MP Materials Investor Conference Presentation Deck

4.

جی

5.

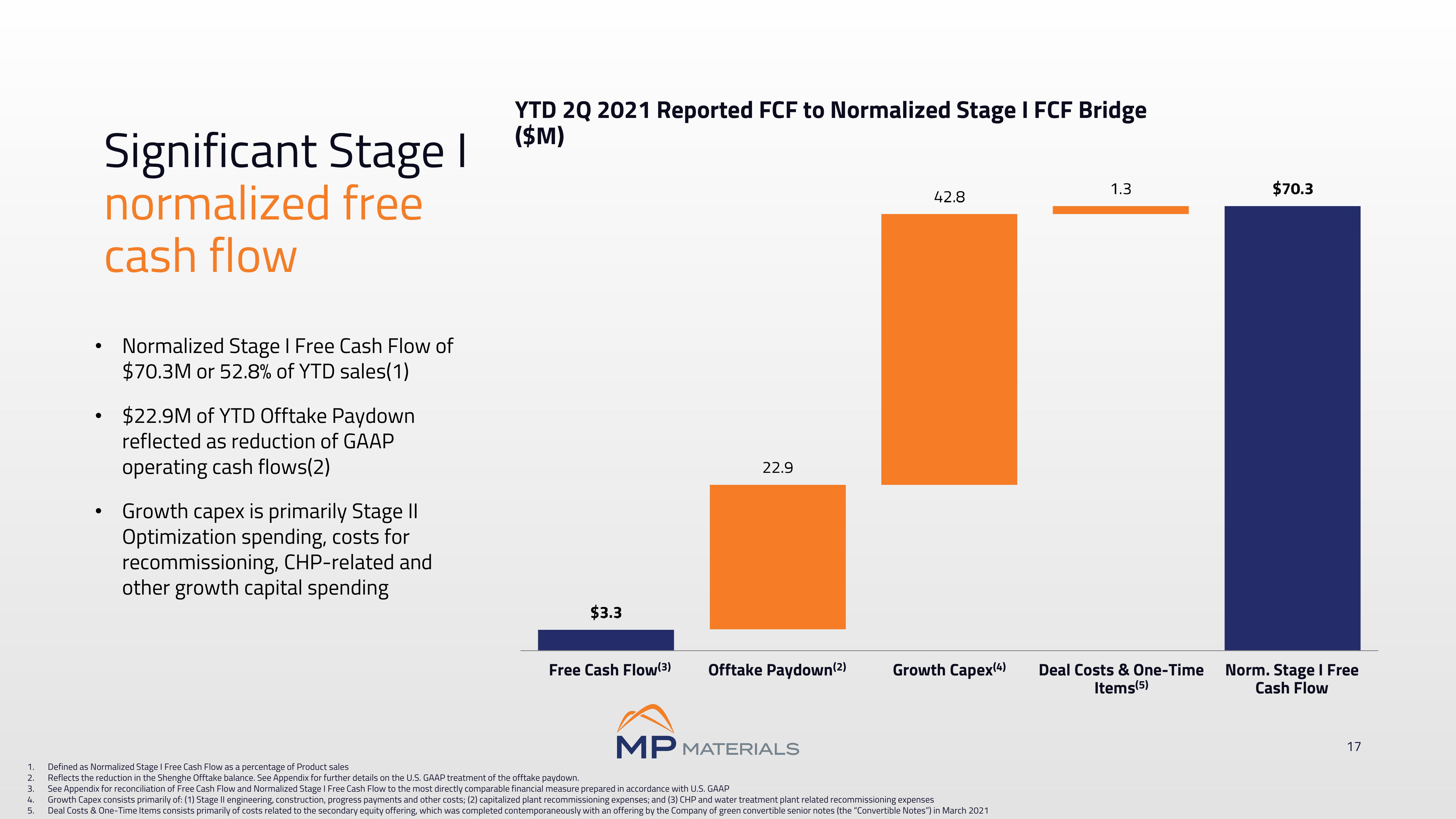

Significant Stage |

normalized free

cash flow

●

Normalized Stage I Free Cash Flow of

$70.3M or 52.8% of YTD sales(1)

●

• $22.9M of YTD Offtake Paydown

reflected as reduction of GAAP

operating cash flows(2)

Growth capex is primarily Stage II

Optimization spending, costs for

recommissioning, CHP-related and

other growth capital spending

YTD 2Q 2021 Reported FCF to Normalized Stage I FCF Bridge

($M)

$3.3

Free Cash Flow (3)

22.9

Offtake Paydown(2)

MP MATERIALS

Defined as Normalized Stage I Free Cash Flow as a percentage of Product sales

Reflects the reduction in the Shenghe Offtake balance. See Appendix for further details on the U.S. GAAP treatment of the offtake paydown.

3. See Appendix for reconciliation of Free Cash Flow and Normalized Stage I Free Cash Flow to the most directly comparable financial measure prepared in accordance with U.S. GAAP

Growth Capex consists primarily of: (1) Stage Il engineering, construction, progress payments and other costs; (2) capitalized plant recommissioning expenses; and (3) CHP and water treatment plant related recommissioning expenses

Deal Costs. One-Time Items consists primarily of costs related to the secondary equity offering, which was completed contemporaneously with an offering by the Company of green convertible senior notes (the "Convertible Notes") in March 2021

42.8

Growth Capex(4)

1.3

Deal Costs & One-Time

Items (5)

$70.3

Norm. Stage I Free

Cash Flow

17View entire presentation