Forge SPAC Presentation Deck

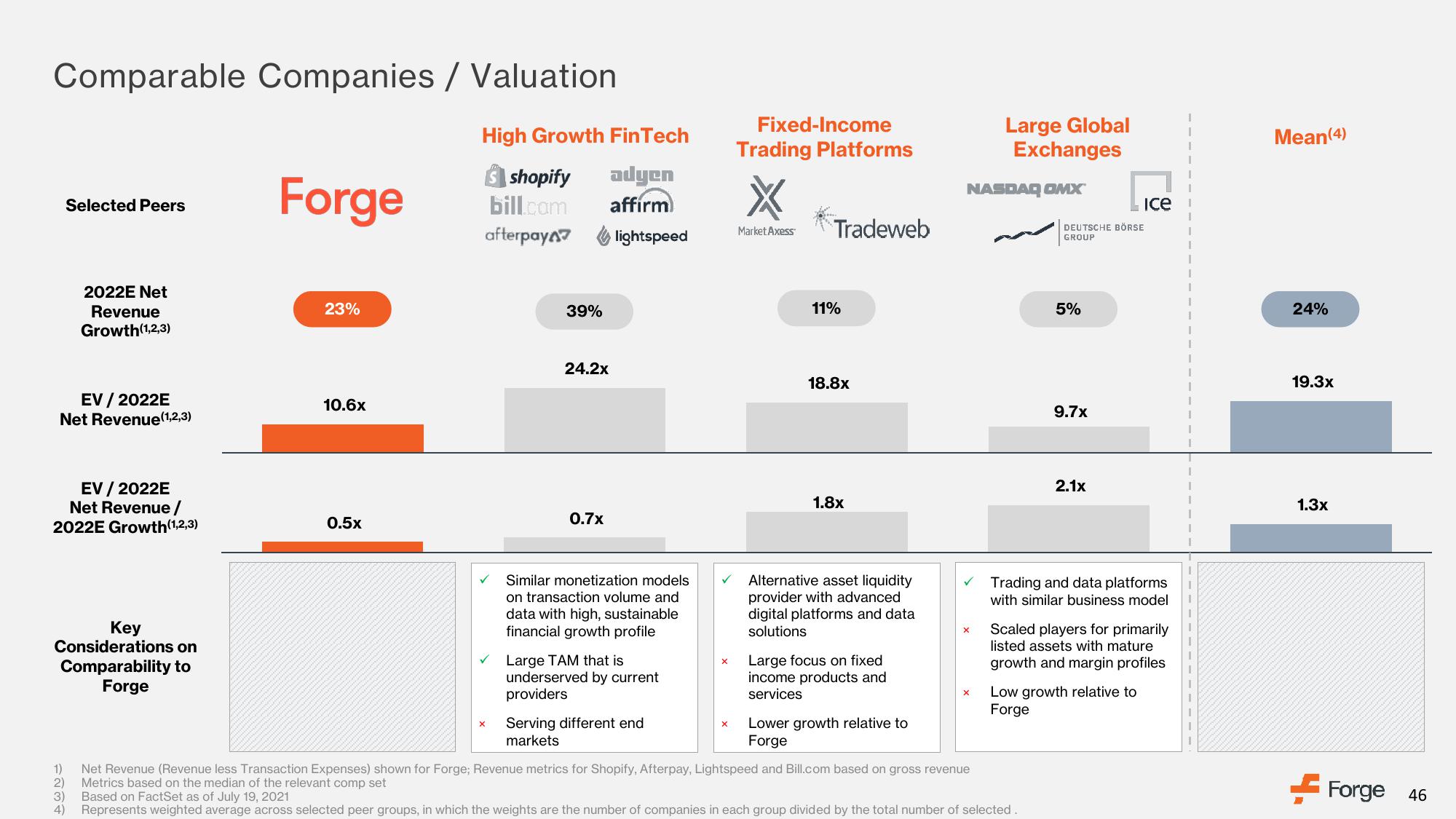

Comparable Companies / Valuation

EV / 2022E

Net Revenue (1,2,3)

Selected Peers

EV/ 2022E

Net Revenue /

2022E Growth (1,2,3)

2022E Net

Revenue

Growth(1,2,3)

Key

Considerations on

Comparability to

Forge

1234

2)

3)

Forge

23%

10.6x

0.5x

High Growth FinTech

adyen

affirm

lightspeed

shopify

bill.com

afterpay

39%

X

24.2x

0.7x

✓ Similar monetization models

on transaction volume and

data with high, sustainable

financial growth profile

Large TAM that is

underserved by current

providers

Serving different end

markets

Fixed-Income

Trading Platforms

MarketAxess

Tradeweb

11%

18.8x

1.8x

✓ Alternative asset liquidity

provider with advanced

digital platforms and data

solutions

Large focus on fixed

income products and

services

Lower growth relative to

Forge

1) Net Revenue (Revenue less Transaction Expenses) shown for Forge; Revenue metrics for Shopify, Afterpay, Lightspeed and Bill.com based on gross revenue

Metrics based on the median of the relevant comp set

NASDAQ OMX

X

Large Global

Exchanges

DEUTSCHE BÖRSE

GROUP

5%

Based on FactSet as of July 19, 2021

4) Represents weighted average across selected peer groups, in which the weights are the number of companies in each group divided by the total number of selected.

9.7x

Lice

2.1x

Trading and data platforms

with similar business model

Scaled players for primarily

listed assets with mature

growth and margin profiles

Low growth relative to

Forge

I

Mean(4)

24%

19.3x

1.3x

Forge

46View entire presentation