Barclays Investment Banking Pitch Book

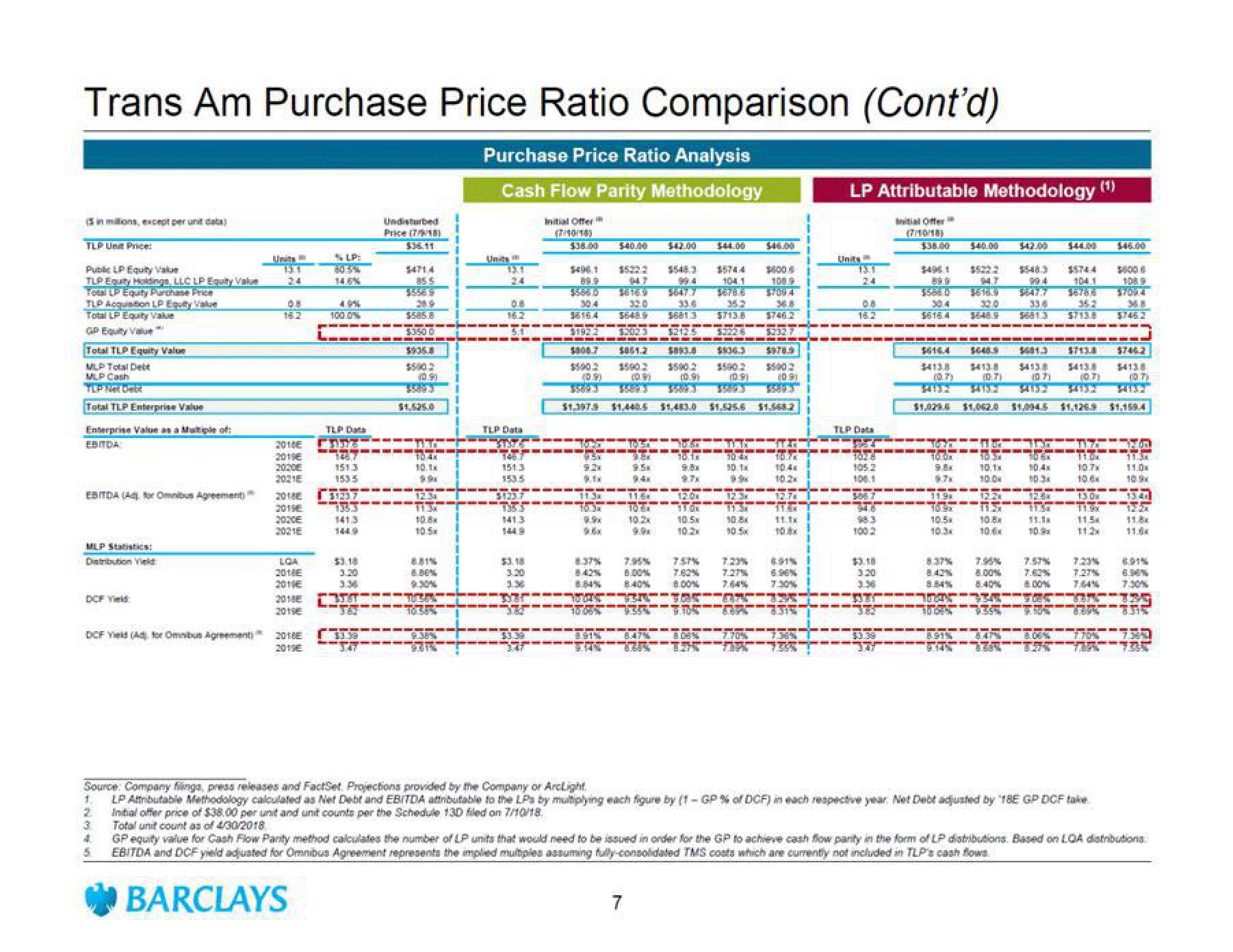

Trans Am Purchase Price Ratio Comparison (Cont'd)

Purchase Price Ratio Analysis

Cash Flow Parity Methodology

Initial Offer

(7/10/98)

$38.00

TLP Unit Price:

