Bird SPAC Presentation Deck

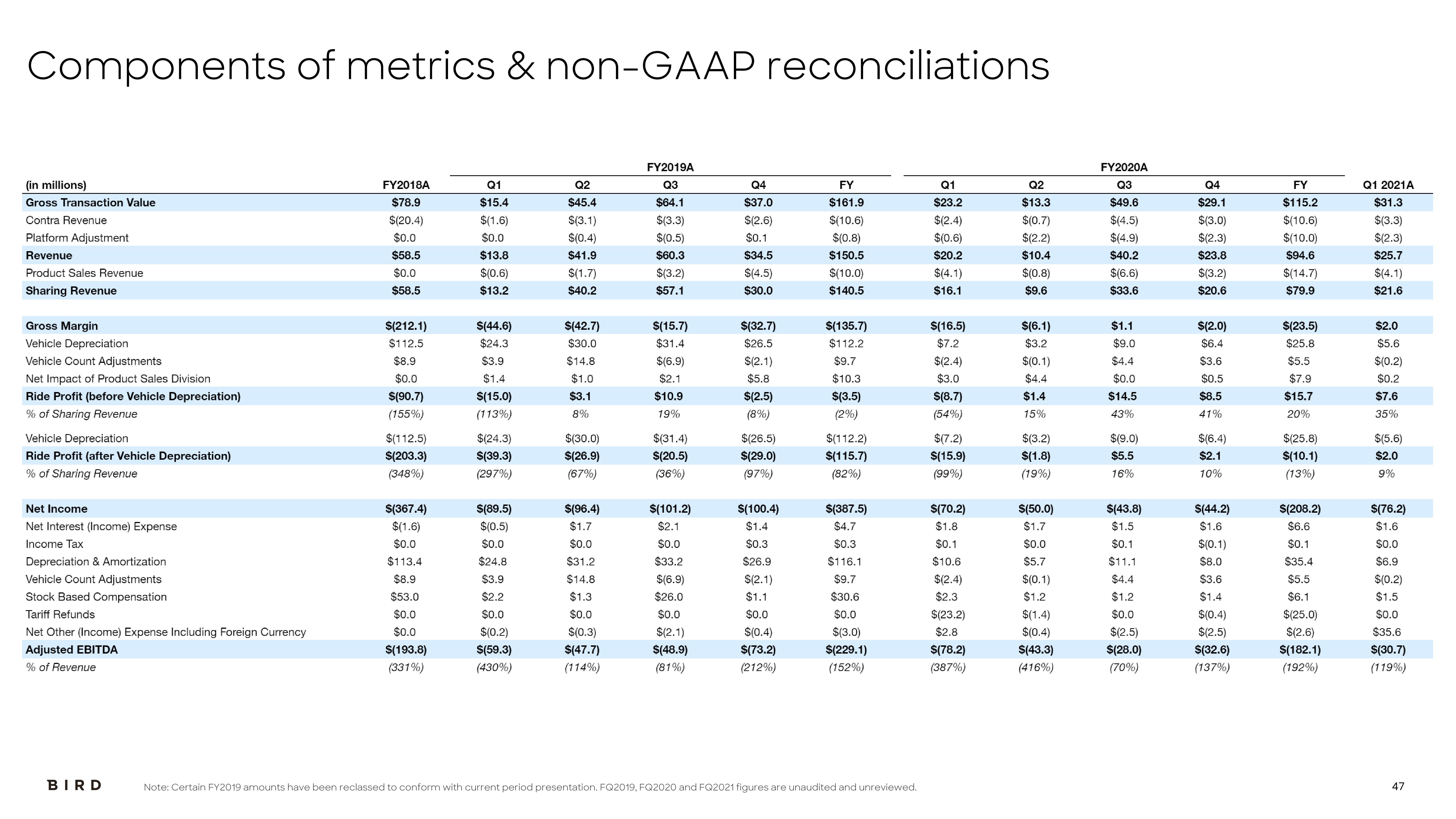

Components of metrics & non-GAAP reconciliations

(in millions)

Gross Transaction Value

Contra Revenue

Platform Adjustment

Revenue

Product Sales Revenue

Sharing Revenue

Gross Margin

Vehicle Depreciation

Vehicle Count Adjustments

Net Impact of Product Sales Division

Ride Profit (before Vehicle Depreciation)

% of Sharing Revenue

Vehicle Depreciation

Ride Profit (after Vehicle Depreciation)

% of Sharing Revenue

Net Income

Net Interest (Income) Expense

Income Tax

Depreciation & Amortization

Vehicle Count Adjustments

Stock Based Compensation

Tariff Refunds

Net Other (Income) Expense Including Foreign Currency

Adjusted EBITDA

% of Revenue

BIRD

FY2018A

$78.9

$(20.4)

