J.P.Morgan Results Presentation Deck

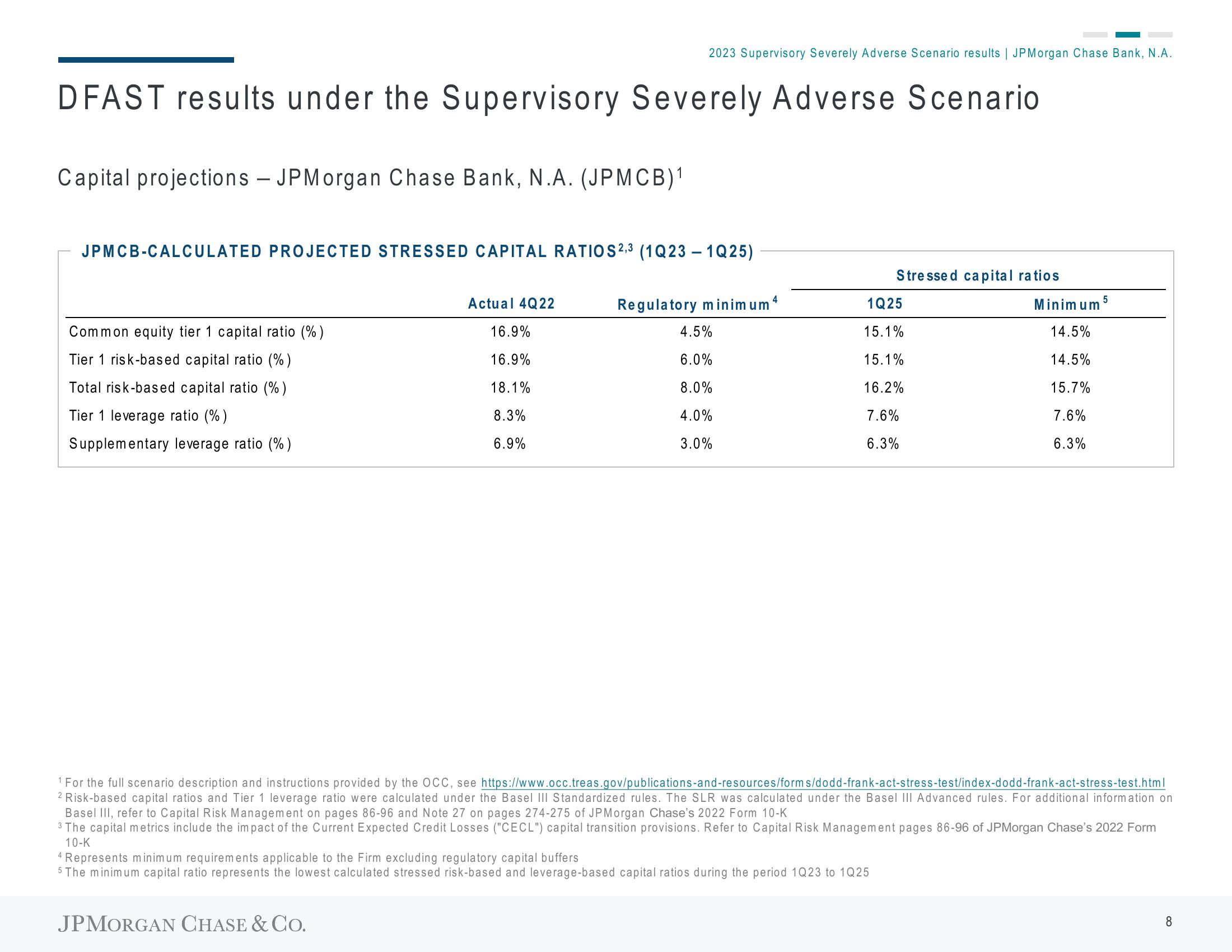

DFAST results under the Supervisory Severely Adverse Scenario

Capital projections - JPMorgan Chase Bank, N.A. (JPMCB)¹

JPMCB-CALCULATED PROJECTED STRESSED CAPITAL RATIOS 2,3 (1Q23 - 1Q25)

Common equity tier 1 capital ratio (%)

Tier 1 risk-based capital ratio (%)

Total risk-based capital ratio (%)

Tier 1 leverage ratio (%)

Supplementary leverage ratio (%)

2023 Supervisory Severely Adverse Scenario results | JPMorgan Chase Bank, N.A.

Actual 4Q22

16.9%

16.9%

18.1%

8.3%

6.9%

JPMORGAN CHASE & CO.

Regulatory minimum

4.5%

6.0%

8.0%

4.0%

3.0%

4

Stressed capital ratios

1Q25

15.1%

15.1%

16.2%

7.6%

6.3%

4 Represents minimum requirements applicable to the Firm excluding regulatory capital buffers

5 The minimum capital ratio represents the lowest calculated stressed risk-based and leverage-based capital ratios during the period 1Q23 to 1Q25

Minimum

14.5%

14.5%

15.7%

7.6%

6.3%

¹ For the full scenario description and instructions provided by the OCC, see https://www.occ.treas.gov/publications-and-resources/forms/dodd-frank-act-stress-test/index-dodd-frank-act-stress-test.html

2 Risk-based capital ratios and Tier 1 leverage ratio were calculated under the Basel III Standardized rules. The SLR was calculated under the Basel III Advanced rules. For additional information on

Basel III, refer to Capital Risk Management on pages 86-96 and Note 27 on pages 274-275 of JPMorgan Chase's 2022 Form 10-K

3 The capital metrics include the impact of the Current Expected Credit Losses ("CECL") capital transition provisions. Refer to Capital Risk Management pages 86-96 of JPMorgan Chase's 2022 Form

10-K

5

8View entire presentation