Kinnevik Results Presentation Deck

Intro

Net Asset Value

Note 4 Financial Assets Accounted at

Fair Value Through Profit & Loss

OUR FRAMEWORK AND PRINCIPLES

In assessing the fair value of our unlisted investments, we apply IFRS

13 and the International Private Equity and Venture Capital Valuation

Guidelines, whereunder we make a collective assessment to establish

the valuation methods and points of reference that are suitable and rel-

evant in determining the fair value of each of our unlisted investments.

Valuations in recent transactions are not applied as a valuation method,

but typically provides important points of reference for our valuations.

When applicable, consideration is taken to preferential rights such as

liquidation preferences to proceeds in a sale or listing of a business.

Valuation methods include revenue, GMV, and profit multiples, with

consideration to differences in size, growth, profitability and cost of equity

capital. We also consider the strength of a company's financial position,

cash runway, and the funding environment.

The valuation process is led independently from the investment team.

Accuracy and reliability of financial information is ensured through con-

tinuous contacts with investee management teams and regular reviews

of their financial and operational reporting. Information and opinions on

applicable valuation methods are obtained periodically from investment

managers and well-renowned investment banks and audit firms. The val-

uations are approved by Kinnevik's CFO and CEO after which a proposal

is presented and discussed with the Audit & Sustainability Committee and

Kinnevik's external auditors. After their scrutiny and potential adjustments,

the valuations are approved by the Audit & Sustainability Committee and

included in Kinnevik's financial reports.

When establishing the fair value of other financial instruments, meth-

ods assumed to provide the best estimation of fair value are used. For

assets and liabilities maturing within one year, a nominal value adjusted

for interest payments and premiums is assumed to provide a good

approximation of fair value.

Information in this note is provided per class of financial instruments

that are valued at fair value in the balance sheet, distributed in the levels

stated below:

