Baird Investment Banking Pitch Book

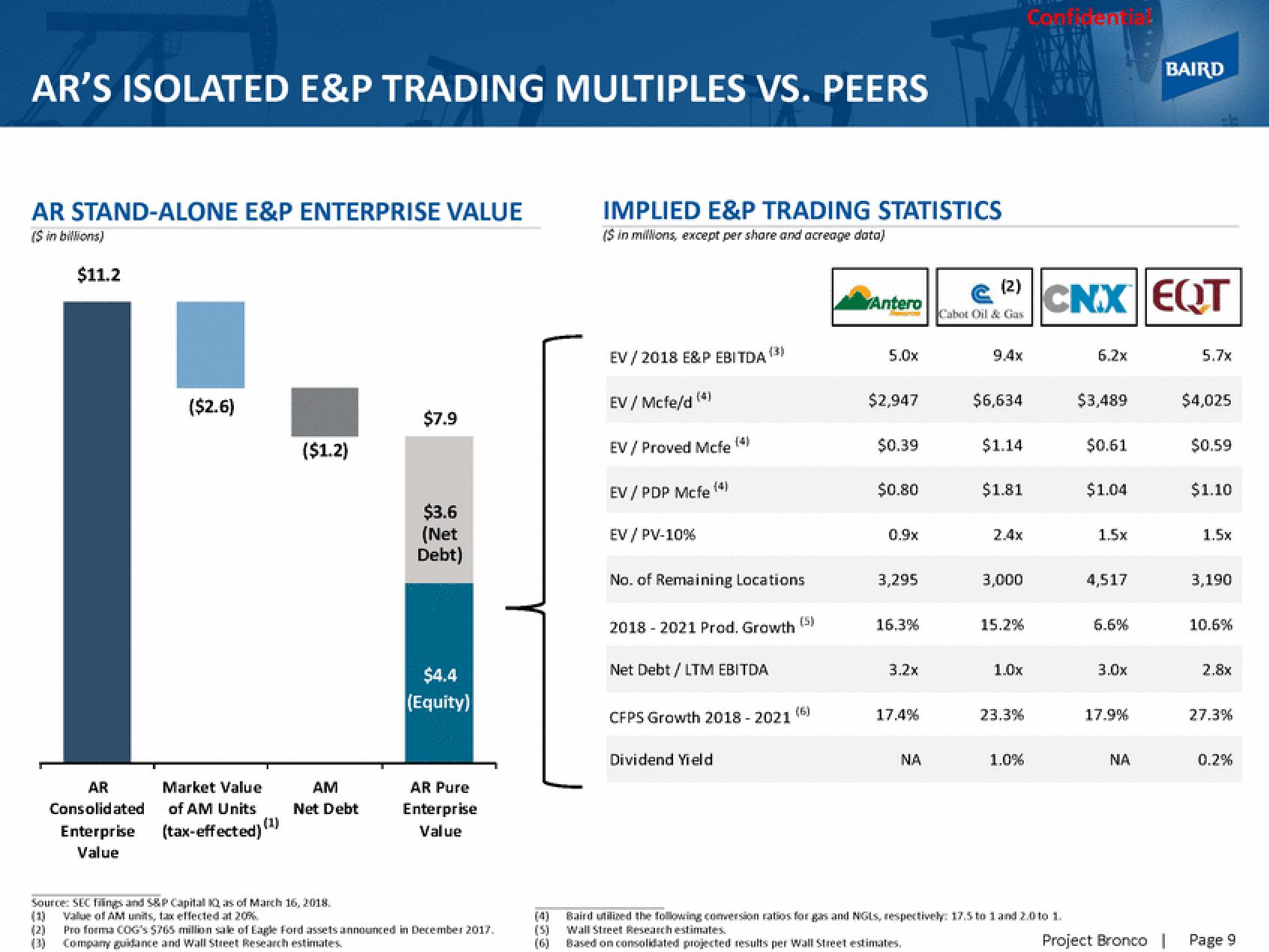

AR'S ISOLATED E&P TRADING MULTIPLES VS. PEERS

AR STAND-ALONE E&P ENTERPRISE VALUE

($ in billions)

$11.2

AR

Consolidated

Enterprise

Value

($2.6)

Market Value

of AM Units

(tax-effected) (¹)

($1.2)

AM

Net Debt

Source: SEC filings and S&P Capital as of March 16, 2018.

(1)

Value of AM units, tax effected at 20%

$7.9

$3.6

(Net

Debt)

$4.4

(Equity)

AR Pure

Enterprise

Value

Pro forma COG's $765 million sale of Eagle Ford assets announced in December 2017.

Company guidance and Wall Street Research estimates.

(4)

(5)

IMPLIED E&P TRADING STATISTICS

($ in millions, except per share and acreage data)

EV/2018 E&P EBITDA

EV / Mcfe/d (4)

EV/ Proved Mcfe

EV / PDP Mcfe

EV / PV-10%

No. of Remaining Locations

2018-2021 Prod. Growth

Net Debt / LTM EBITDA

CFPS Growth 2018 - 2021

Dividend Yield

(5)

(6)

Antero

5.0x

$2,947

$0.39

$0.80

0.9x

3,295

16.3%

3.2x

17.4%

NA

(2)

Cabot Oil & Gas

$6,634

$1.14

$1.81

3,000

15.2%

1.0x

23.3%

1.0%

Confidential

CNX EQT

Baird utilized the following conversion ratios for gas and NGLS, respectively: 17.5 to 1 and 2.0 to 1.

Wall Street Research estimates.

Based on consolidated projected results per Wall Street estimates.

6.2x

$3,489

$0.61

$1.04

1.5x

4,517

6.6%

3.0x

17.9%

NA

BAIRD

Project Bronco

5.7x

$4,025

$0.59

$1.10

1.5x

3,190

10.6%

2.8x

27.3%

0.2%

Page 9View entire presentation