Apollo Global Management Investor Presentation Deck

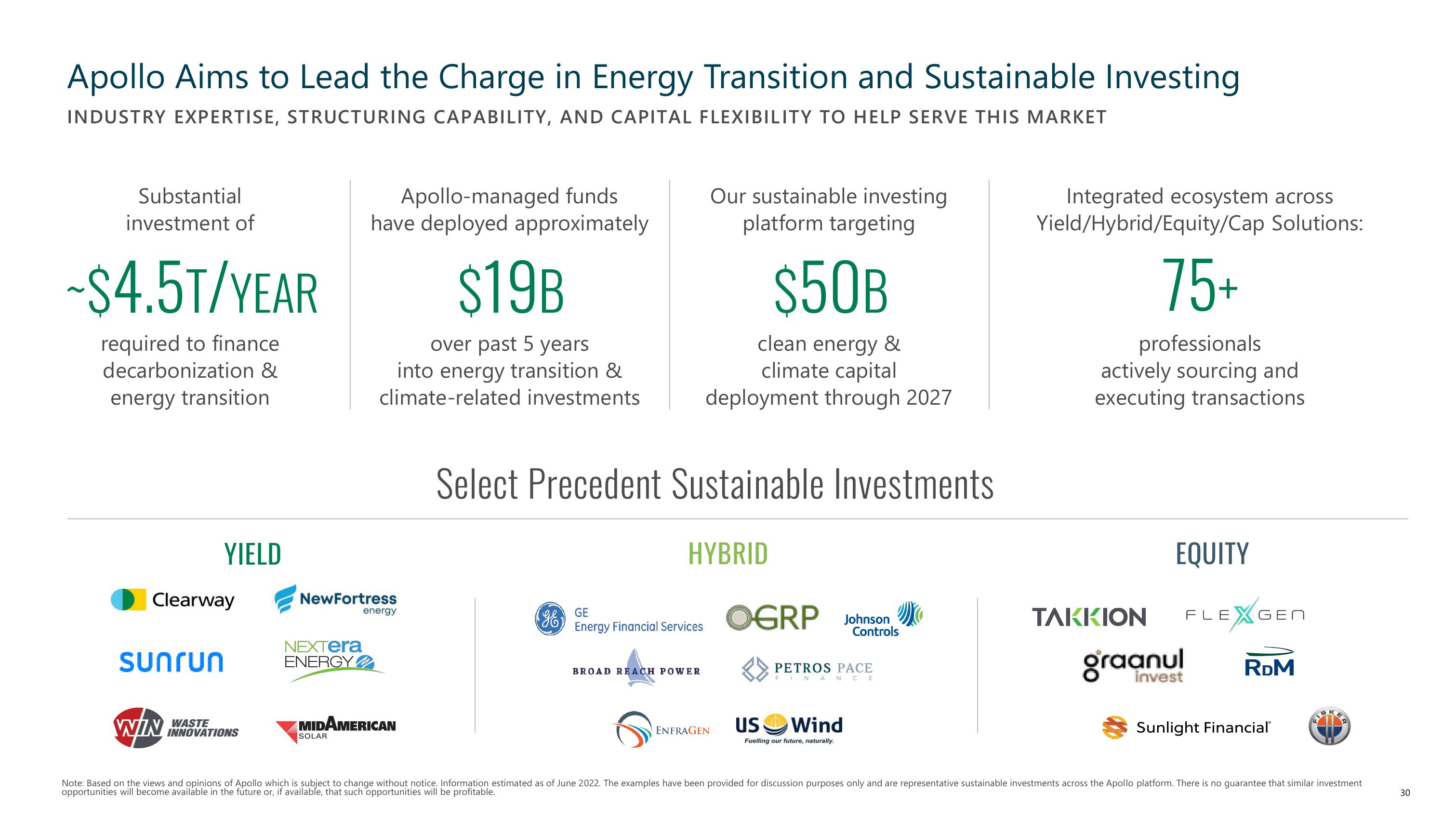

Apollo Aims to Lead the Charge in Energy Transition and Sustainable Investing

INDUSTRY EXPERTISE, STRUCTURING CAPABILITY, AND CAPITAL FLEXIBILITY TO HELP SERVE THIS MARKET

Substantial

investment of

-$4.5T/YEAR

required to finance

decarbonization &

energy transition

Clearway

sunrun

YIELD

WIN

WASTE

INNOVATIONS

NEXTera

ENERGY

Apollo-managed funds

have deployed approximately

NewFortress

$19B

over past 5 years

into energy transition &

climate-related investments

SOLAR

energy

MIDAMERICAN

(GE)

Select Precedent Sustainable Investments

$50B

clean energy &

climate capital

deployment through 2027

Our sustainable investing

platform targeting

HYBRID

GE

Energy Financial Services

BROAD REACH POWER

ENFRAGEN

OGRP Johnson

Controls

PETROS PACE

FINANCE

US Wind

Fuelling our future, naturally.

Integrated ecosystem across

Yield/Hybrid/Equity/Cap Solutions:

75+

professionals

actively sourcing and

executing transactions

EQUITY

TAKKION

LEXGE

graanul RDM

Sunlight Financial

1

Note: Based on the views and opinions of Apollo which is subject to change without notice. Information estimated as of June 2022. The examples have been provided for discussion purposes only and are representative sustainable investments across the Apollo platform. There is no guarantee that similar investment

opportunities will become available in the future or, if available, that such opportunities will be profitable.

30View entire presentation