Evercore Investment Banking Pitch Book

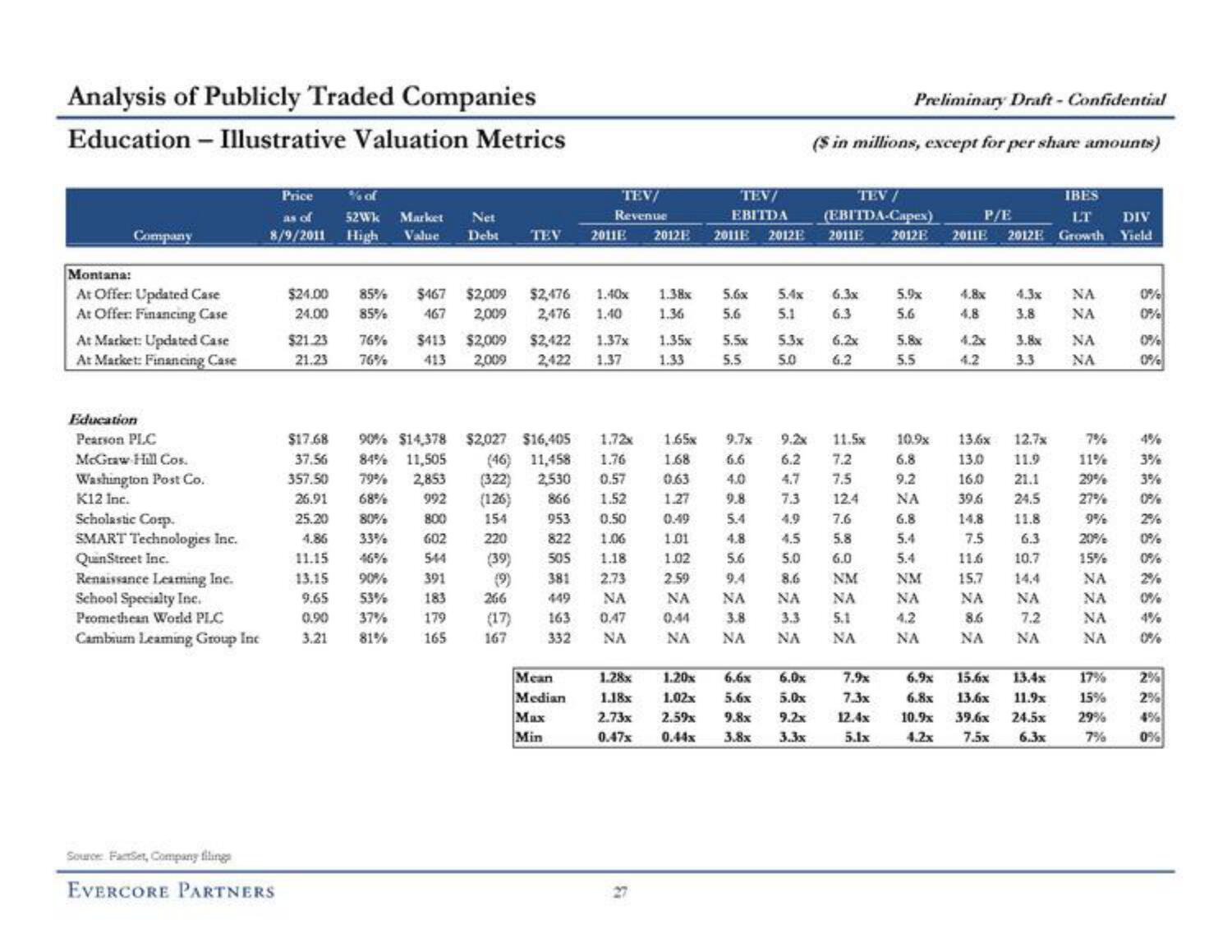

Analysis of Publicly Traded Companies

Education - Illustrative Valuation Metrics

Company

Montana:

At Offer: Updated Case

At Offer: Financing Case

At Market: Updated Case

At Market: Financing Case

Education

Pearson PLC

McGraw Hill Cos.

Washington Post Co.

K12 Inc.

Scholastic Corp.

SMART Technologies Inc.

QuinStreet Inc.

Renaissance Leaming Inc.

School Specialty Inc.

Promethean World PLC

Cambium Leaming Group Inc

Price

as of

8/9/2011

Source FactSet, Company filings

EVERCORE PARTNERS

$17.68

37.56

357.50

26.91

25.20

4.86

11.15

$24.00 85% $467 $2,009 $2,476 1.40x 1.38x

24.00 85% 467 2,009 2,476 1.40 1.36

$21.23 76% $413 $2,009 $2,422 1.37x 1.35x

21.23 76% 413 2,009 2,422 1.37 1.33

13.15

9.65

0.90

3.21

% of

52Wk

Market

Net

High Value Debt TEV 2011E 2012E 2011E 20121

90% $14,378

84% 11,505

79% 2,853

68%

992

80%

800

33%

602

544

391

183

179

165

53%

37%

81%

TEV/

Revenue

1.72x

$2,027 $16,405

(46) 11,458 1.76

(322) 2,530

0.57

(126)

866

1.52

154

953 0.50

220

822 1.06

(39)

505

1.18

(9)

381 2.73

449

266

(17)

167

NA

163 0.47

332

NA

Mean

Median

Max

Min

TEV/

EBITDA

F

5.6x 5.4x

5.6 5.1

5.5x 5.3x

5.5

5.0

6.0x

1.28x 1.20x 6.6x

1.18x 1.02x 5.6x 5.0x

2.73x 2.59x 9.8x 9.2x

0.47x 0.44x

3.8x 3.3x

Preliminary Draft- Confidential

($ in millions, except for per share amounts)

TEV /

(EBITDA-Capex)

2011E 2012E

6.3x

6.3

6.2x

6.2

1.65x 9.7x 9.2x

115

1.68

6.6

6.2

7.2

0.63

4.0

4,7 7.5

1.27

9.8

7.3

0.49

5.4

4.9

1.01

4.8

4.5

5.8

1.02

5.6

5.0

6.0

2.59

9.4

8.6

NM

ΝΑ NA

NA

NA

0.44

3.3 5.1

3.8

NA NA NA

NA

12.4

7.6

7.9x

7.3x

12.4x

5.1x

5.9x

5.6

5.8x

5.5

10.9x

6.8

9.2

NA

6.8

5.4

5.4

NM

NA

4.2

NA

IBES

LT

2011E 2012E Growth

P/E

4.8x 4.3x ΝΑ

4.8 3.8 NA

4.2x 3.8x NA

4.2

3.3

NA

13.6x

12.7x

13.0 11.9

16.0

21.1

39.6

24.5

14.8

7.5

11.6

15,7

NA

NA

8.6

7.2

NA NA

11.8

6.3

10.7

7%

11%

29%

27%

9%

20%

15%

NA

NA

NA

NA

15.6x 13.4x

17%

6.9x

6.8x 13.6x 11.9x

15%

10.9x 39.6x 21.5x 29%

4.2x

7.5x

6.3x

7%

DIV

Yield

0%

0%

0%

0%

4%

3%

3%

0%

2%

0%

0%

0%

0%

2%

2%

4%

0%View entire presentation