OppFi Results Presentation Deck

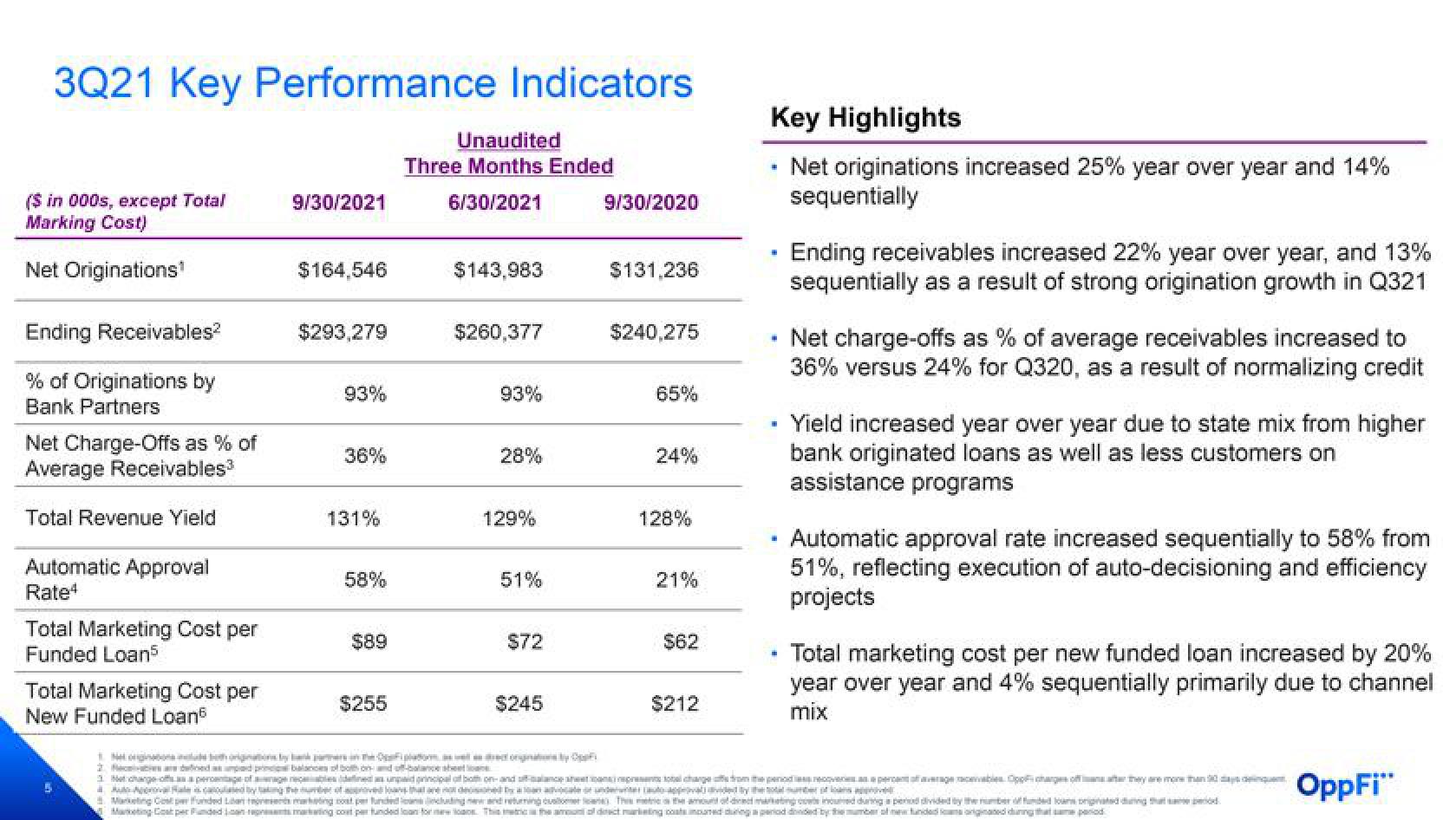

3Q21 Key Performance Indicators

($ in 000s, except Total

Marking Cost)

Net Originations¹

Ending Receivables²

% of Originations by

Bank Partners

Net Charge-Offs as % of

Average Receivables³

Total Revenue Yield

Automatic Approval

Rate4

Total Marketing Cost per

Funded Loans

Total Marketing Cost per

New Funded Loan

5

9/30/2021

$164,546

$293,279

93%

36%

131%

58%

$89

$255

Unaudited

Three Months Ended

6/30/2021

$143,983

$260,377

93%

28%

129%

51%

$72

$245

9/30/2020

$131,236

$240,275

65%

24%

128%

21%

$62

$212

Key Highlights

Net originations increased 25% year over year and 14%

sequentially

.

W

.

Ending receivables increased 22% year over year, and 13%

sequentially as a result of strong origination growth in Q321

Net charge-offs as % of average receivables increased to

36% versus 24% for Q320, as a result of normalizing credit

Yield increased year over year due to state mix from higher

bank originated loans as well as less customers on

assistance programs

Automatic approval rate increased sequentially to 58% from

51%, reflecting execution of auto-decisioning and efficiency

projects

Total marketing cost per new funded loan increased by 20%

year over year and 4% sequentially primarily due to channel.

mix

Avi Hale is calculated by taking the number of approved loans that are not desoned by a loan advocate or underver auto-approval dvided by the total sunder of loans approved.

5. Marketing Cost perfunded Liten represents making cost perfunded leading and returning cusThe amount of direct marketing concurred during a period divided by the number of funded loans originated during that same period.

OppFi"View entire presentation