SoftBank Results Presentation Deck

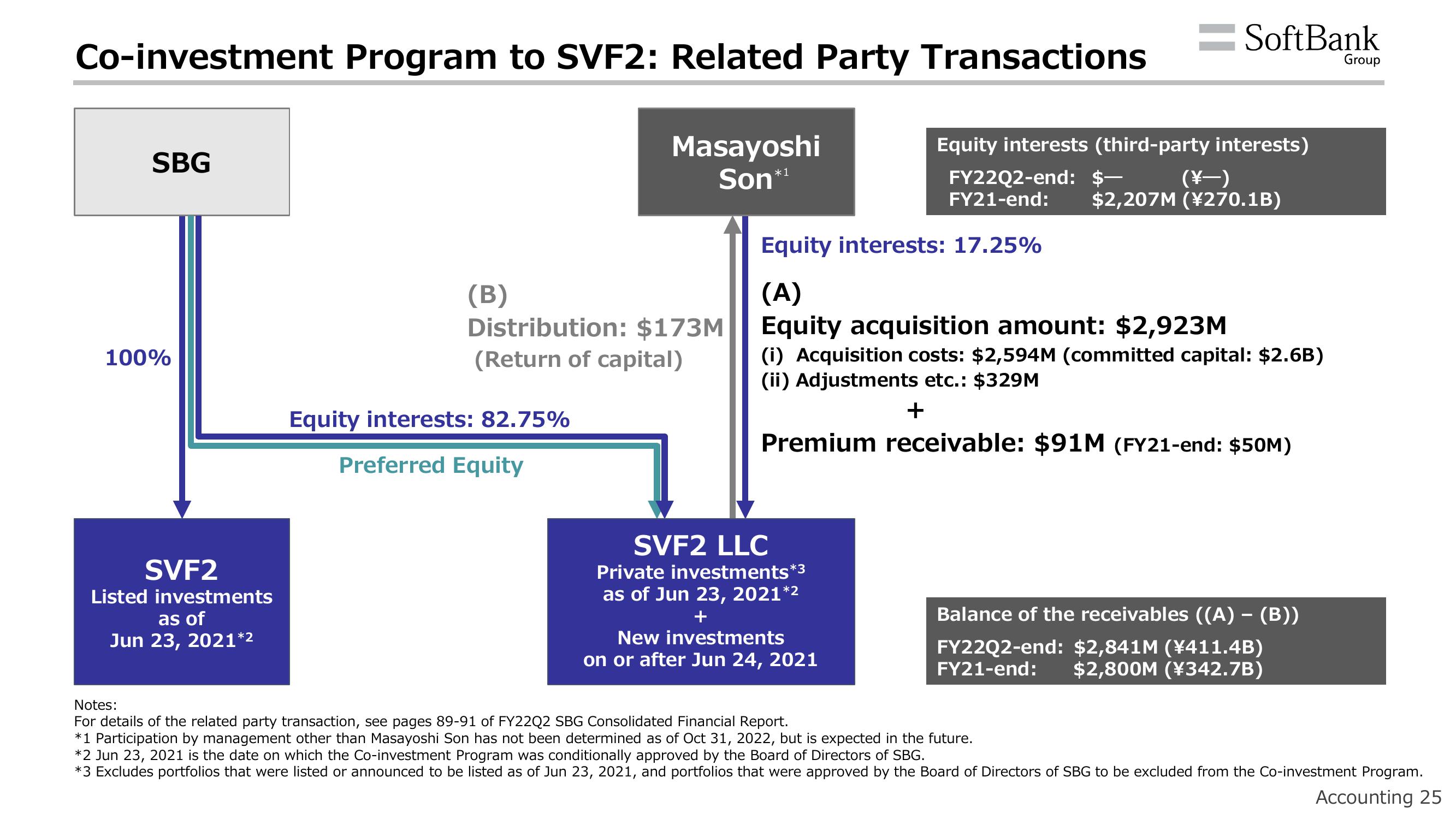

Co-investment Program to SVF2: Related Party Transactions

Masayoshi

Son*¹

SBG

100%

SVF2

Listed investments

as of

Jun 23, 2021*2

(B)

Distribution: $173M

(Return of capital)

Equity interests: 82.75%

Preferred Equity

SoftBank

SVF2 LLC

Private investments*3

as of Jun 23, 2021*²

+

New investments

on or after Jun 24, 2021

Equity interests (third-party interests)

FY22Q2-end: $-

FY21-end:

(\-)

$2,207M (¥270.1B)

Equity interests: 17.25%

(A)

Equity acquisition amount: $2,923M

(i) Acquisition costs: $2,594M (committed capital: $2.6B)

(ii) Adjustments etc.: $329M

+

Premium receivable: $91M (FY21-end: $50M)

Balance of the receivables ((A) – (B))

FY22Q2-end: $2,841M (¥411.4B)

FY21-end: $2,800M (¥342.7B)

Group

Notes:

For details of the related party transaction, see pages 89-91 of FY22Q2 SBG Consolidated Financial Report.

*1 Participation by management other than Masayoshi Son has not been determined as of Oct 31, 2022, but is expected in the future.

*2 Jun 23, 2021 is the date on which the Co-investment Program was conditionally approved by the Board of Directors of SBG.

*3 Excludes portfolios that were listed or announced to be listed as of Jun 23, 2021, and portfolios that were approved by the Board of Directors of SBG to be excluded from the Co-investment Program.

Accounting 25View entire presentation