MSR Value Growth & Market Trends

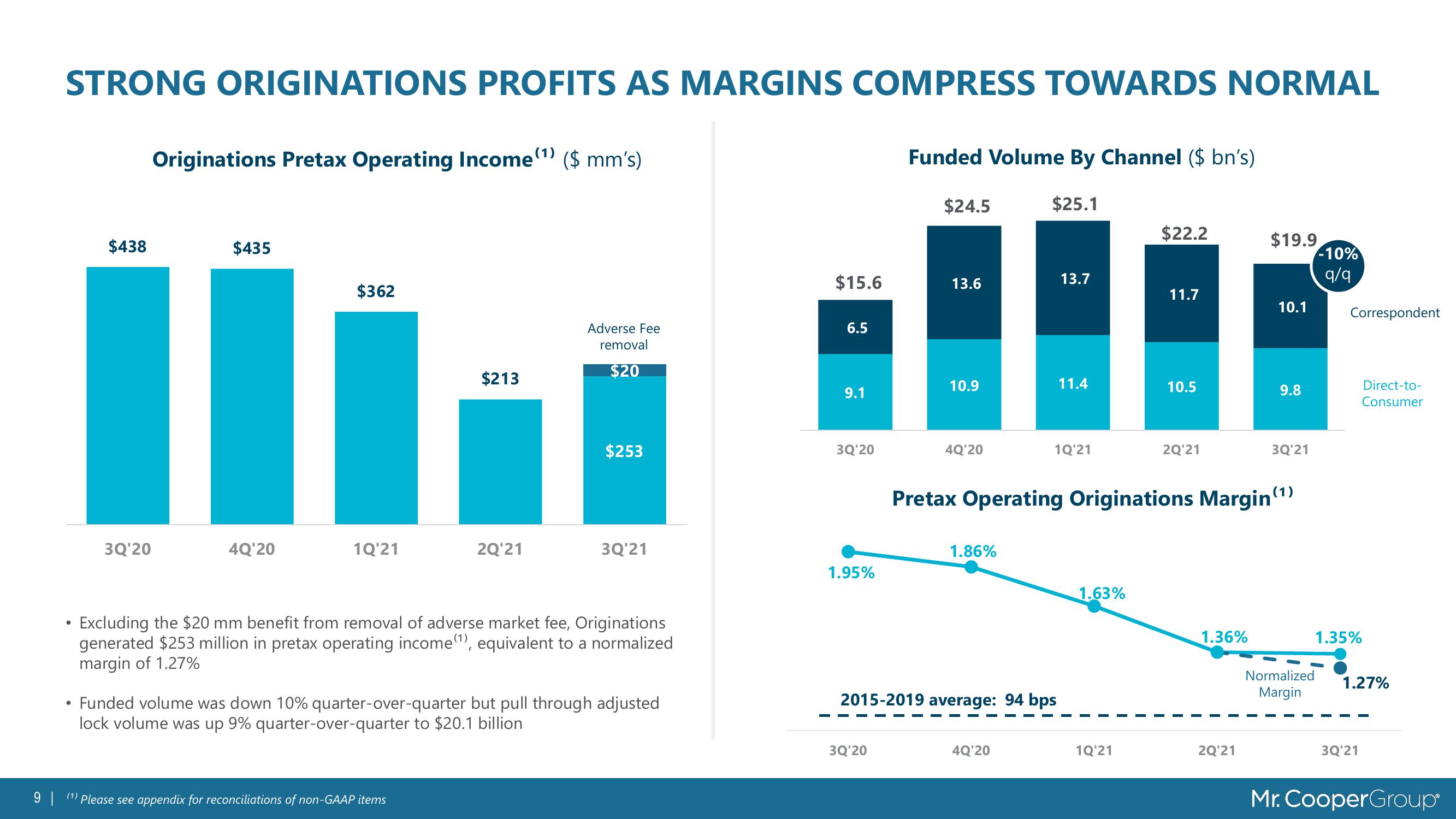

STRONG ORIGINATIONS PROFITS AS MARGINS COMPRESS TOWARDS NORMAL

●

$438

3Q'20

Originations Pretax Operating Income (1) ($ mm's)

$435

4Q'20

$362

1Q'21

$213

2Q¹21

9 (¹) Please see appendix for reconciliations of non-GAAP items

Adverse Fee

removal

$20

$253

3Q'21

Excluding the $20 mm benefit from removal of adverse market fee, Originations

generated $253 million in pretax operating income(¹), equivalent to a normalized

margin of 1.27%

unded volume was down 10% quarter-over-quarter but pull through adjusted

lock volume was up 9% quarter-over-quarter to $20.1 billion

$15.6

6.5

9.1

3Q'20

1.95%

Funded Volume By Channel ($ bn's)

3Q'20

$24.5

13.6

10.9

4Q'20

1.86%

$25.1

2015-2019 average: 94 bps

4Q'20

13.7

11.4

1Q'21

1.63%

$22.2

1Q'21

11.7

10.5

2Q'21

Pretax Operating Originations Margin(¹)

1.36%

$19.9

2Q'21

10.1

9.8

3Q'21

Normalized

Margin

-10%

q/q

Correspondent

1.35%

Direct-to-

Consumer

1.27%

3Q'21

Mr. CooperGroupView entire presentation