Baird Investment Banking Pitch Book

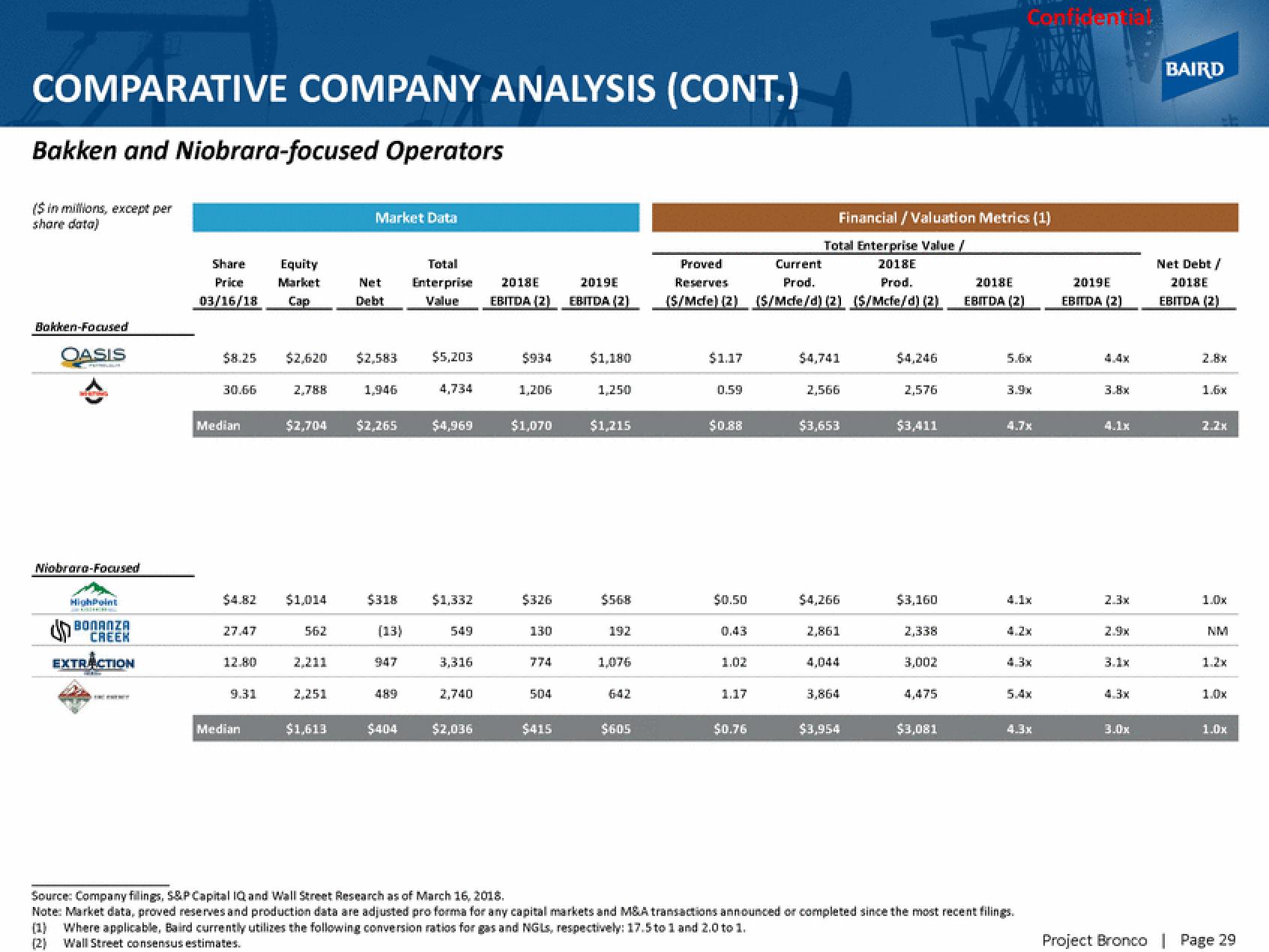

COMPARATIVE COMPANY ANALYSIS (CONT.)

Bakken and Niobrara-focused Operators

($ in millions, except per

share data)

Bakken-Focused

OASIS

Niobrara-Focused

HighPoint

BONANZA

CREEK

EXTRACTION

Share

Price

03/16/18

30.66

Median

$8.25 $2,620 $2,583

27.47

12.80

Equity

Market

Cap

$4.82 $1,014

9.31

Median

2,788

562

$2,704 $2,265

2,211

Market Data

2,251

Net

Debt

$1,613

1,946

$318

(13)

947

$404

Total

Enterprise 2018E

Value

$5,203

4,734

$4,969

$1,332

549

3,316

2.740

$2,036

EBITDA (2)

$934

1,206

$1,070

$326

130

774

504

$415

2019E

EBITDA (2)

$1,180

1,250

$1,215

$568

192

1,076

$605

Financial / Valuation Metrics (1)

Total Enterprise Value /

Proved

Current

2018E

Reserves

Prod.

Prod.

(S/Mce) (2) (S/Mde/d) (2) (S/Mcfe/d) (2)

$1.17

0.59

$0.88

$0.50

1.17

$0.76

$4,741

2,566

$3,653

$4,266

2,861

3,864

$3,954

$4,246

2,576

$3,411

$3,160

2,338

3,002

4,475

$3,081

2018E

EBITDA (2)

Confidential

5.6x

4.7%

4.1x

4.3x

5.4x

4.3x

Source: Company filings, S&P Capital IQ and Wall Street Research as of March 16, 2018.

Note: Market data, proved reserves and production data are adjusted pro forma for any capital markets and M&A transactions announced or completed since the most recent filings.

(1) Where applicable, Baird currently utilizes the following conversion ratios for gas and NGLs, respectively: 17.5 to 1 and 2.0 to 1.

(2)

Wall Street consensus estimates.

2019E

EBITDA (2)

3.8x

4.1x

2.3x

3.1x

3.0x

BAIRD

Net Debt /

2018E

EBITDA (2)

1.6x

2.2x

1.0x

NM

1.2x

1.0x

1.0x

Project Bronco | Page 29View entire presentation