$0.0

$58.5

$0.0

$58.5

$(212.1)

$112.5

$8.9

$0.0

$(90.7)

(155%)

$(112.5)

$(203.3)

(348%)

$(367.4)

$(1.6)

$0.0

$113.4

$8.9

$53.0

$0.0

$0.0

$(193.8)

(331%)

Q1

$15.4

$(1.6)

$0.0

$13.8

$(0.6)

$13.2

$(44.6)

$24.3

$3.9

$1.4

$(15.0)

(113%)

$(24.3)

$(39.3)

(297%)

$(89.5)

$(0.5)

$0.0

$24.8

$3.9

$2.2

$0.0

$(0.2)

$(59.3)

(430%)

Q2

$45.4

$(3.1)

$(0.4)

$41.9

$(1.7)

$40.2

$(42.7)

$30.0

$14.8

$1.0

$3.1

8%

$(30.0)

$(26.9)

(67%)

$(96.4)

$1.7

$0.0

$31.2

$14.8

$1.3

$0.0

$(0.3)

$(47.7)

(114%)

FY2019A

Q3

$64.1

$(3.3)

$(0.5)

$60.3

$(3.2)

$57.1

$(15.7)

$31.4

$(6.9)

$2.1

$10.9

19%

$(31.4)

$(20.5)

(36%)

$(101.2)

$2.1

$0.0

$33.2

$(6.9)

$26.0

$0.0

$(2.1)

$(48.9)

(81%)

Q4

$37.0

$(2.6)

$0.1

$34.5

$(4.5)

$30.0

$(32.7)

$26.5

$(2.1)

$5.8

$(2.5)

(8%)

$(26.5)

$(29.0)

(97%)

$(100.4)

$1.4

$0.3

$26.9

$(2.1)

$1.1

$0.0

$(0.4)

$(73.2)

(212%)

FY

$161.9

$(10.6)

$(0.8)

$150.5

$(10.0)

$140.5

$(135.7)

$112.2

$9.7

$10.3

$(3.5)

(2%)

$(112.2)

$(115.7)

(82%)

$(387.5)

$4.7

$0.3

$116.1

$9.7

$30.6

$0.0

$(3.0)

$(229.1)

(152%)

Note: Certain FY2019 amounts have been reclassed to conform with current period presentation. FQ2019, FQ2020 and FQ2021 figures are unaudited and unreviewed.

Q1

$23.2

$(2.4)

$(0.6)

$20.2

$(4.1)

$16.1

$(16.5)

$7.2

$(2.4)

$3.0

$(8.7)

(54%)

$(7.2)

$(15.9)

(99%)

$(70.2)

$1.8

$0.1

$10.6

$(2.4)

$2.3

$(23.2)

$2.8

$(78.2)

(387%)

Q2

$13.3

$(0.7)

$(2.2)

$10.4

$(0.8)

$9.6

$(6.1)

$3.2

$(0.1)

$4.4

$1.4

15%

$(3.2)

$(1.8)

(19%)

$(50.0)

$1.7

$0.0

$5.7

$(0.1)

$1.2

$(1.4)

$(0.4)

$(43.3)

(416%)

FY2020A

Q3

$49.6

$(4.5)

$(4.9)

$40.2

$(6.6)

$33.6

$1.1

$9.0

$4.4

$0.0

$14.5

43%

$(9.0)

$5.5

16%

$(43.8)

$1.5

$0.1

$11.1

$4.4

$1.2

$0.0

$(2.5)

$(28.0)

(70%)

Q4

$29.1

$(3.0)

$(2.3)

$23.8

$(3.2)

$20.6

$(2.0)

$6.4

$3.6

$0.5

$8.5

41%

$(6.4)

$2.1

10%

$(44.2)

$1.6

$(0.1)

$8.0

$3.6

$1.4

$(0.4)

$(2.5)

$(32.6)

(137%)

FY

$115.2

$(10.6)

$(10.0)

$94.6

$(14.7)

$79.9

$(23.5)

$25.8

$5.5

$7.9

$15.7

20%

$(25.8)

$(10.1)

(13%)

$(208.2)

$6.6

$0.1

$35.4

$5.5

$6.1

$(25.0)

$(2.6)

$(182.1)

(192%)

Q1 2021A

$31.3

$(3.3)

$(2.3)

$25.7

$(4.1)

$21.6

$2.0

$5.6

$(0.2)

$0.2

$7.6

35%

$(5.6)

$2.0

9%

$(76.2)

$1.6

$0.0

$6.9

$(0.2)

$1.5

$0.0

$35.6

$(30.7)

(119%)

47View entire presentation