IGI SPAC Presentation Deck

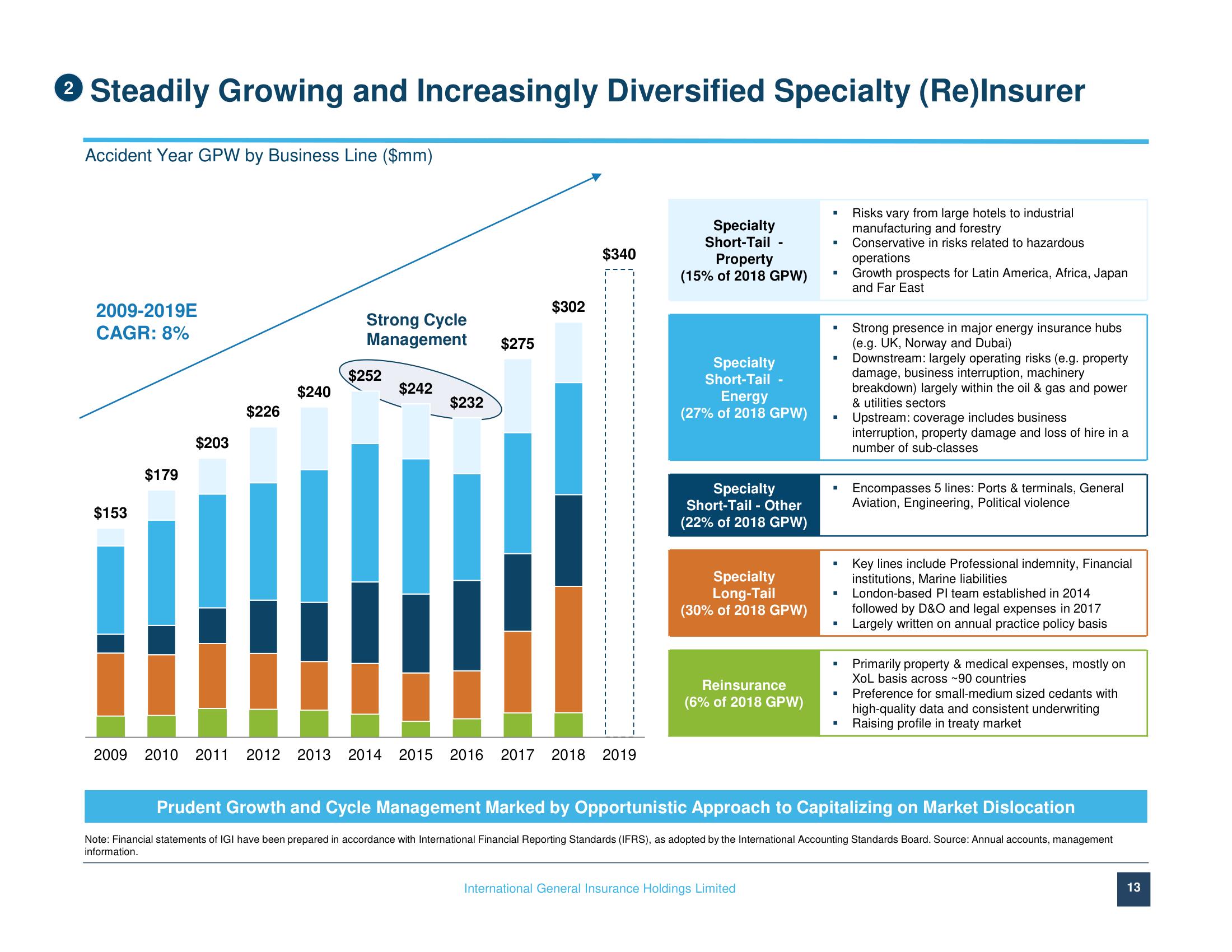

→ Steadily Growing and Increasingly Diversified Specialty (Re)Insurer

Accident Year GPW by Business Line ($mm)

2009-2019E

CAGR: 8%

$153

$179

$203

$226

$240

Strong Cycle

Management

$252

$242

$232

$275

$302

$340

I

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Specialty

Short-Tail

Property

(15% of 2018 GPW)

Specialty

Short-Tail

-

Energy

(27% of 2018 GPW)

Specialty

Short-Tail - Other

(22% of 2018 GPW)

Specialty

Long-Tail

(30% of 2018 GPW)

Reinsurance

(6% of 2018 GPW)

International General Insurance Holdings Limited

Risks vary from large hotels to industrial

manufacturing and forestry

Conservative in risks related to hazardous

operations

Growth prospects for Latin America, Africa, Japan

and Far East

Strong presence in major energy insurance hubs

(e.g. UK, Norway and Dubai)

Downstream: largely operating risks (e.g. property

damage, business interruption, machinery

breakdown) largely within the oil & gas and power

& utilities sectors

Upstream: coverage includes business

interruption, property damage and loss of hire in a

number of sub-classes

Encompasses 5 lines: Ports & terminals, General

Aviation, Engineering, Political violence

Key lines include Professional indemnity, Financial

institutions, Marine liabilities

London-based Pl team established in 2014

followed by D&O and legal expenses in 2017

Largely written on annual practice policy basis

Primarily property & medical expenses, mostly on

XoL basis across ~90 countries

I Preference for small-medium sized cedants with

high-quality data and consistent underwriting

Raising profile in treaty market

Prudent Growth and Cycle Management Marked by Opportunistic Approach to Capitalizing on Market Dislocation

Note: Financial statements of IGI have been prepared in accordance with International Financial Reporting Standards (IFRS), as adopted by the International Accounting Standards Board. Source: Annual accounts, management

information.

13View entire presentation