UBS Results Presentation Deck

Prudent management of liquidity and funding

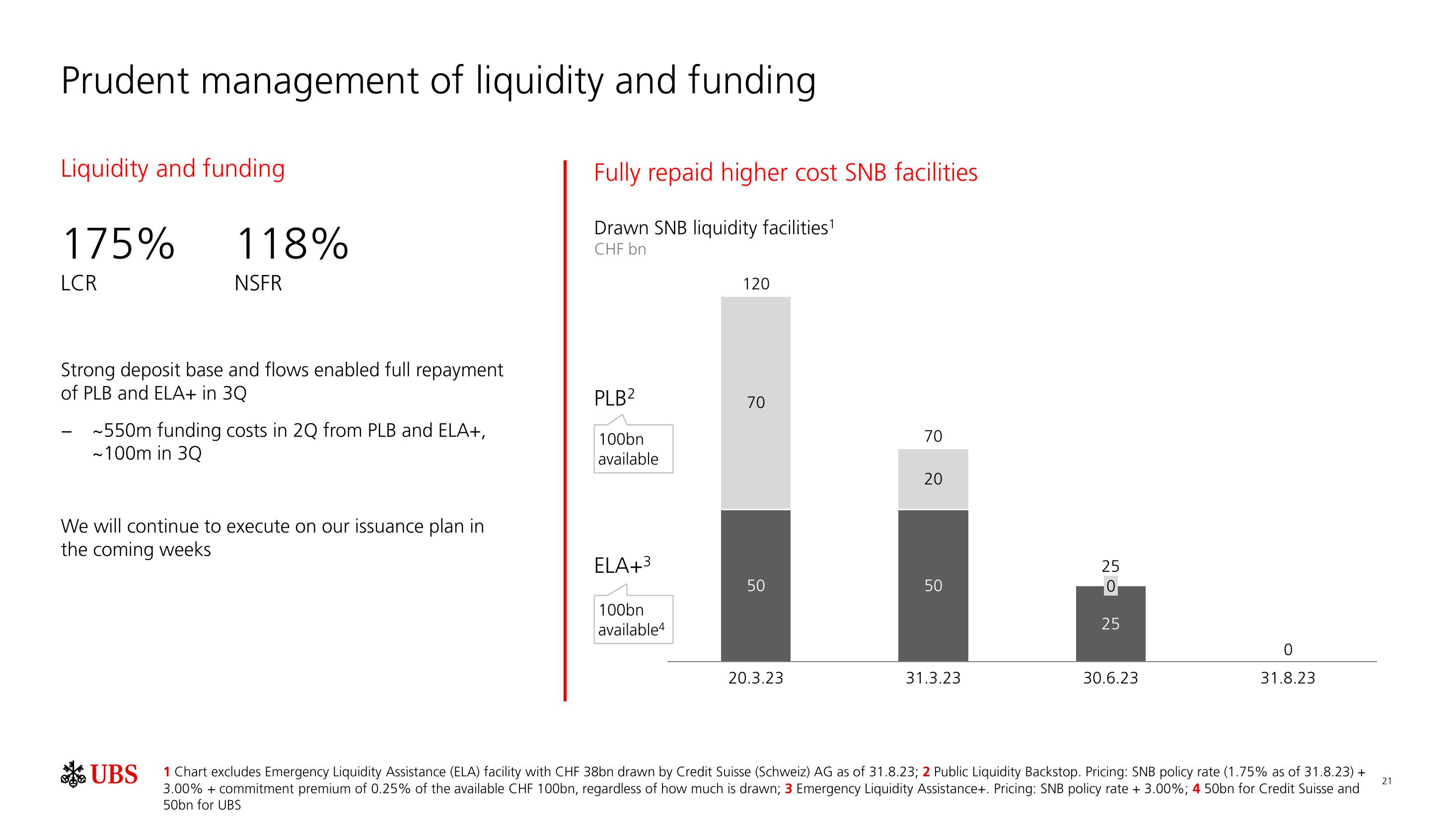

Liquidity and funding

175% 118%

NSFR

LCR

Strong deposit base and flows enabled full repayment

of PLB and ELA+ in 3Q

~550m funding costs in 2Q from PLB and ELA+,

~100m in 3Q

We will continue to execute on our issuance plan in

the coming weeks

Fully repaid higher cost SNB facilities

Drawn SNB liquidity facilities¹

CHF bn

PLB²

100bn

available

ELA+³

100bn

available4

120

70

50

20.3.23

70

20

50

31.3.23

25

0₁

25

30.6.23

0

31.8.23

UBS

1 Chart excludes Emergency Liquidity Assistance (ELA) facility with CHF 38bn drawn by Credit Suisse (Schweiz) AG as of 31.8.23; 2 Public Liquidity Backstop. Pricing: SNB policy rate (1.75% as of 31.8.23) +

3.00% + commitment premium of 0.25% of the available CHF 100bn, regardless of how much is drawn; 3 Emergency Liquidity Assistance+. Pricing: SNB policy rate + 3.00%; 4 50bn for Credit Suisse and

50bn for UBS

21View entire presentation