Bank of America Investment Banking Pitch Book

Project PIONEER

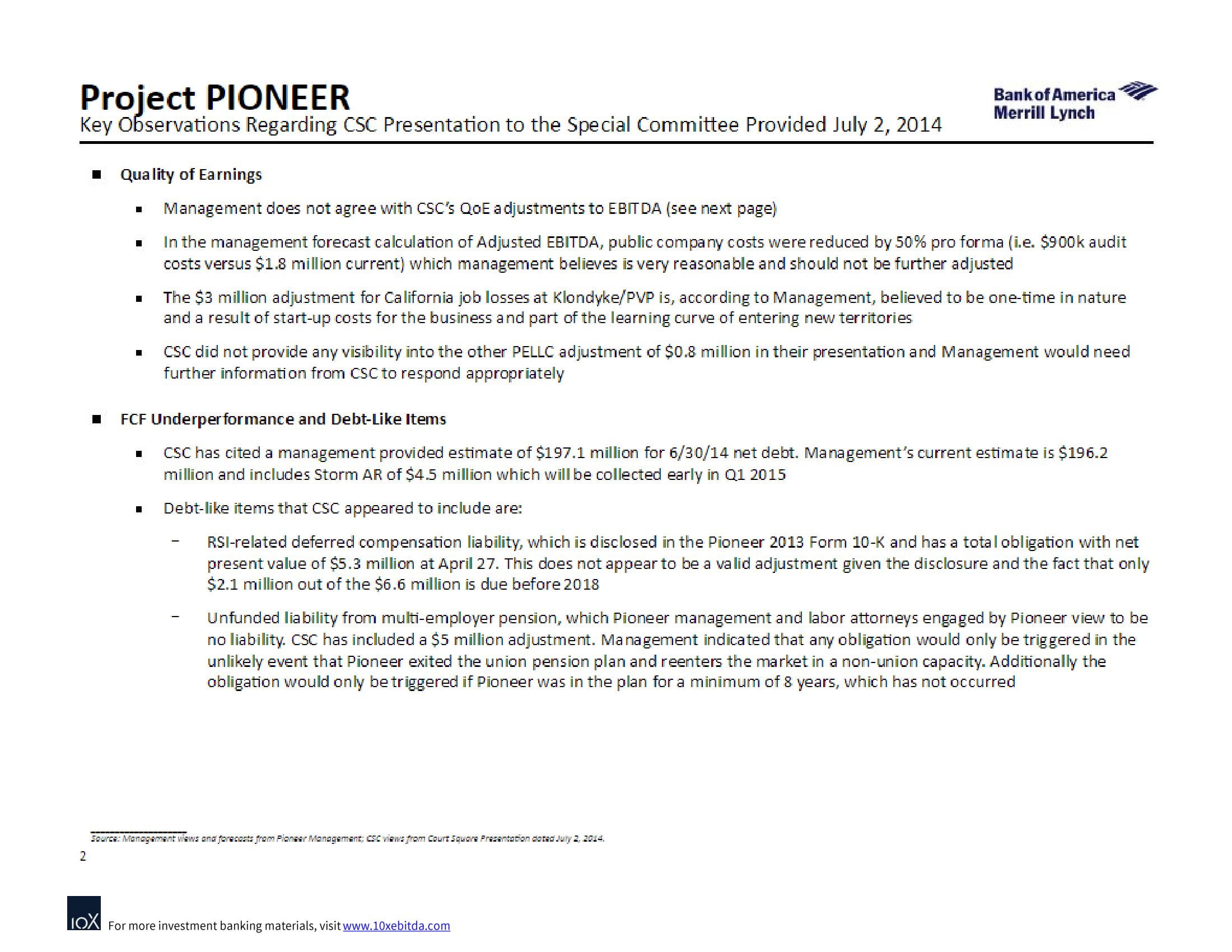

Key Observations Regarding CSC Presentation to the Special Committee Provided July 2, 2014

2

Z Quality of Earnings

■

1

I

1

Management does not agree with CSC's QoE adjustments to EBITDA (see next page)

In the management forecast calculation of Adjusted EBITDA, public company costs were reduced by 50% pro forma (i.e. $900k audit

costs versus $1.8 million current) which management believes is very reasonable and should not be further adjusted

Bank of America

Merrill Lynch

The $3 million adjustment for California job losses at Klondyke/PVP is, according to Management, believed to be one-time in nature

and a result of start-up costs for the business and part of the learning curve of entering new territories

■ FCF Underperformance and Debt-Like Items

CSC has cited a management provided estimate of $197.1 million for 6/30/14 net debt. Management's current estimate is $196.2

million and includes Storm AR of $4.5 million which will be collected early in Q1 2015

Debt-like items that CSC appeared to include are:

RSI-related deferred compensation liability, which is disclosed in the Pioneer 2013 Form 10-K and has a total obligation with net

present value of $5.3 million at April 27. This does not appear to be a valid adjustment given the disclosure and the fact that only

$2.1 million out of the $6.6 million is due before 2018

CSC did not provide any visibility into the other PELLC adjustment of $0.8 million in their presentation and Management would need

further information from CSC to respond appropriately

Unfunded liability from multi-employer pension, which Pioneer management and labor attorneys engaged by Pioneer view to be

no liability. CSC has included a $5 million adjustment. Management indicated that any obligation would only be triggered in the

unlikely event that Pioneer exited the union pension plan and reenters the market in a non-union capacity. Additionally the

obligation would only be triggered if Pioneer was in the plan for a minimum of 8 years, which has not occurred

Source: Management views and forecasts from Pioneer Management; CSC views from Court Square Presentation dated July 2, 2014.

LOX For more investment banking materials, visit www.10xebitda.comView entire presentation