Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

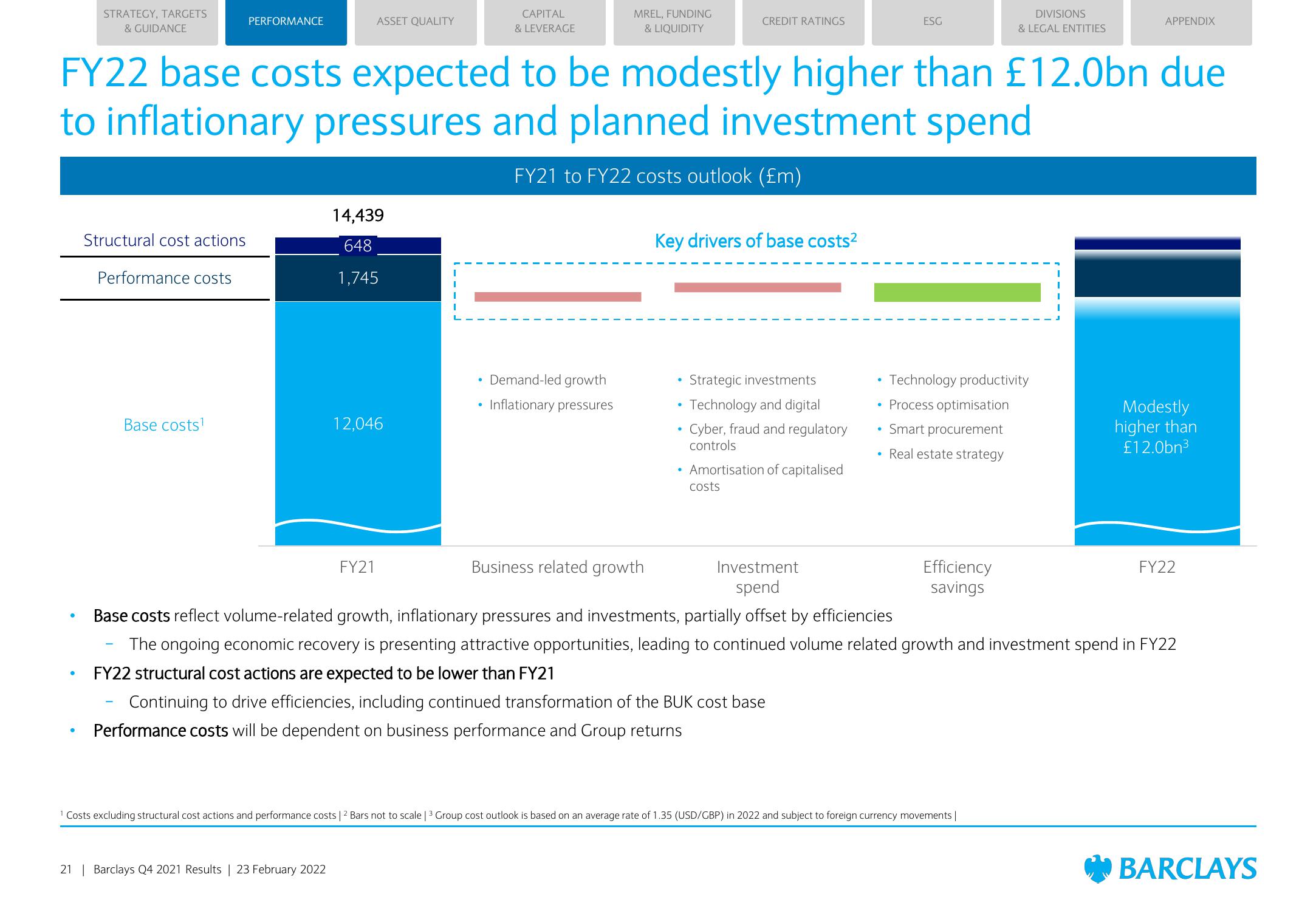

Structural cost actions

Performance costs

PERFORMANCE

Base costs¹

ASSET QUALITY

14,439

648

1,745

21 | Barclays Q4 2021 Results | 23 February 2022

FY22 base costs expected to be modestly higher than £12.0bn due

to inflationary pressures and planned investment spend

FY21 to FY22 costs outlook (£m)

12,046

CAPITAL

& LEVERAGE

FY21

MREL, FUNDING

& LIQUIDITY

Demand-led growth

Inflationary pressures

CREDIT RATINGS

Key drivers of base costs²

Strategic investments

Technology and digital

Cyber, fraud and regulatory

controls

• Amortisation of capitalised

costs

.

ESG

Investment

spend

●

Technology productivity

• Process optimisation

• Smart procurement

• Real estate strategy

DIVISIONS

& LEGAL ENTITIES

Business related growth

Base costs reflect volume-related growth, inflationary pressures and investments, partially offset by efficiencies

The ongoing economic recovery is presenting attractive opportunities, leading to continued volume related growth and investment spend in FY22

FY22 structural cost actions are expected to be lower than FY21

Continuing to drive efficiencies, including continued transformation of the BUK cost base

Performance costs will be dependent on business performance and Group returns

Efficiency

savings

¹ Costs excluding structural cost actions and performance costs | ² Bars not to scale | ³ Group cost outlook is based on an average rate of 1.35 (USD/GBP) in 2022 and subject to foreign currency movements |

APPENDIX

Modestly

higher than

£12.0bn³

FY22

BARCLAYSView entire presentation