Lyft Results Presentation Deck

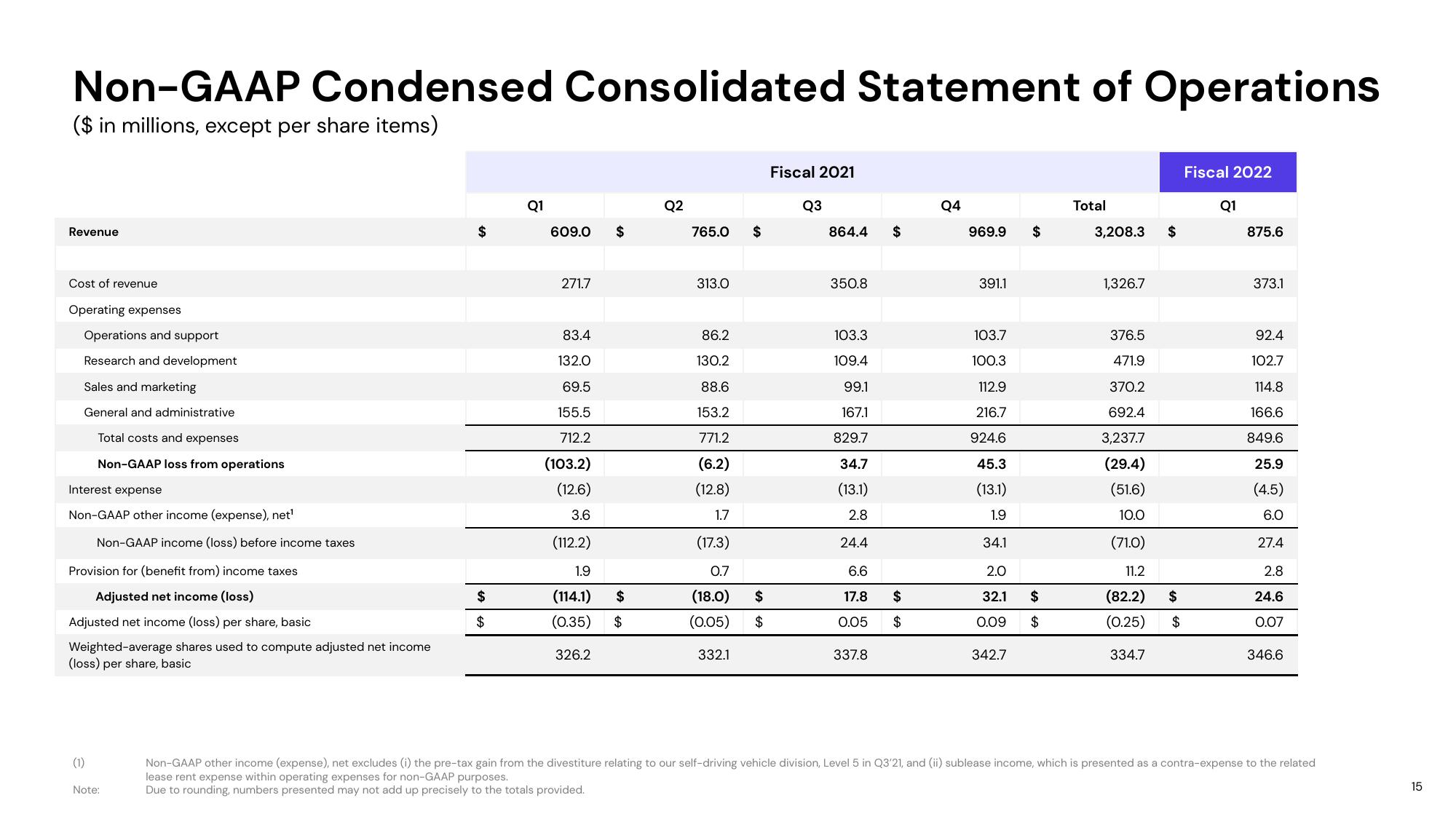

Non-GAAP Condensed Consolidated Statement of Operations

($ in millions, except per share items)

Revenue

Cost of revenue

Operating expenses

Operations and support

Research and development

Sales and marketing

General and administrative

Total costs and expenses

Non-GAAP loss from operations

Interest expense

Non-GAAP other income (expense), net¹

Non-GAAP income (loss) before income taxes

Provision for (benefit from) income taxes

Adjusted net income (loss)

Adjusted net income (loss) per share, basic

Weighted-average shares used to compute adjusted net income

(loss) per share, basic

(1)

Note:

$

$

$

Q1

609.0

271.7

$

83.4

132.0

69.5

155.5

712.2

(103.2)

(12.6)

3.6

(112.2)

1.9

(114.1) $

(0.35) $

326.2

Q2

765.0

313.0

$

86.2

130.2

88.6

153.2

771.2

(6.2)

(12.8)

1.7

(17.3)

0.7

(18.0) $

(0.05) $

332.1

Fiscal 2021

Q3

864.4

350.8

103.3

109.4

99.1

167.1

829.7

34.7

(13.1)

2.8

24.4

6.6

17.8

0.05

337.8

$

$

$

Q4

969.9

391.1

103.7

100.3

112.9

216.7

924.6

45.3

(13.1)

1.9

34.1

2.0

32.1

0.09

342.7

$

$

$

Total

3,208.3 $

1,326.7

376.5

471.9

370.2

692.4

3,237.7

(29.4)

(51.6)

10.0

(71.0)

11.2

(82.2)

(0.25)

334.7

$

$

Fiscal 2022

Q1

875.6

373.1

92.4

102.7

114.8

166.6

849.6

25.9

(4.5)

6.0

27.4

2.8

24.6

0.07

346.6

Non-GAAP other income (expense), net excludes (i) the pre-tax gain from the divestiture relating to our self-driving vehicle division, Level 5 in Q3'21, and (ii) sublease income, which is presented as a contra-expense to the related

lease rent expense within operating expenses for non-GAAP purposes.

Due to rounding, numbers presented may not add up precisely to the totals provided.

15View entire presentation