KINNEVIK

Interim Report Q1 2022

Portfolio Overview

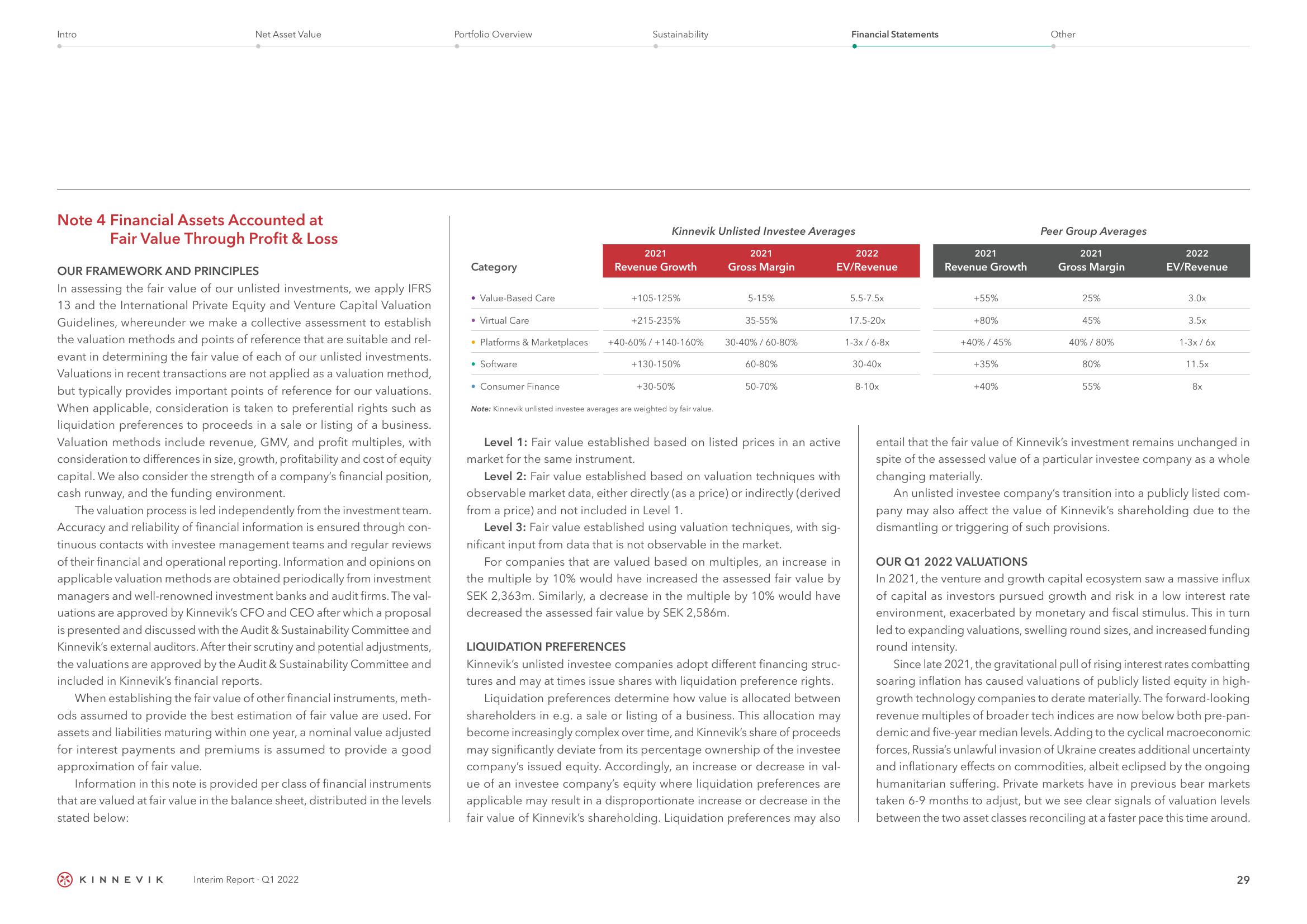

Category

• Value-Based Care

• Virtual Care

• Platforms & Marketplaces

• Software

• Consumer Finance

Sustainability

2021

Kinnevik Unlisted Investee Averages

Revenue Growth

+105-125%

+215-235%

+40-60% / +140-160%

+130-150%

+30-50%

Note: Kinnevik unlisted investee averages are weighted by fair value.

2021

Gross Margin

5-15%

35-55%

30-40% / 60-80%

60-80%

50-70%

Financial Statements

2022

EV/Revenue

Level 1: Fair value established based on listed prices in an active

market for the same instrument.

Level 2: Fair value established based on valuation techniques with

observable market data, either directly (as a price) or indirectly (derived

from a price) and not included in Level 1.

Level 3: Fair value established using valuation techniques, with sig-

nificant input from data that is not observable in the market.

For companies that are valued based on multiples, an increase in

the multiple by 10% would have increased the assessed fair value by

SEK 2,363m. Similarly, a decrease in the multiple by 10% would have

decreased the assessed fair value by SEK 2,586m.

LIQUIDATION PREFERENCES

Kinnevik's unlisted investee companies adopt different financing struc-

tures and may at times issue shares with liquidation preference rights.

Liquidation preferences determine how value is allocated between

shareholders in e.g. a sale or listing of a business. This allocation may

become increasingly complex over time, and Kinnevik's share of proceeds

may significantly deviate from its percentage ownership of the investee

company's issued equity. Accordingly, an increase or decrease in val-

ue of an investee company's equity where liquidation preferences are

applicable may result in a disproportionate increase or decrease in the

fair value of Kinnevik's shareholding. Liquidation preferences may also

5.5-7.5x

17.5-20x

1-3x/6-8x

30-40x

8-10x

2021

Revenue Growth

+55%

+80%

+40% / 45%

+35%

+40%

Other

Peer Group Averages

2021

Gross Margin

25%

45%

40% / 80%

80%

55%

2022

EV/Revenue

3.0x

3.5x

1-3x/6x

11.5x

8x

entail that the fair value of Kinnevik's investment remains unchanged in

spite of the assessed value of a particular investee company as a whole

changing materially.

An unlisted investee company's transition into a publicly listed com-

pany may also affect the value of Kinnevik's shareholding due to the

dismantling or triggering of such provisions.

OUR Q1 2022 VALUATIONS

In 2021, the venture and growth capital ecosystem saw a massive influx

of capital as investors pursued growth and risk in a low interest rate

environment, exacerbated by monetary and fiscal stimulus. This in turn

led to expanding valuations, swelling round sizes, and increased funding

round intensity.

Since late 2021, the gravitational pull of rising interest rates combatting

soaring inflation has caused valuations of publicly listed equity in high-

growth technology companies to derate materially. The forward-looking

revenue multiples of broader tech indices are now below both pre-pan-

demic and five-year median levels. Adding to the cyclical macroeconomic

forces, Russia's unlawful invasion of Ukraine creates additional uncertainty

and inflationary effects on commodities, albeit eclipsed by the ongoing

humanitarian suffering. Private markets have in previous bear markets

taken 6-9 months to adjust, but we see clear signals of valuation levels

between the two asset classes reconciling at a faster pace this time around.

29View entire presentation