Credit Suisse Results Presentation Deck

Asset Management

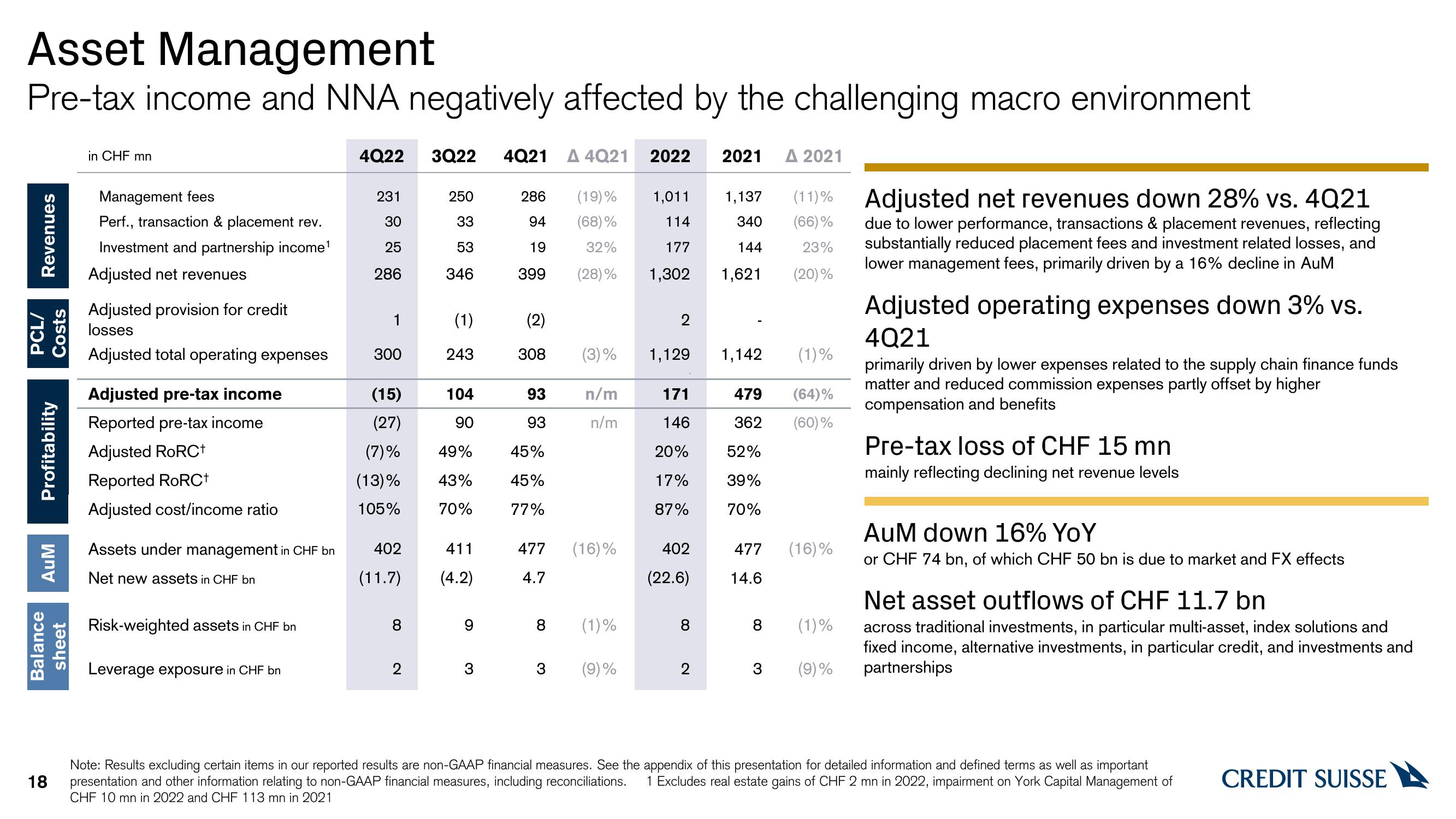

Pre-tax income and NNA negatively affected by the challenging macro environment

Revenues

PCL/

Costs

Profitability

AuM

Balance

sheet

18

in CHF mn

Management fees

Perf., transaction & placement rev.

Investment and partnership income¹

Adjusted net revenues

Adjusted provision for credit

losses

Adjusted total operating expenses

Adjusted pre-tax income

Reported pre-tax income

Adjusted RoRC+

Reported RoRC+

Adjusted cost/income ratio

Assets under management in CHF bn

Net new assets in CHF bn

Risk-weighted assets in CHF bn

Leverage exposure in CHF bn

4Q22

231

30

25

286

1

300

(15)

(27)

(7)%

(13)%

105%

402

(11.7)

2

3Q22 4Q21 A 4Q21 2022 2021 A 2021

250

33

53

346

(1)

243

104

90

49%

43%

70%

411

(4.2)

3

286 (19)% 1,011

94 (68)%

114

19 32%

177

399 (28)% 1,302

(2)

308

93

93

45%

45%

77%

477

4.7

8

(3)%

n/m

n/m

(16) %

(1)%

3 (9)%

2

1,129

171

146

20%

17%

87%

402

(22.6)

8

340 (66)%

144 23%

1,621 (20)%

1,137 (11)% Adjusted net revenues down 28% vs. 4Q21

due to lower performance, transactions & placement revenues, reflecting

substantially reduced placement fees and investment related losses, and

lower management fees, primarily driven by a 16% decline in AuM

1,142

479

362

52%

39%

70%

477

14.6

8

3

(1)%

(64)%

(60)%

(16)%

(1)%

(9)%

Adjusted operating expenses down 3% vs.

4Q21

primarily driven by lower expenses related to the supply chain finance funds

matter and reduced commission expenses partly offset by higher

compensation and benefits

Pre-tax loss of CHF 15 mn

mainly reflecting declining net revenue levels

AuM down 16% YoY

or CHF 74 bn, of which CHF 50 bn is due to market and FX effects

Net asset outflows of CHF 11.7 bn

across traditional investments, in particular multi-asset, index solutions and

fixed income, alternative investments, in particular credit, and investments and

partnerships

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Excludes real estate gains of CHF 2 mn in 2022, impairment on York Capital Management of

CHF 10 mn in 2022 and CHF 113 mn in 2021

CREDIT SUISSEView entire presentation