Allwyn Results Presentation Deck

Consolidated P&L

●

●

14

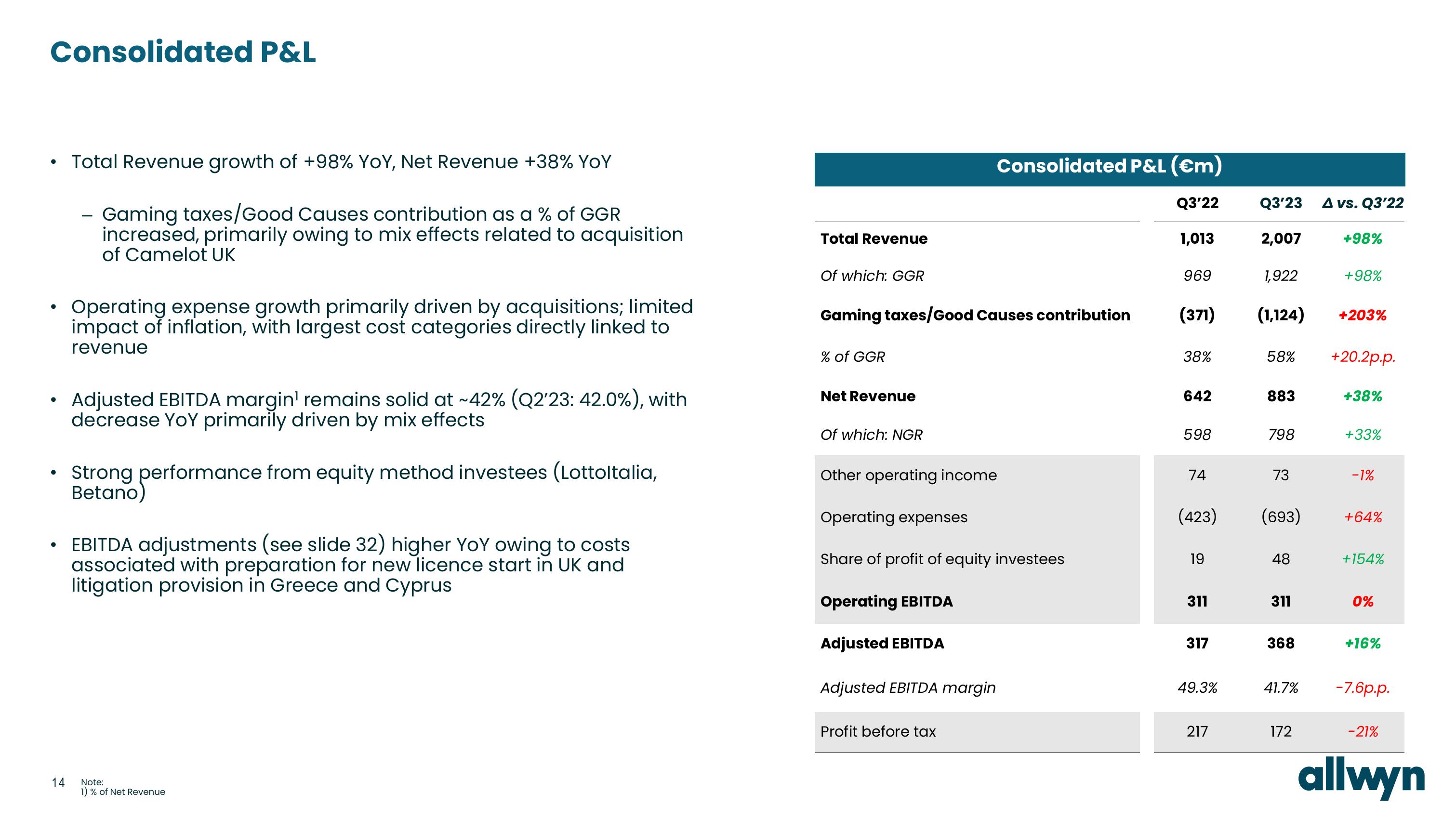

Total Revenue growth of +98% YOY, Net Revenue +38% YoY

Gaming taxes/Good Causes contribution as a % of GGR

increased, primarily owing to mix effects related to acquisition

of Camelot UK

Operating expense growth primarily driven by acquisitions; limited

impact of inflation, with largest cost categories directly linked to

revenue

Adjusted EBITDA margin¹ remains solid at ~42% (Q2'23: 42.0%), with

decrease YoY primarily driven by mix effects

Strong performance from equity method investees (Lottoltalia,

Betano)

EBITDA adjustments (see slide 32) higher YoY owing to costs

associated with preparation for new licence start in UK and

litigation provision in Greece and Cyprus

Note:

1) % of Net Revenue

Total Revenue

Of which: GGR

Gaming taxes/Good Causes contribution

% of GGR

Net Revenue

Of which: NGR

Other operating income

Operating expenses

Share of profit of equity investees

Operating EBITDA

Adjusted EBITDA

Consolidated P&L (€m)

Q3'22

1,013

Adjusted EBITDA margin

Profit before tax

969

(371)

38%

642

598

74

(423)

19

311

317

49.3%

217

Q3'23 A vs. Q3'22

2,007

1,922

(1,124)

58%

883

798

73

(693)

48

311

368

41.7%

172

+98%

+98%

+203%

+20.2p.p.

+38%

+33%

-1%

+64%

+154%

0%

+16%

-7.6p.p.

-21%

allwynView entire presentation