JD Sports Results Presentation Deck

JD

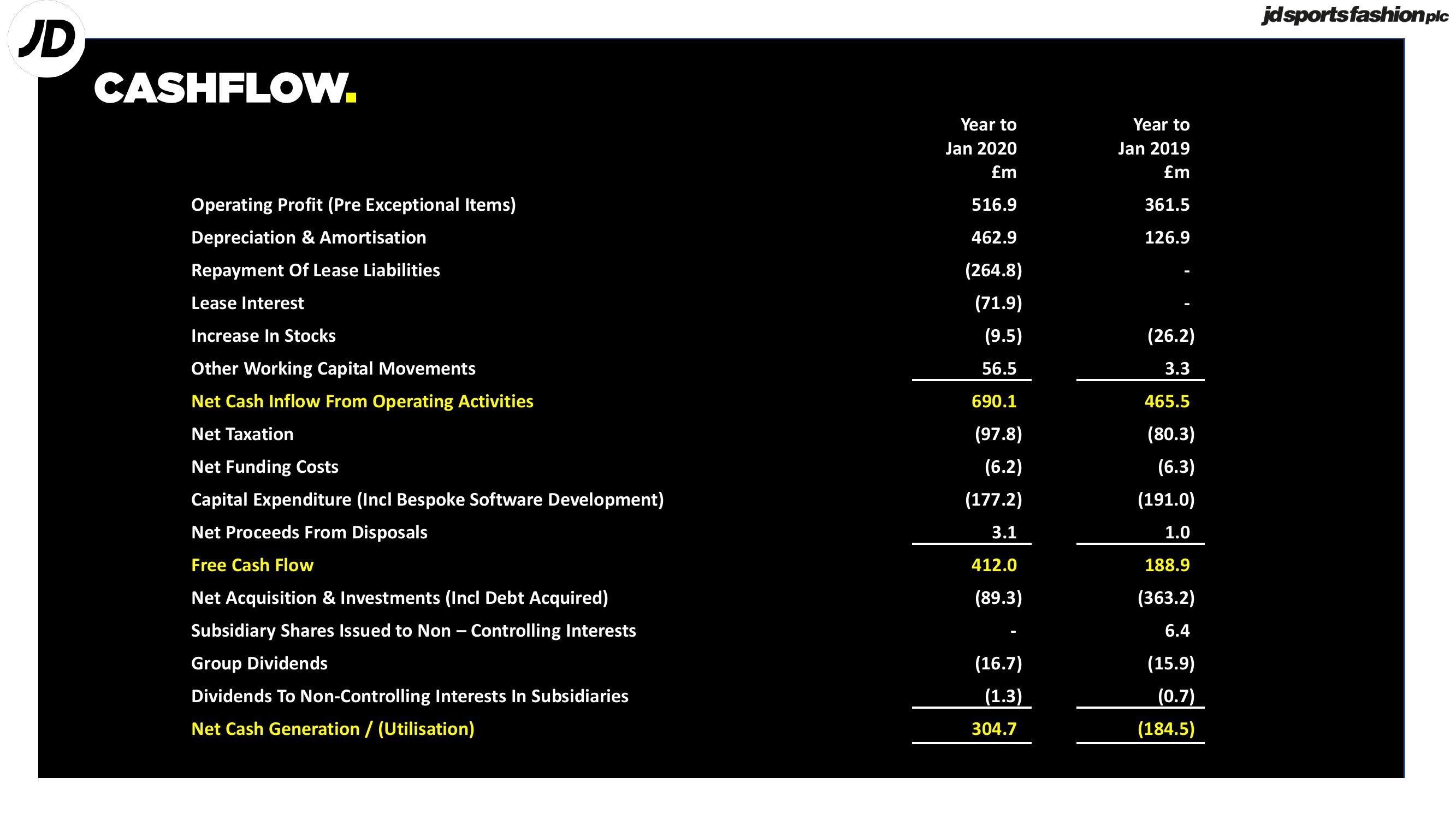

CASHFLOW.

Operating Profit (Pre Exceptional Items)

Depreciation & Amortisation

Repayment Of Lease Liabilities

Lease Interest

Increase In Stocks

Other Working Capital Movements

Net Cash Inflow From Operating Activities

Net Taxation

Net Funding Costs

Capital Expenditure (Incl Bespoke Software Development)

Net Proceeds From Disposals

Free Cash Flow

Net Acquisition & Investments (Incl Debt Acquired)

Subsidiary Shares Issued to Non - Controlling Interests

Group Dividends

Dividends To Non-Controlling Interests In Subsidiaries

Net Cash Generation / (Utilisation)

Year to

Jan 2020

£m

516.9

462.9

(264.8)

(71.9)

(9.5)

56.5

690.1

(97.8)

(6.2)

(177.2)

3.1

412.0

(89.3)

(16.7)

(1.3)

304.7

Year to

Jan 2019

£m

361.5

126.9

(26.2)

3.3

465.5

(80.3)

(6.3)

(191.0)

1.0

188.9

(363.2)

6.4

(15.9)

(0.7)

(184.5)

jd sports fashion plcView entire presentation