Fresnillo Results Presentation Deck

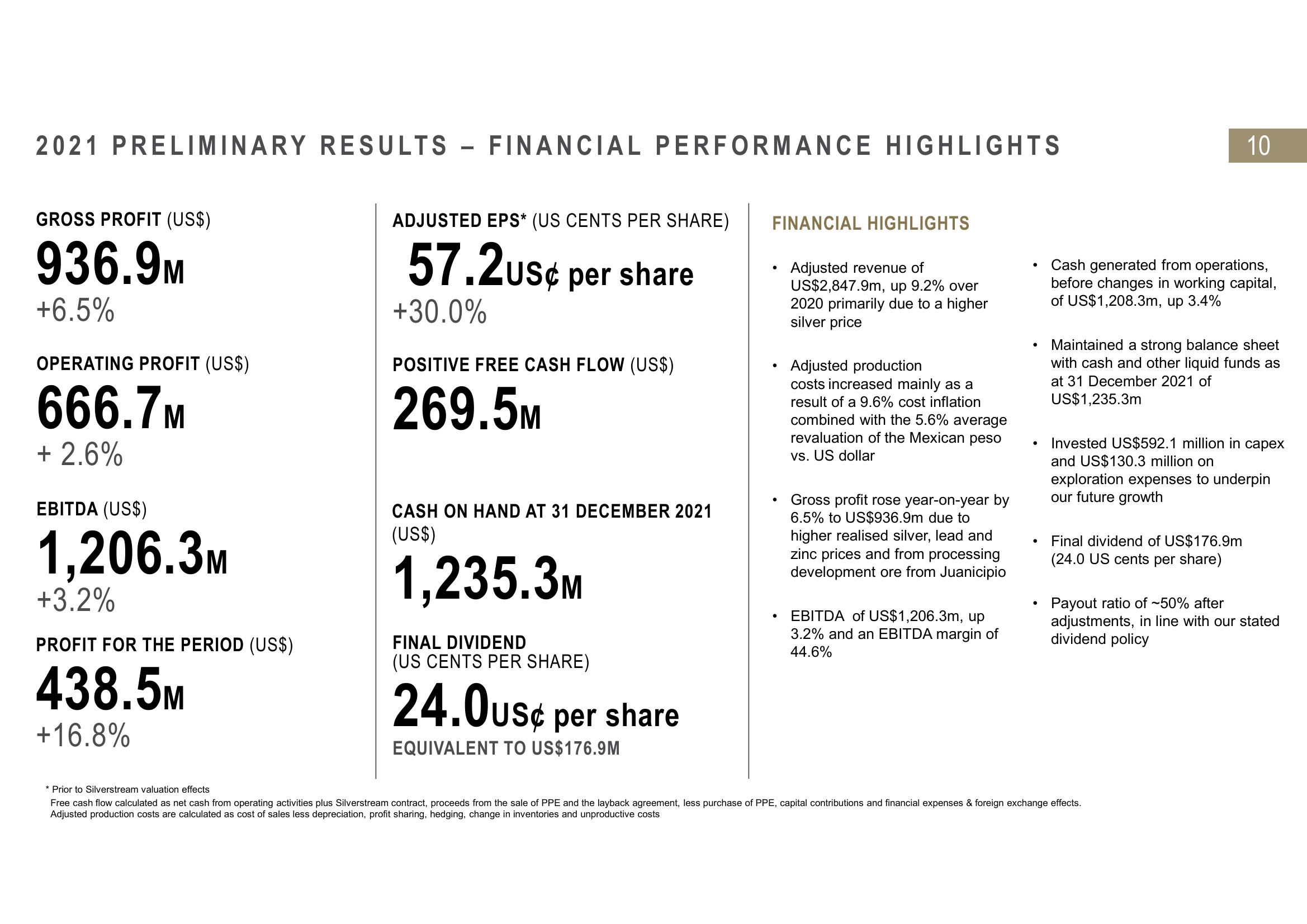

2021 PRELIMINARY RESULTS - FINANCIAL PERFORMANCE HIGHLIGHTS

GROSS PROFIT (US$)

936.9M

+6.5%

OPERATING PROFIT (US$)

666.7M

+ 2.6%

EBITDA (US$)

1,206.3M

+3.2%

PROFIT FOR THE PERIOD (US$)

438.5M

+16.8%

ADJUSTED EPS* (US CENTS PER SHARE)

57.2us¢ per share

+30.0%

POSITIVE FREE CASH FLOW (US$)

269.5M

CASH ON HAND AT 31 DECEMBER 2021

(US$)

1,235.3M

FINAL DIVIDEND

(US CENTS PER SHARE)

24.0usc per share

EQUIVALENT TO US$176.9M

FINANCIAL HIGHLIGHTS

●

●

●

Adjusted revenue of

US$2,847.9m, up 9.2% over

2020 primarily due to a higher

silver price

Adjusted production

costs increased mainly as a

result of a 9.6% cost inflation

combined with the 5.6% average

revaluation of the Mexican peso

vs. US dollar

Gross profit rose year-on-year by

6.5% to US$936.9m due to

higher realised silver, lead and

zinc prices and from processing

development ore from Juanicipio

EBITDA of US$1,206.3m, up

3.2% and an EBITDA margin of

44.6%

●

●

●

Cash generated from operations,

before changes in working capital,

of US$1,208.3m, up 3.4%

10

Maintained a strong balance sheet

with cash and other liquid funds as

at 31 December 2021 of

US$1,235.3m

Invested US$592.1 million in capex

and US$130.3 million on

exploration expenses to underpin

our future growth

Final dividend of US$176.9m

(24.0 US cents per share)

Payout ratio of ~50% after

adjustments, in line with our stated

dividend policy

* Prior to Silverstream valuation effects

Free cash flow calculated as net cash from operating activities plus Silverstream contract, proceeds from the sale of PPE and the layback agreement, less purchase of PPE, capital contributions and financial expenses & foreign exchange effects.

Adjusted production costs are calculated as cost of sales less depreciation, profit sharing, hedging, change in inventories and unproductive costsView entire presentation