Silicon Valley Bank Results Presentation Deck

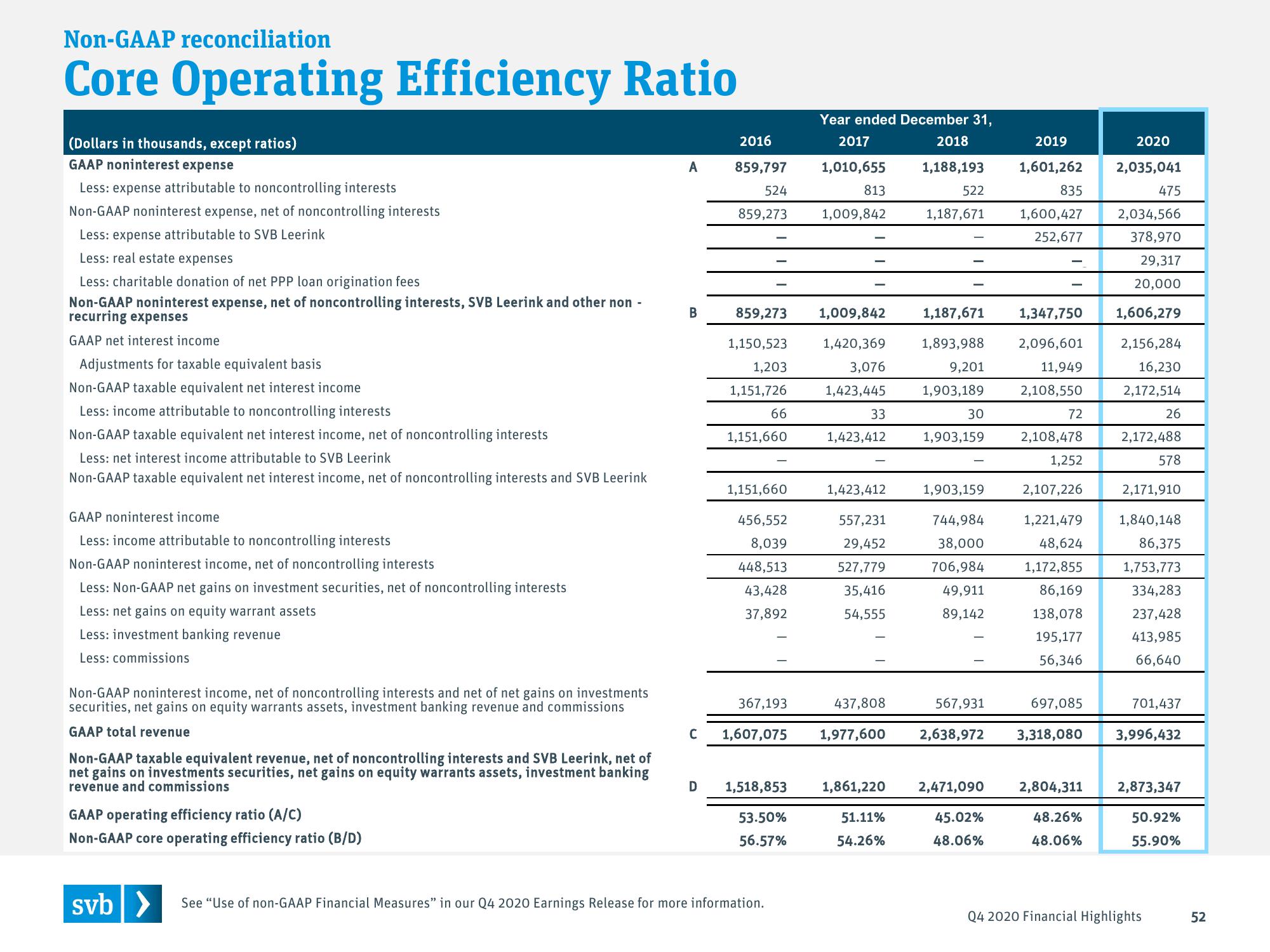

Non-GAAP reconciliation

Core Operating Efficiency Ratio

(Dollars in thousands, except ratios)

GAAP noninterest expense

Less: expense attributable to noncontrolling interests

Non-GAAP noninterest expense, net of noncontrolling interests

Less: expense attributable to SVB Leerink

Less: real estate expenses

Less: charitable donation of net PPP loan origination fees

Non-GAAP noninterest expense, net of noncontrolling interests, SVB Leerink and other non-

recurring expenses

GAAP net interest income

Adjustments for taxable equivalent basis

Non-GAAP taxable equivalent net interest income

Less: income attributable to noncontrolling interests

Non-GAAP taxable equivalent net interest income, net of noncontrolling interests

Less: net interest income attributable to SVB Leerink

Non-GAAP taxable equivalent net interest income, net of noncontrolling interests and SVB Leerink

GAAP noninterest income

Less: income attributable to noncontrolling interests

Non-GAAP noninterest income, net of noncontrolling interests

Less: Non-GAAP net gains on investment securities, net of noncontrolling interests

Less: net gains on equity warrant assets

Less: investment banking revenue

Less: commissions

Non-GAAP noninterest income, net of noncontrolling interests and net of net gains on investments

securities, net gains on equity warrants assets, investment banking revenue and commissions

GAAP total revenue

Non-GAAP taxable equivalent revenue, net of noncontrolling interests and SVB Leerink, net of

net gains on investments securities, net gains on equity warrants assets, investment banking

revenue and commissions

GAAP operating efficiency ratio (A/C)

Non-GAAP core operating efficiency ratio (B/D)

A

B

2016

859,797

524

859,273

D

859,273

1,150,523

1,203

1,151,726

66

1,151,660

1,151,660

456,552

8,039

448,513

43,428

37,892

367,193

C 1,607,075

1,518,853

53.50%

56.57%

svb > See "Use of non-GAAP Financial Measures" in our Q4 2020 Earnings Release for more information.

Year ended December 31,

2017

1,010,655

2018

1,188,193

813

1,009,842

1,009,842

1,420,369

3,076

1,423,445

33

1,423,412

1,423,412

557,231

29,452

527,779

35,416

54,555

437,808

1,977,600

522

51.11%

54.26%

1,187,671

1,187,671

1,893,988

9,201

1,903,189

30

1,903,159

1,903,159

744,984

38,000

706,984

49,911

89,142

567,931

2,638,972

1,861,220 2,471,090

45.02%

48.06%

2019

1,601,262

835

1,600,427

252,677

-

1,347,750

2,096,601

11,949

2,108,550

72

2,108,478

1,252

2,107,226

1,221,479

48,624

1,172,855

86,169

138,078

195,177

56,346

2,804,311

2020

2,035,041

48.26%

48.06%

475

2,034,566

378,970

29,317

20,000

1,606,279

2,156,284

16,230

2,172,514

26

2,172,488

578

2,171,910

697,085

701,437

3,318,080 3,996,432

1,840,148

86,375

1,753,773

334,283

237,428

413,985

66,640

Q4 2020 Financial Highlights

2,873,347

50.92%

55.90%

52View entire presentation