Crocs Investor Presentation Deck

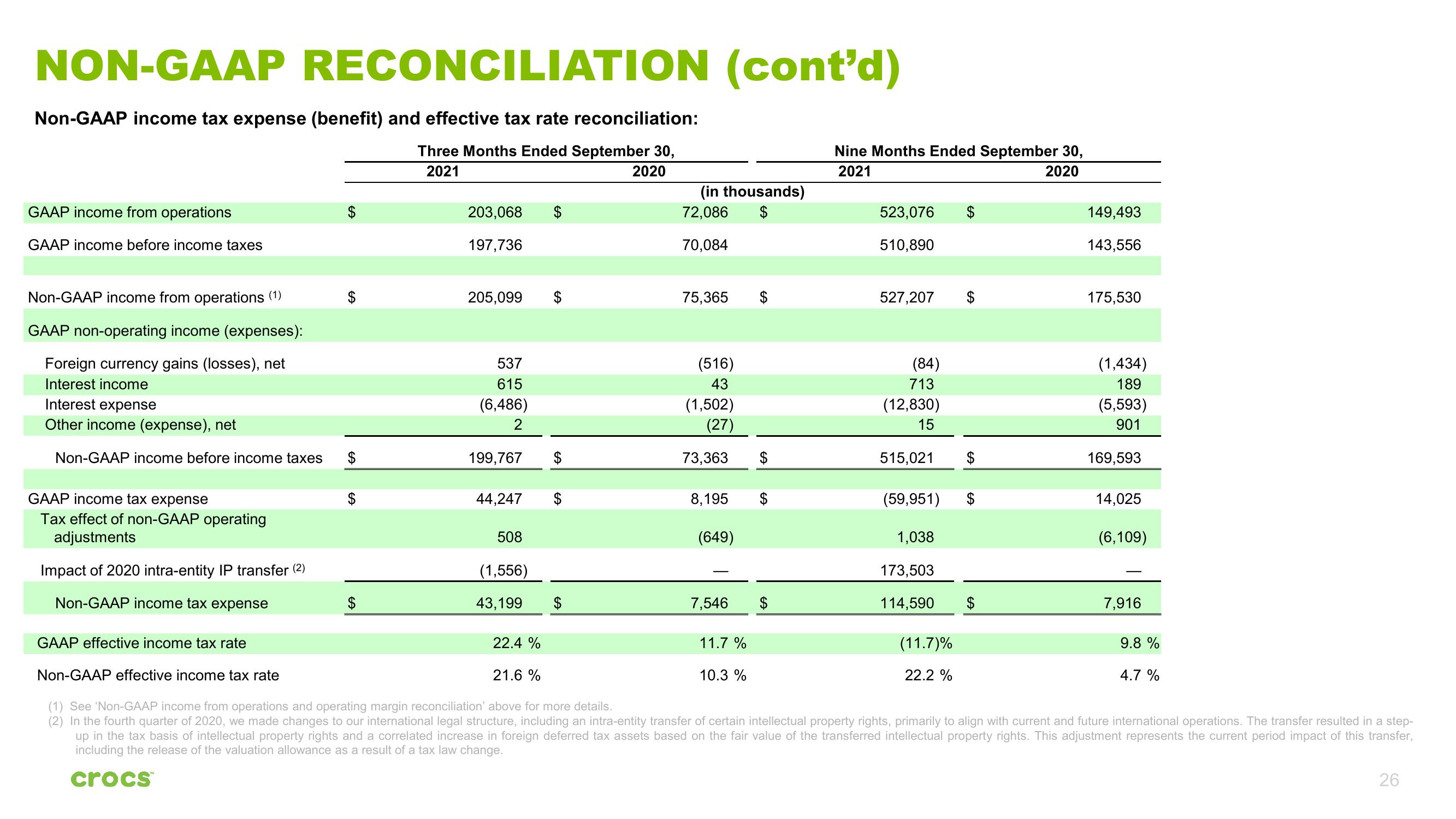

NON-GAAP RECONCILIATION (cont'd)

Non-GAAP income tax expense (benefit) and effective tax rate reconciliation:

Three Months Ended September 30,

2021

2020

GAAP income from operations

GAAP income before income taxes

Non-GAAP income from operations (1)

GAAP non-operating income (expenses):

Foreign currency gains (losses), net

Interest income

Interest expense

Other income (expense), net

Non-GAAP income before income taxes

GAAP income tax expense

Tax effect of non-GAAP operating

adjustments

Impact of 2020 intra-entity IP transfer (2)

Non-GAAP income tax expense

203,068

197,736

205,099

537

615

(6,486)

2

199,767

44,247

508

(1,556)

43,199

(in thousands)

72,086 $

70,084

75,365

(516)

43

(1,502)

(27)

73,363

8,195

(649)

7,546

11.7 %

$

10.3 %

Nine Months Ended September 30,

2021

2020

523,076

510,890

527,207

(84)

713

(12,830)

15

$

(59,951) $

1,038

173,503

114,590

515,021

149,493

143,556

(11.7)%

22.2 %

175,530

(1,434)

189

(5,593)

901

169,593

14,025

(6,109)

GAAP effective income tax rate

22.4 %

Non-GAAP effective income tax rate

21.6 %

(1) See 'Non-GAAP income from operations and operating margin reconciliation' above for more details.

(2) In the fourth quarter of 2020, we made changes to our international legal structure, including an intra-entity transfer of certain intellectual property rights, primarily to align with current and future international operations. The transfer resulted in a step-

up in the tax basis of intellectual property rights and a correlated increase in foreign deferred tax assets based on the fair value of the transferred intellectual property rights. This adjustment represents the current period impact of this transfer,

including the release of the valuation allowance as a result of a tax law change.

crocs™

7,916

9.8%

4.7 %

26View entire presentation