Evercore Investment Banking Pitch Book

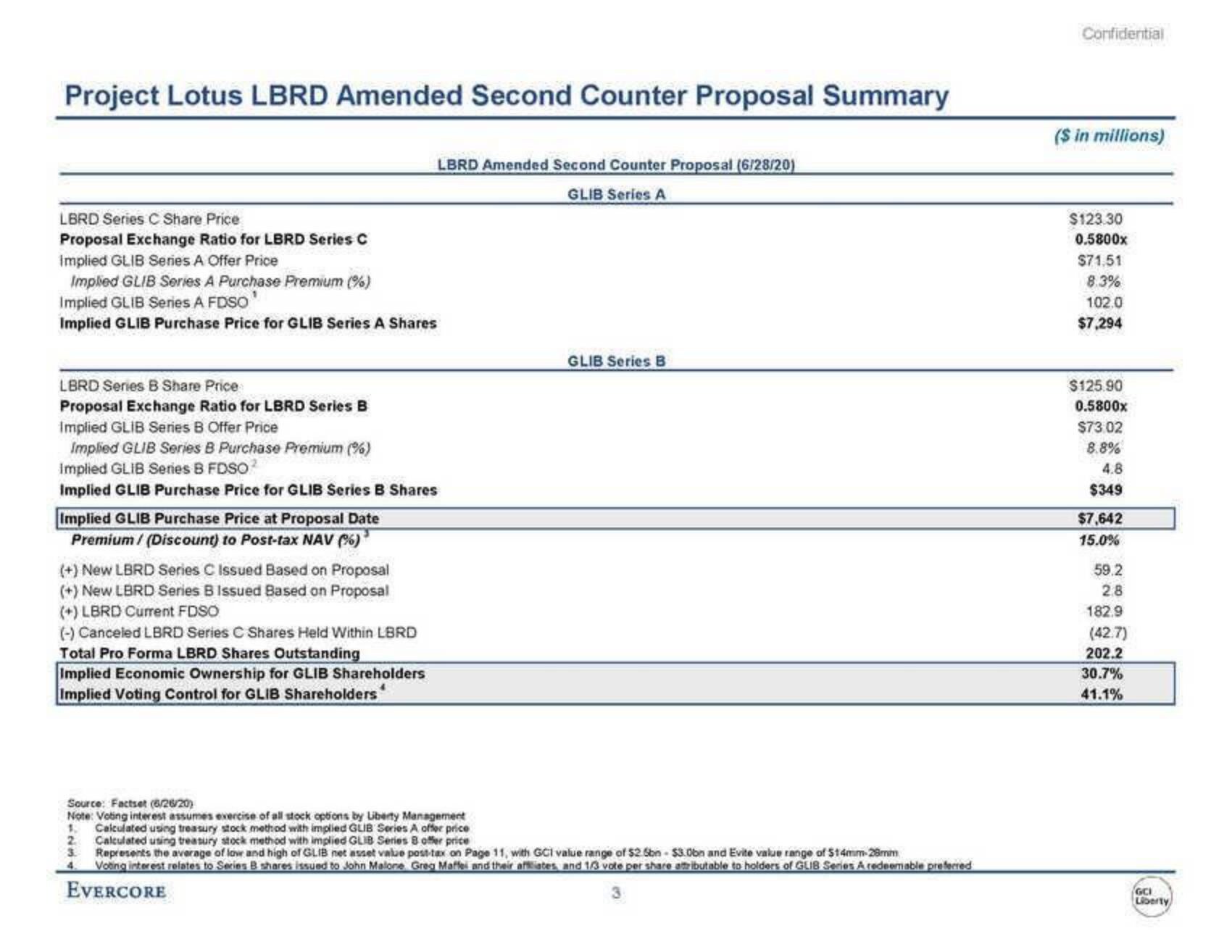

Project Lotus LBRD Amended Second Counter Proposal Summary

LBRD Amended Second Counter Proposal (6/28/20)

GLIB Series A

LBRD Series C Share Price

Proposal Exchange Ratio for LBRD Series C

Implied GLIB Series A Offer Price

Implied GLIB Series A Purchase Premium (%)

Implied GLIB Series A FDSO

Implied GLIB Purchase Price for GLIB Series A Shares

LBRD Series B Share Price

Proposal Exchange Ratio for LBRD Series B

Implied GLIB Series B Offer Price

Implied GLIB Series B Purchase Premium (%)

Implied GLIB Series B FDSO²

Implied GLIB Purchase Price for GLIB Series B Shares

Implied GLIB Purchase Price at Proposal Date

Premium / (Discount) to Post-tax NAV (%)

(+) New LBRD Series C Issued Based on Proposal

(+) New LBRD Series B Issued Based on Proposal

(+) LBRD Current FDSO

(-) Canceled LBRD Series C Shares Held Within LBRD

Total Pro Forma LBRD Shares Outstanding

Implied Economic Ownership for GLIB Shareholders

Implied Voting Control for GLIB Shareholders

GLIB Series B

Source: Factset (6/26/20)

1.

Note: Voting interest assumes exercise of all stock options by Liberty Management

Calculated using treasury stock method with implied GLIB Series A offer price

Calculated using treasury stock method with implied GLIB Series B offer price

2

3. Represents the average of low and high of GLIB net asset value post-tax on Page 11, with GCI value range of $2.6bn-$3.0bn and Evite value range of $14mm-28mm

Voting interest relates to Series B shares issued to John Malone Greg Maffei and their affiliates and 1/3 vote per share attributable to holders of GLIB Series A redeemable preferred

EVERCORE

Confidential

($ in millions)

$123.30

0.5800x

$71.51

8.3%

102.0

$7,294

$125.90

0.5800x

$73.02

8.8%

4.8

$349

$7,642

15.0%

59.2

2.8

182.9

(42.7)

202.2

30.7%

41.1%

GCI

LibertyView entire presentation