Silicon Valley Bank Results Presentation Deck

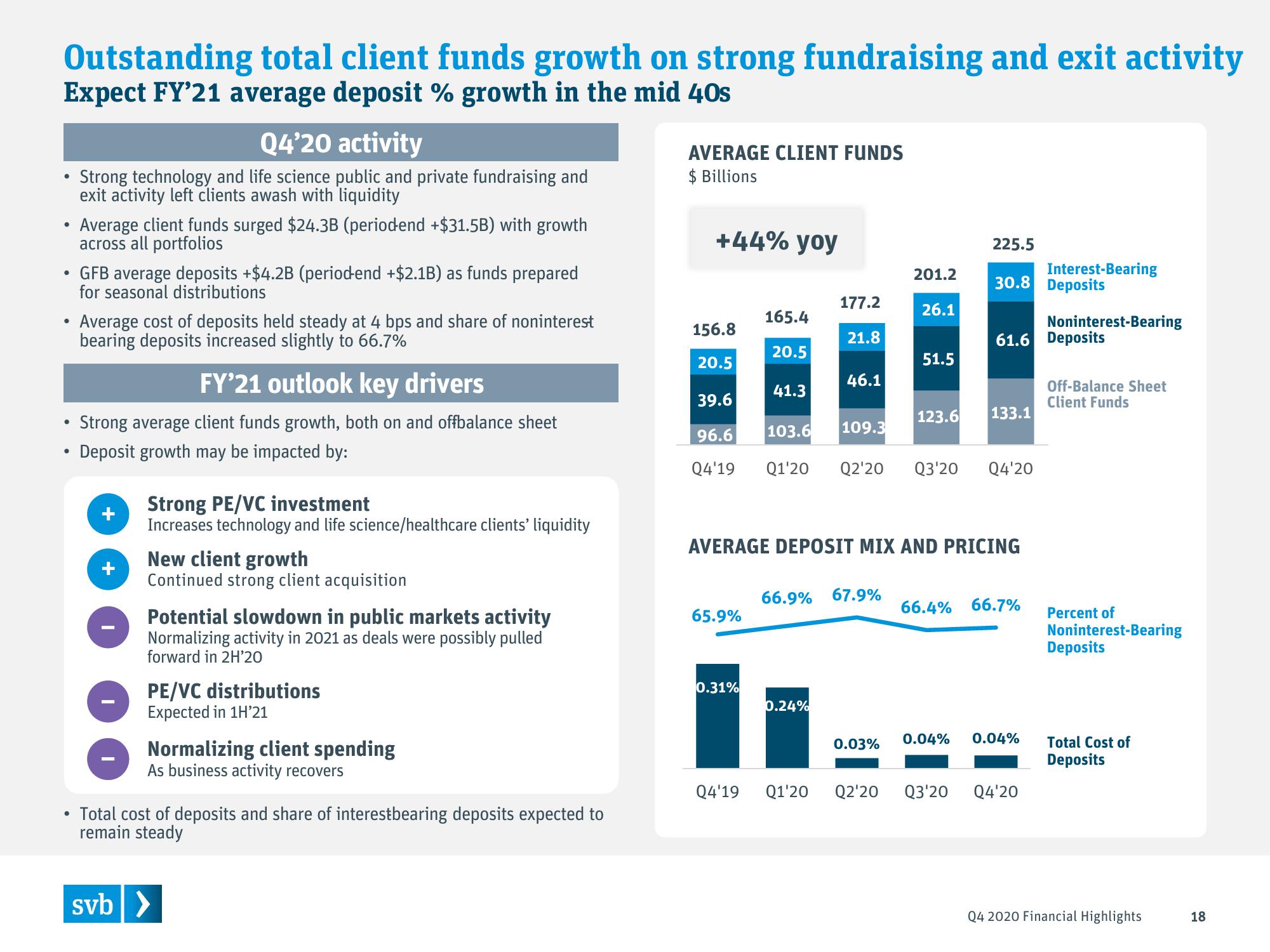

Outstanding total client funds growth on strong fundraising and exit activity

Expect FY'21 average deposit % growth in the mid 40s

●

• Average client funds surged $24.3B (periodend +$31.5B) with growth

across all portfolios

• GFB average deposits +$4.2B (period-end +$2.1B) as funds prepared

for seasonal distributions

●

●

Q4'20 activity

Strong technology and life science public and private fundraising and

exit activity left clients awash with liquidity

●

●

Average cost of deposits held steady at 4 bps and share of noninterest

bearing deposits increased slightly to 66.7%

FY'21 outlook key drivers

Strong average client funds growth, both on and offbalance sheet

Deposit growth may be impacted by:

+

Strong PE/VC investment

Increases technology and life science/healthcare clients' liquidity

New client growth

Continued strong client acquisition

Potential slowdown in public markets activity

Normalizing activity in 2021 as deals were possibly pulled

forward in 2H'20

PE/VC distributions

Expected in 1H'21

Normalizing client spending

As business activity recovers

Total cost of deposits and share of interestbearing deposits expected to

remain steady

svb >

AVERAGE CLIENT FUNDS

$ Billions

+44% yoy

156.8

20.5

65.9%

165.4

20.5

0.31%

41.3

Q4'19

177.2

21.8

46.1

0.24%

39.6

96.6

103.6 109.3

Q4'19 Q1'20 Q2'20 Q3'20 Q4'20

66.9% 67.9%

201.2

26.1

0.03%

51.5

AVERAGE DEPOSIT MIX AND PRICING

123.6

225.5

30.8 Deposits

61.6 Deposits

133.1

Q1'20 Q2'20 Q3'20

66.4% 66.7%

0.04% 0.04%

Interest-Bearing

Q4'20

Noninterest-Bearing

Off-Balance Sheet

Client Funds

Percent of

Noninterest-Bearing

Deposits

Total Cost of

Deposits

Q4 2020 Financial Highlights

18View entire presentation