Booking Holdings Shareholder Engagement Presentation Deck

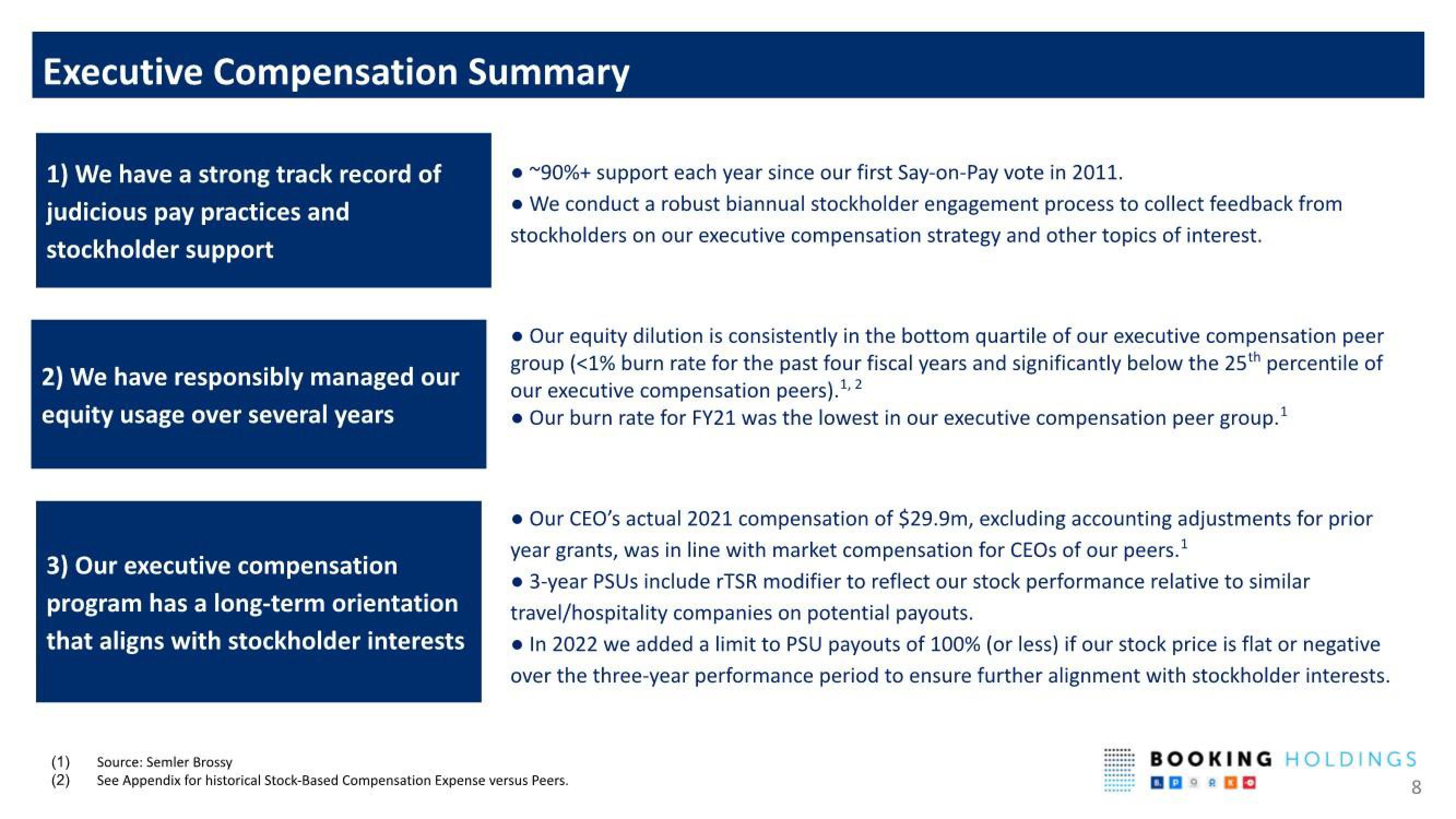

Executive Compensation Summary

1) We have a strong track record of

judicious pay practices and

stockholder support

2) We have responsibly managed our

equity usage over several years

3) Our executive compensation

program has a long-term orientation

that aligns with stockholder interests

(1)

(2)

~90%+ support each year since our first Say-on-Pay vote in 2011.

• We conduct a robust biannual stockholder engagement process to collect feedback from

stockholders on our executive compensation strategy and other topics of interest.

• Our equity dilution is consistently in the bottom quartile of our executive compensation peer

group (<1% burn rate for the past four fiscal years and significantly below the 25th percentile of

our executive compensation peers). 1¹,

1, 2

. Our burn rate for FY21 was the lowest in our executive compensation peer group.¹

• Our CEO's actual 2021 compensation of $29.9m, excluding accounting adjustments for prior

year grants, was in line with market compensation for CEOs of our peers. ¹

1

• 3-year PSUs include rTSR modifier to reflect our stock performance relative to similar

travel/hospitality companies on potential payouts.

• In 2022 we added a limit to PSU payouts of 100% (or less) if our stock price is flat or negative

over the three-year performance period to ensure further alignment with stockholder interests.

Source: Semler Brossy

See Appendix for historical Stock-Based Compensation Expense versus Peers.

BOOKING HOLDINGS

8View entire presentation