Barclays Capital 2010 Global Financial Services Conference

1

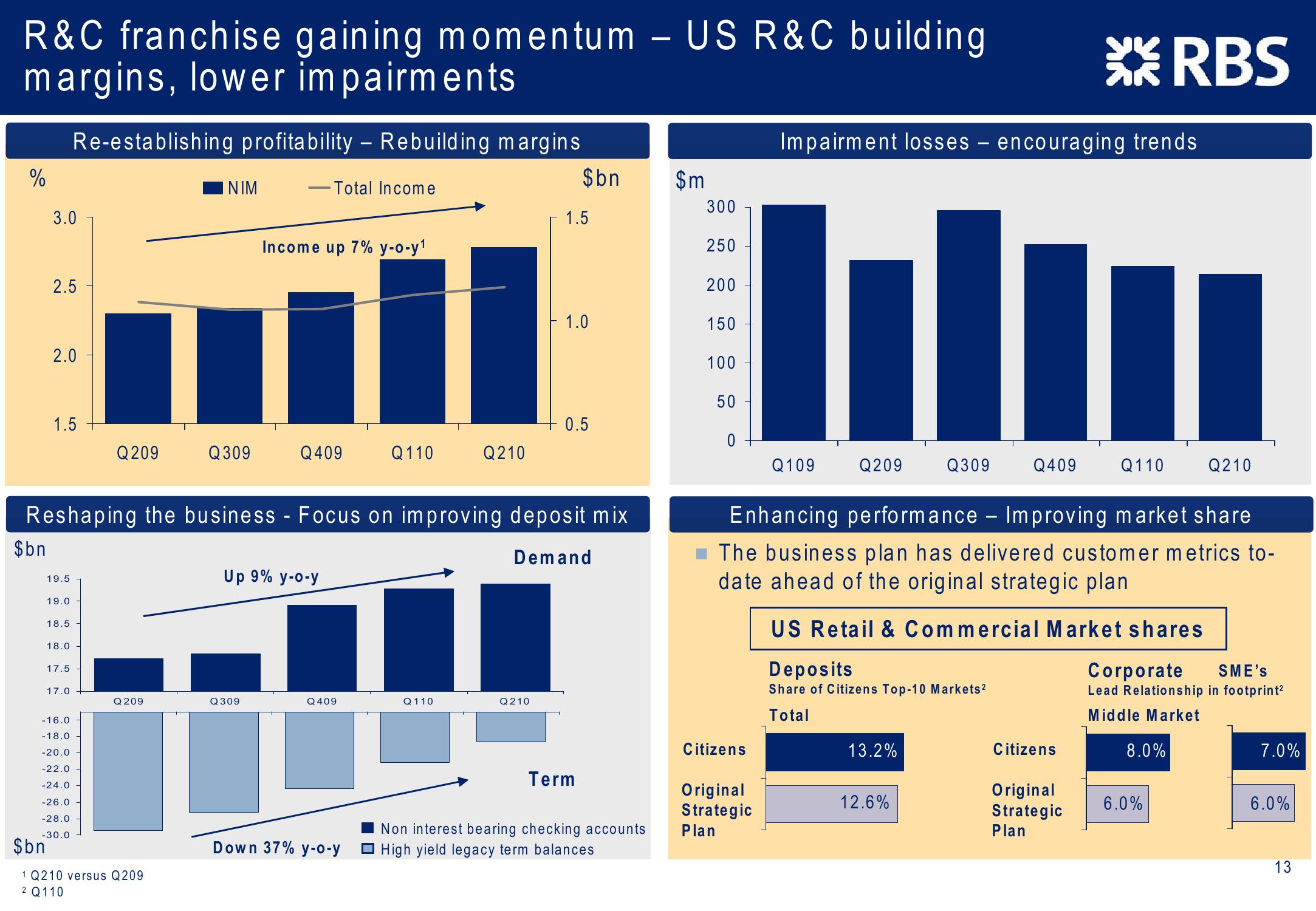

R&C franchise gaining momentum – US R&C building

margins, lower impairments

%

Re-establishing profitability - Rebuilding margins

INIM

-Total Income

XRBS

Impairment losses - encouraging trends

$bn

$m

300

3.0

1.5

Income up 7% y-o-y1

250

2.5

200

- 1.0

150

2.0

100

50

1.5

0.5

0

Q209

Q309

Q409

Q110

Q210

Q109

Q209

Q309

Q409

Q110

T

Q210

Reshaping the business - Focus on improving deposit mix

Up 9% y-o-y

Demand

$bn

19.5

19.0

18.5

18.0

17.5

17.0

Q209

Q309

Q409

Q110

Q210

-16.0

-18.0

-20.0

-22.0

-24.0

-26.0

-28.0

$bn

-30.0

1 Q210 versus Q209

2 Q110

Down 37% y-o-y

Term

Non interest bearing checking accounts

☐ High yield legacy term balances

Enhancing performance – Improving market share

The business plan has delivered customer metrics to-

date ahead of the original strategic plan

US Retail & Commercial Market shares

Deposits

Share of Citizens Top-10 Markets²

Corporate

SME's

Lead Relationship in footprint²

Total

Middle Market

Citizens

13.2%

Citizens

8.0%

7.0%

Original

12.6%

Strategic

Plan

Original

Strategic

Plan

6.0%

6.0%

13View entire presentation