capacity incorporates changes to idling, vessel speed, average length of trade and container network; 2. Q4 2020 is Maersk internal estimates where actual data is not available

yet; 3. Global nominal capacity is deliveries minus scrapping.

Source: Alphaliner, Maersk.

Intra

58%

Capacity

(TEU)

22%

Capacity

(TEU)

20%

Capacity

(TEU)

MAERSKView entire presentation