FlexJet SPAC Presentation Deck

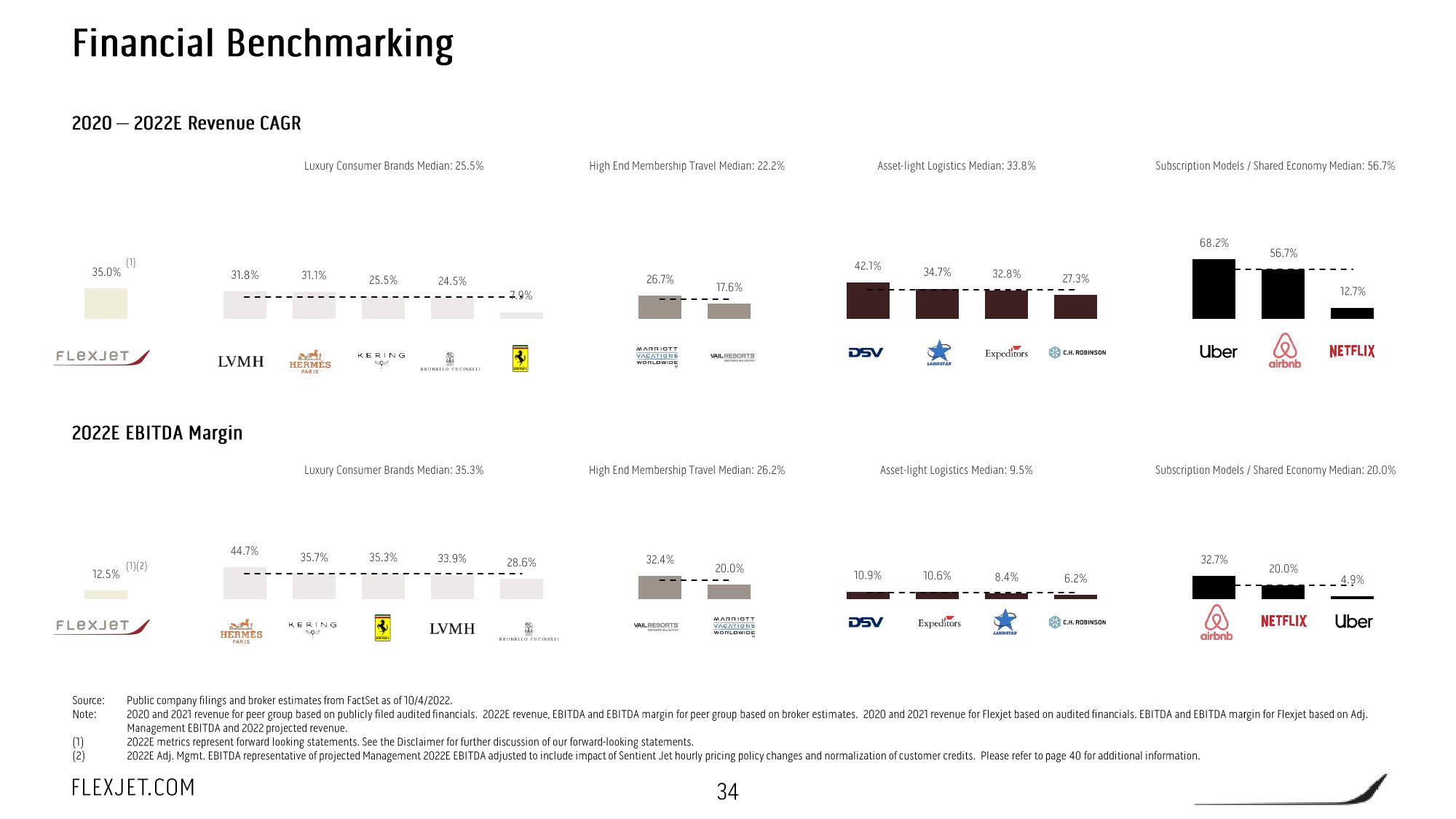

Financial Benchmarking

2020 2022E Revenue CAGR

35.0%

FLeXJеT

(1)

12.5%

2022E EBITDA Margin

Source:

Note:

(1)

(2)

FLeXJET

(1)(2)

31.8%

LVMH

44.7%

HERMES

PARIS

Luxury Consumer Brands Median: 25.5%

31.1%

HERMÈS

PARIS

35.7%

25.5%

KERING

KERING

24.5%

Luxury Consumer Brands Median: 35.3%

35.3%

R

BRUNELLO CUCINELLI

33.9%

LVMH

.8%

F

28.6%

X

BRUNELLO CUCINELLI

High End Membership Travel Median: 22.2%

26.7%

MARRIOTT

VACATIONS

WORLDWIDE

32,4%

17.6%

High End Membership Travel Median: 26.2%

VAIL RESORTS

VAILRESORTS

20.0%

MARRIOTT

VACATIONS

WORLDWIDE

Asset-light Logistics Median: 33.8%

42.1%

DSV

10.9%

34.7%

DSV

LANDSTAR

Asset-light Logistics Median: 9.5%

10.6%

32.8%

Expeditors

Expeditors

8.4%

LANDSTAR

27.3%

C.H. ROBINSON

6.2%

C.H. ROBINSON

Subscription Models/ Shared Economy Median: 56.7%

68.2%

Uber

32.7%

56.7%

airbnb

airbnb

Subscription Models / Shared Economy Median: 20.0%

12.7%

20.0%

NETFLIX

4.9%

Public company filings and broker estimates from FactSet as of 10/4/2022.

2020 and 2021 revenue for peer group based on publicly filed audited financials. 2022E revenue, EBITDA and EBITDA margin for peer group based on broker estimates. 2020 and 2021 revenue for Flexjet based on audited financials. EBITDA and EBITDA margin for Flexjet based on Adj.

Management EBITDA and 2022 projected revenue.

2022E metrics represent forward looking statements. See the Disclaimer for further discussion of our forward-looking statements.

2022E Adj. Mgmt. EBITDA representative of projected Management 2022E EBITDA adjusted to include impact of Sentient Jet hourly pricing policy changes and normalization of customer credits. Please refer to page 40 for additional information.

FLEXJET.COM

34

NETFLIX UberView entire presentation