Sonos Results Presentation Deck

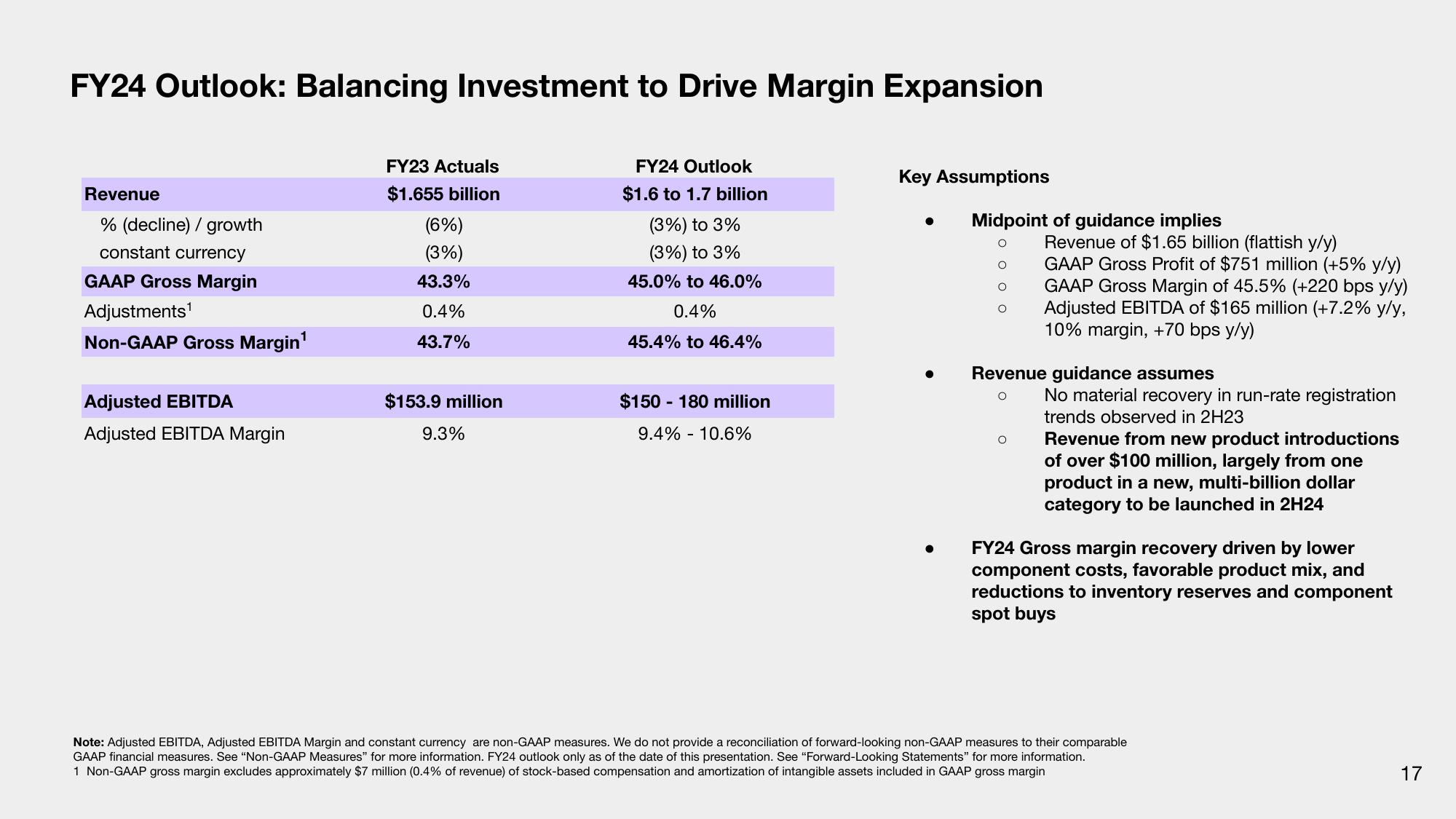

FY24 Outlook: Balancing Investment to Drive Margin Expansion

Revenue

% (decline) / growth

constant currency

GAAP Gross Margin

Adjustments¹

Non-GAAP Gross Margin¹ 1

Adjusted EBITDA

Adjusted EBITDA Margin

FY23 Actuals

$1.655 billion

(6%)

(3%)

43.3%

0.4%

43.7%

$153.9 million

9.3%

FY24 Outlook

$1.6 to 1.7 billion

(3%) to 3%

(3%) to 3%

45.0% to 46.0%

0.4%

45.4% to 46.4%

$150-180 million

9.4% 10.6%

Key Assumptions

Midpoint of guidance implies

O

O

O

Revenue of $1.65 billion (flattish y/y)

GAAP Gross Profit of $751 million (+5% y/y)

O

GAAP Gross Margin of 45.5% (+220 bps y/y)

Adjusted EBITDA of $165 million (+7.2% y/y,

10% margin, +70 bps y/y)

Revenue guidance assumes

O

No material recovery in run-rate registration

trends observed in 2H23

Revenue from new product introductions

of over $100 million, largely from one

product in a new, multi-billion dollar

category to be launched in 2H24

FY24 Gross margin recovery driven by lower

component costs, favorable product mix, and

reductions to inventory reserves and component

spot buys

Note: Adjusted EBITDA, Adjusted EBITDA Margin and constant currency are non-GAAP measures. We do not provide a reconciliation of forward-looking non-GAAP measures to their comparable

GAAP financial measures. See "Non-GAAP Measures" for more information. FY24 outlook only as of the date of this presentation. See "Forward-Looking Statements" for more information.

1 Non-GAAP gross margin excludes approximately $7 million (0.4% of revenue) of stock-based compensation and amortization of intangible assets included in GAAP gross margin

17View entire presentation