Public LP Equity Value

TLP Equity Holdings, LLC LP Equity Value

Total LP Equity Purchase Price

Total LP Equity Value

GP Equity Value

Total TLP Equity Value

MLP Total Debt

MLP Cash

TLP Net Deba

Total TLP Enterprise Value

Enterprise Value as a Multiple of:

EBITDA

EBITDA (A) for Omnibus Agreement)

MLP Statistics

Distribution Vid

DCF Yield (A4 for Omnibus Agreement

1

2

3

Units

13.1

15

OF

157

2018E

2015E

2000€

2021E

2018巴

2019

2020E

2021E

LOA

2018E

2010E

2018E

2019E

2018E

2019€

NLP:

6054

100.0%

TLP Data

148.7

1513

1535

3

141.3

1449

Undisturbed

Price (718)

TOT

54714

85 5

319

$5858

$350 0

$905

$500.2

10.9)

$1.525.0

10.1x

**

TIJx

10.8x

th

8.81%

8.86%

9.30%

T=== TO 35%

10.35%

9.38%

Units

13.4

24

DE

51

TLP Data

1513

153 5

THE

13513

141.3

$3.18

3.20

3.36

$406.1

540.00

$600.6

100.9

$574 4

104.1

$678.6 $709.49

35.2

304

1616.4 $6489 $681.3 $7138 57462

$500.2

(0.9)

58023

$1.397.9

TEST

1950

7037

RUM

9.6x

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

16169 3647.7

33.6

$42.00

$2025 $212.5 $2326

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

$548.3

TOSA

9.80

9.5.

11.6

$500 2 $500.2 $500.2 $500 2

(0.9)

10.91

10.91

(0.91

$5893

10.2x

7

$44.00

$1,483,0 $1.525.6 $1.568.2

9.8

ESTYTTE

10:40

10.1x

12.0

$46.00

הד--הדר-החדי

5

10:2x

12.2

10.8x

105x

10.70

10.4x

10 2

TG

7.57%

7.62%

7.27% 6.06%

8.40% 8.00%

DES3850N 13

▬▬▬▬▬▬▬

93055707

8.47% B8% 7.70%

TASON 15 735

LP Attributable Methodology (¹)

Units

131

08

18.2

TLP Data

105.2

98.3

100.2

$3.18

3.20

3.36

Initial Offer

322

$38.00

$495.1

$588 0

304

$616.4

(0.7)

$1,0296

----▬▬▬▬▬▬▬▬▬▬▬▬▬

$631.3

100x

11.9

10.5

10.3x

8.37%

8.42%

8.84%

1000%

$5744

104.1

$616.9 $:47.7 16786 $700.4

32.0

$648.9 $681.3 5713.8

8.91%

$4138 $4138

(0.7) 10.71

10:30

10,1x

$1.002.0 $1.094.5 $1.126.9

12.2x

▬▬▬▬▬▬▬▬▬▬▬▬▬▬

10.8x

106x

$44.00 $46.00

"NG====117O

BỘ

10.6x

10:4x

10:3

1959

$2.5

11.50

(0.71

10.9

7.95%

7.23%

8.00%

7.62%

7.27% 6.96%

8.40% 8.00% 7,64% 7.30%

A-135

-

11.0x

10.7x

$746.2

13.0x

---

115.

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

50%

(0.7)

10.9v

1934

13 2x

11.8x

11.04

Source: Company filings, press releases and FactSet. Projections provided by the Company or ArcLight

LP Attributable Methodology calculated as Net Debt and EBITDA attributable to the LPs by multiplying each figure by (1-GP % of DCF) in each respective year. Net Debt adjusted by 18E GP DCF take

Initial offer price of $38.00 per unit and unit counts per the Schedule 130 filed on 7/10/18

Total unit count as of 4/30/2018

GP equity value for Cash Flow Panity method calculates the number of LP units that would need to be issued in order for the GP to achieve cash flow panty in the form of LP distributions. Based on LQA distributions

EBITDA and DCF yield adjusted for Omnibus Agreement represents the implied multiples assuming fully-consolidated TMS costs which are currently not included in TLP's cash flows

BARCLAYS

8.67 8315

8.06%

7.70% 7533

TA 135View entire presentation