Deutsche Bank Fixed Income Presentation Deck

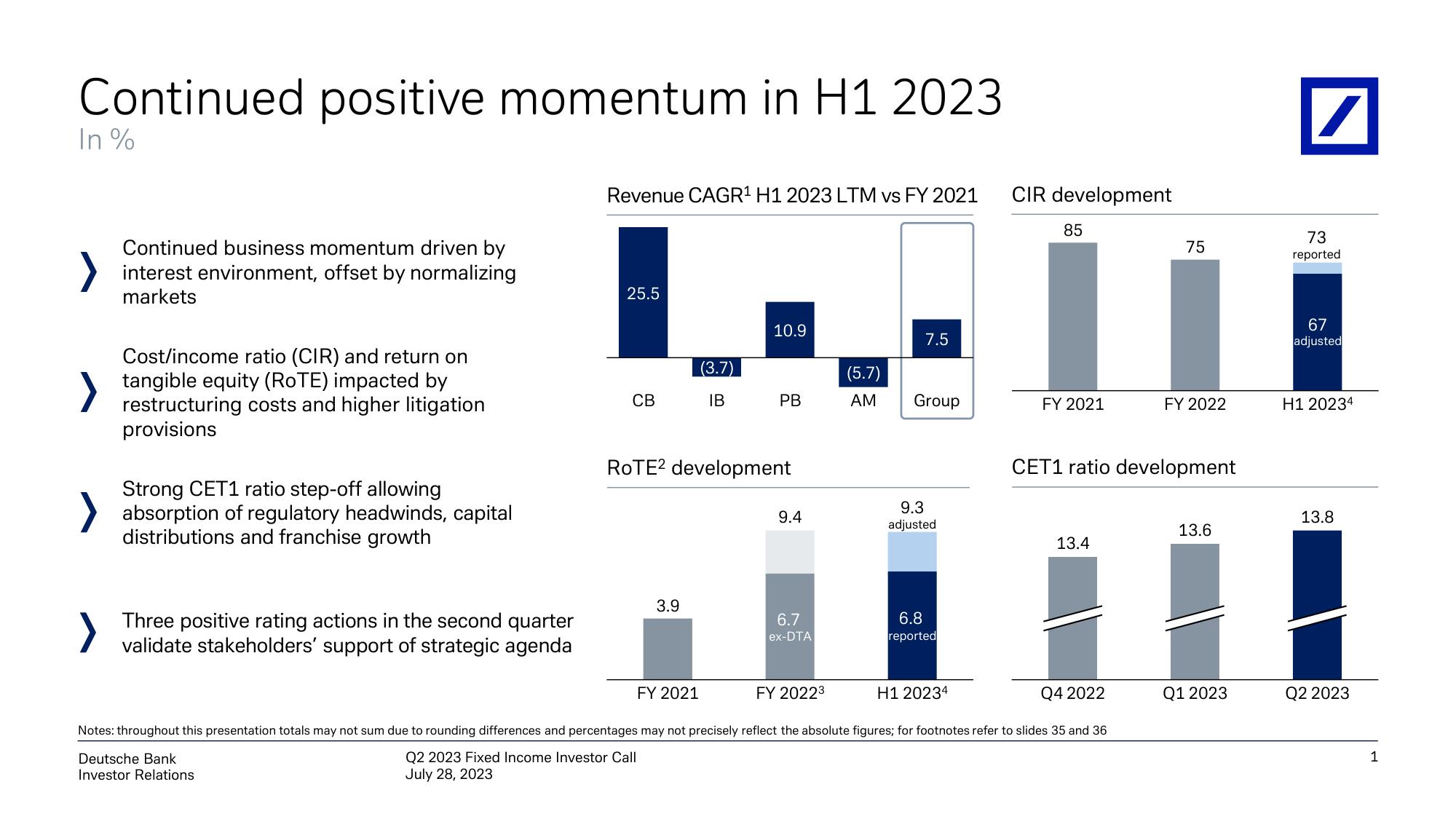

Continued positive momentum in H1 2023

In %

Continued business momentum driven by

interest environment, offset by normalizing

markets

Cost/income ratio (CIR) and return on

tangible equity (RoTE) impacted by

restructuring costs and higher litigation

provisions

Strong CET1 ratio step-off allowing

absorption of regulatory headwinds, capital

distributions and franchise growth

Three positive rating actions in the second quarter

validate stakeholders' support of strategic agenda

Revenue CAGR¹ H1 2023 LTM vs FY 2021

25.5

CB

3.9

(3.7)

IB

FY 2021

10.9

ROTE2 development

PB

9.4

6.7

ex-DTA

FY 2022³

7.5

(5.7)

AM Group

9.3

adjusted

6.8

reported

H1 20234

CIR development

85

FY 2021

13.4

75

CET1 ratio development

Q4 2022

Notes: throughout this presentation totals may not sum due to rounding differences and percentages may not precisely reflect the absolute figures; for footnotes refer to slides 35 and 36

Deutsche Bank

Q2 2023 Fixed Income Investor Call

Investor Relations

July 28, 2023

FY 2022

13.6

Q1 2023

/

73

reported

67

adjusted

H1 20234

13.8

Q2 2023

1View entire presentation