LandSea Homes Investor Presentation

25

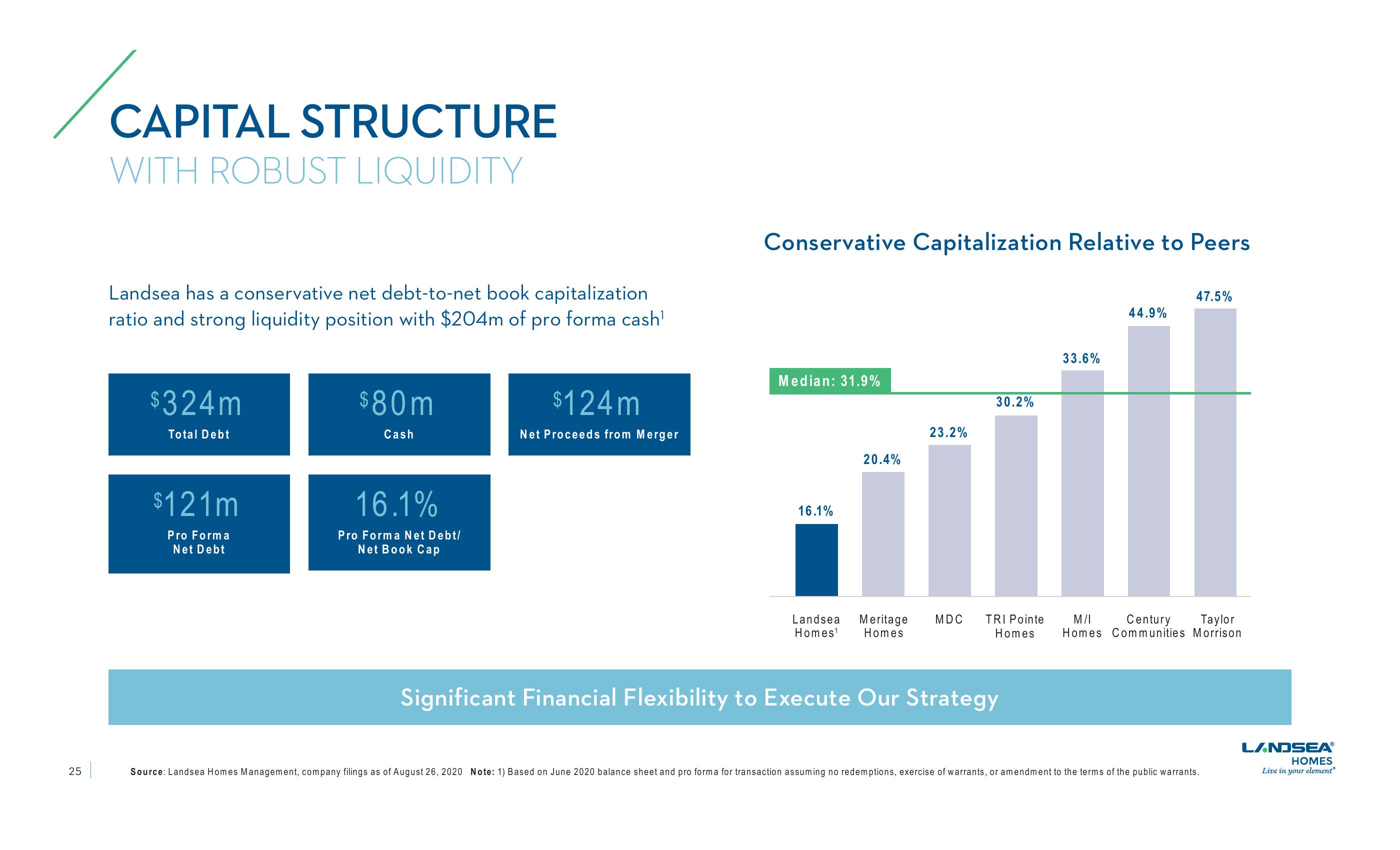

CAPITAL STRUCTURE

WITH ROBUST LIQUIDITY

Landsea has a conservative net debt-to-net book capitalization

ratio and strong liquidity position with $204m of pro forma cash¹

$324m

Total Debt

$121m

Pro Forma

Net Debt

$80m

Cash

16.1%

Pro Forma Net Debt/

Net Book Cap

$124m

Net Proceeds from Merger

Conservative Capitalization Relative to Peers

Median: 31.9%

16.1%

20.4%

23.2%

Landsea Meritage MDC

Homes¹ Homes

30.2%

TRI Pointe

Homes

Significant Financial Flexibility to Execute Our Strategy

33.6%

44.9%

47.5%

M/I Century Taylor

Homes Communities Morrison

Source: Landsea Homes Management, company filings as of August 26, 2020 Note: 1) Based on June 2020 balance sheet and pro forma for transaction assuming no redemptions, exercise of warrants, or amendment to the terms of the public warrants.

LANDSEAⓇ®

HOMES

Live in your elementⓇView entire presentation