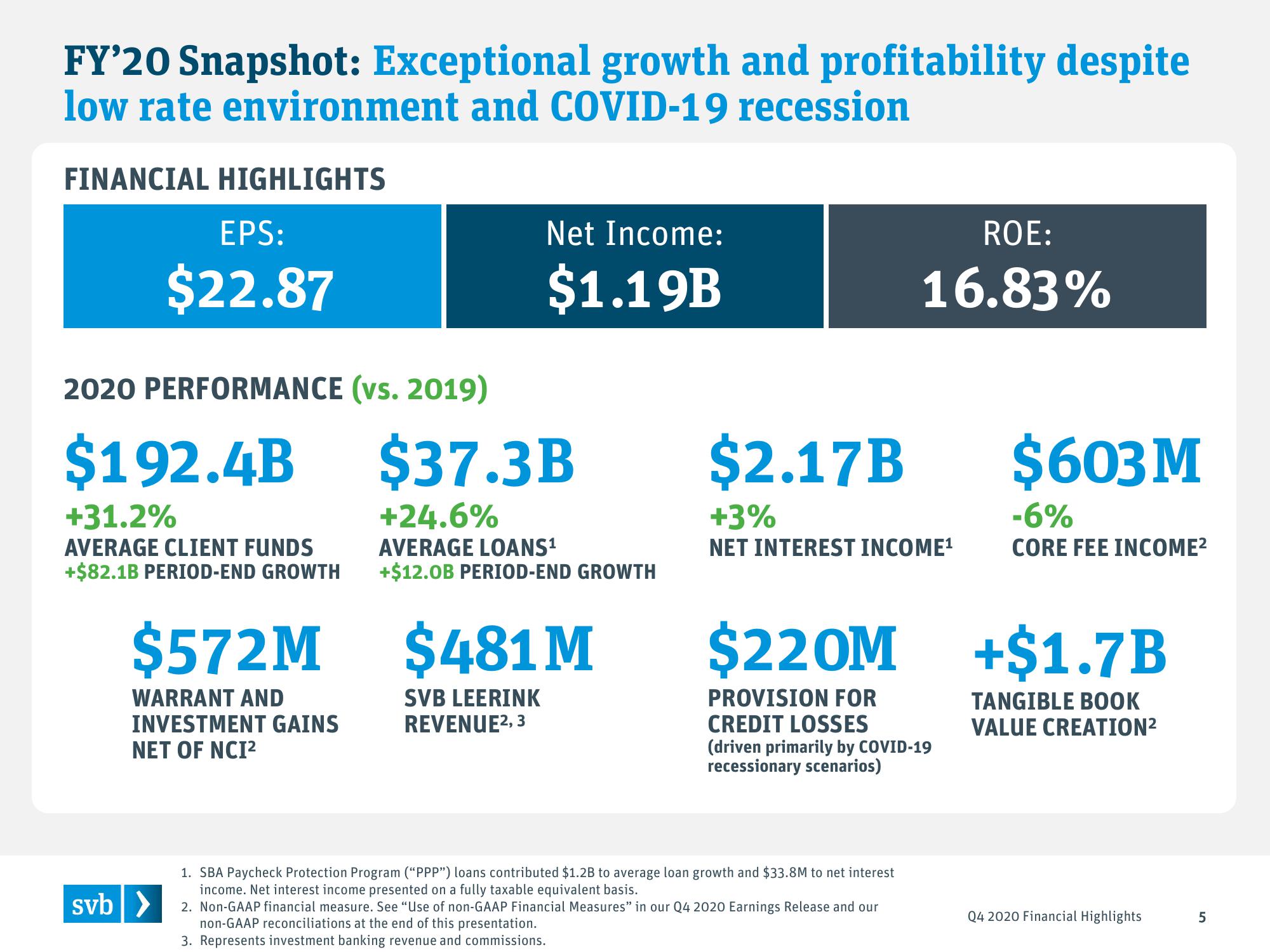

Silicon Valley Bank Results Presentation Deck

FY'20 Snapshot: Exceptional growth and profitability despite

low rate environment and COVID-19 recession

FINANCIAL HIGHLIGHTS

EPS:

$22.87

2020 PERFORMANCE (vs. 2019)

$192.4B

+31.2%

AVERAGE CLIENT FUNDS

+$82.1B PERIOD-END GROWTH

$572M

WARRANT AND

INVESTMENT GAINS

NET OF NCI²

svb >

Net Income:

$1.19B

$37.3B

+24.6%

AVERAGE LOANS¹

+$12.0B PERIOD-END GROWTH

$481 M

SVB LEERINK

REVENUE², 3

ROE:

16.83%

$2.17B

+3%

NET INTEREST INCOME¹

$220M

PROVISION FOR

CREDIT LOSSES

(driven primarily by COVID-19

recessionary scenarios)

1. SBA Paycheck Protection Program ("PPP") loans contributed $1.2B to average loan growth and $33.8M to net interest

income. Net interest income presented on a fully taxable equivalent basis.

2. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q4 2020 Earnings Release and our

non-GAAP reconciliations at the end of this presentation.

3. Represents investment banking revenue and commissions.

$603 M

-6%

CORE FEE INCOME²

+$1.7B

TANGIBLE BOOK

VALUE CREATION²

Q4 2020 Financial Highlights

5View entire presentation