Morgan Stanley Investment Banking Pitch Book

Q1 2016

.

Project Roosevelt

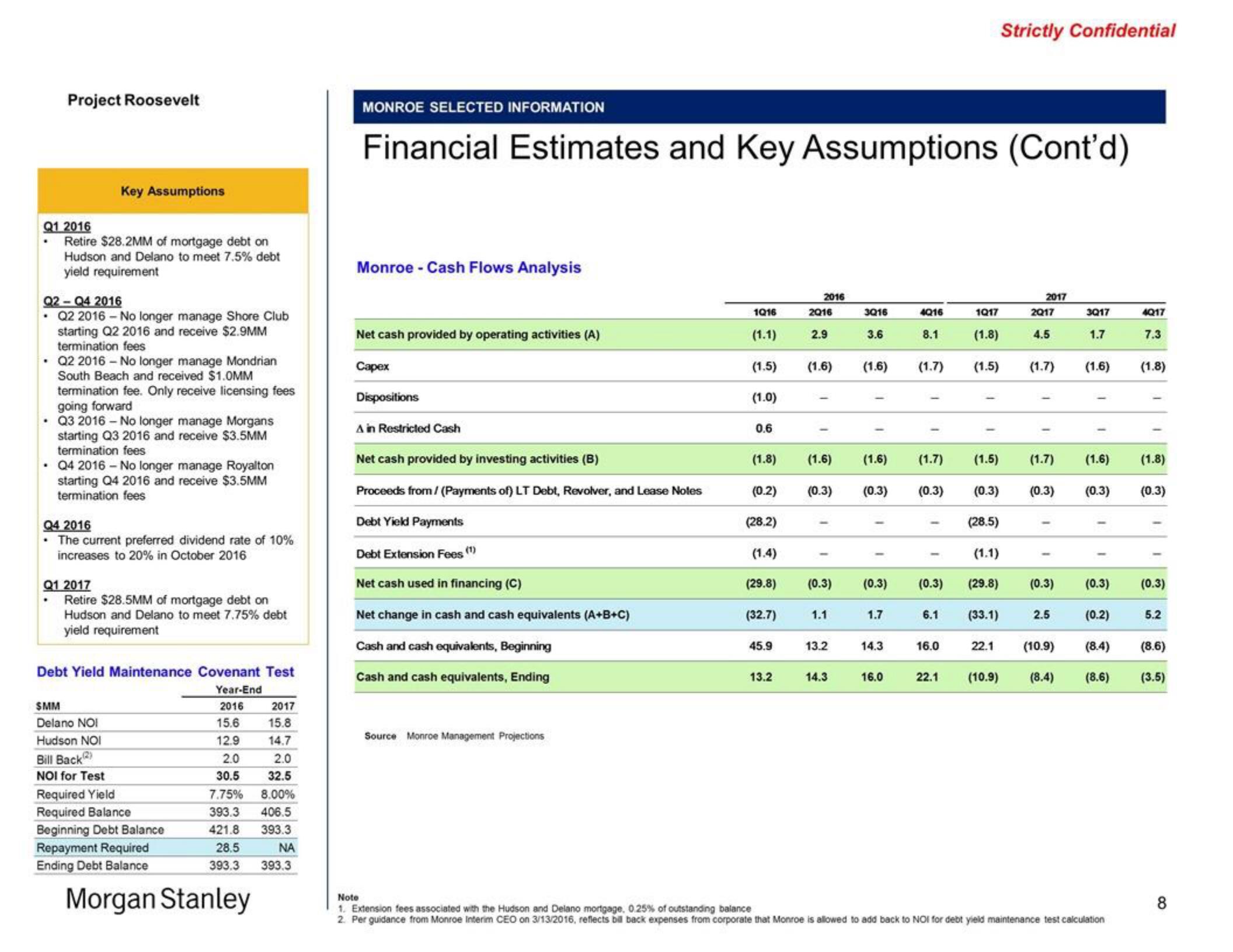

Retire $28.2MM of mortgage debt on

Hudson and Delano to meet 7.5% debt

yield requirement

Q2-Q4 2016

• Q2 2016 - No longer manage Shore Club

starting Q2 2016 and receive $2.9MM

termination fees

Key Assumptions

• Q2 2016 - No longer manage Mondrian

South Beach and received $1.0MM

termination fee. Only receive licensing fees

going forward

• Q3 2016 - No longer manage Morgans

starting Q3 2016 and receive $3.5MM

termination fees

.

Q4 2016-No longer manage Royalton

starting Q4 2016 and receive $3.5MM

termination fees

Q4 2016

• The current preferred dividend rate of 10%

increases to 20% in October 2016

Q1 2017

Retire $28.5MM of mortgage debt on

Hudson and Delano to meet 7.75% debt

yield requirement

Debt Yield Maintenance Covenant Test

Year-End

2016

SMM

Delano NOI

Hudson NOI

Bill Back)

NOI for Test

Required Yield

Required Balance

Beginning Debt Balance

Repayment Required

Ending Debt Balance

2017

15.6

15.8

12.9

14.7

2.0

2.0

30.5

32.5

7.75% 8.00%

393.3 406.5

421.8 393.3

ΝΑ

28.5

393.3

Morgan Stanley

393.3

MONROE SELECTED INFORMATION

Financial Estimates and Key Assumptions (Cont'd)

Monroe - Cash Flows Analysis

Net cash provided by operating activities (A)

Capex

Dispositions

A in Restricted Cash

Net cash provided by investing activities (B)

Proceeds from / (Payments of) LT Debt, Revolver, and Lease Notes

Debt Yield Payments

Debt Extension Fees (¹)

Net cash used in financing (C)

Net change in cash and cash equivalents (A+B+C)

Cash and cash equivalents, Beginning

Cash and cash equivalents, Ending

Source Monroe Management Projections

1Q16

(1.1)

(1.5)

(1.0)

0.6

(1.8)

(0.2)

(28.2)

(1.4)

(29.8)

(32.7)

45.9

13.2

2016

2016

2.9

(1.6)

(1.6)

I

1.1

3016

13.2

3.6

14.3

(1.6)

(1.6)

(0.3) (0.3) (0.3)

I

1.7

4016

14.3

8.1

(0.3) (0.3) (0.3)

16.0

1

(1.8)

(1.7) (1.5) (1.7)

I

1017

6.1

(1.7) (1.5) (1.7)

(0.3)

(28.5)

1

16.0

Strictly Confidential

(1.1)

(29.8)

2017

(33.1)

2017

4.5

(0.3)

3017

2.5

1.7

(1.6)

(0.3) (0.3)

(1.6)

1

(0.3)

(0.2)

4017

Note

1. Extension fees associated with the Hudson and Delano mortgage, 0.25% of outstanding balance

2. Per guidance from Monroe Interim CEO on 3/13/2016, reflects bill back expenses from corporate that Monroe is allowed to add back to NOI for debt yield maintenance test calculation

7.3

(1.8)

(1.8)

(0.3)

I

(0.3)

22.1 (10.9) (8.4)

22.1 (10.9) (8.4) (8.6) (3.5)

5.2

(8.6)

8View entire presentation