Silicon Valley Bank Results Presentation Deck

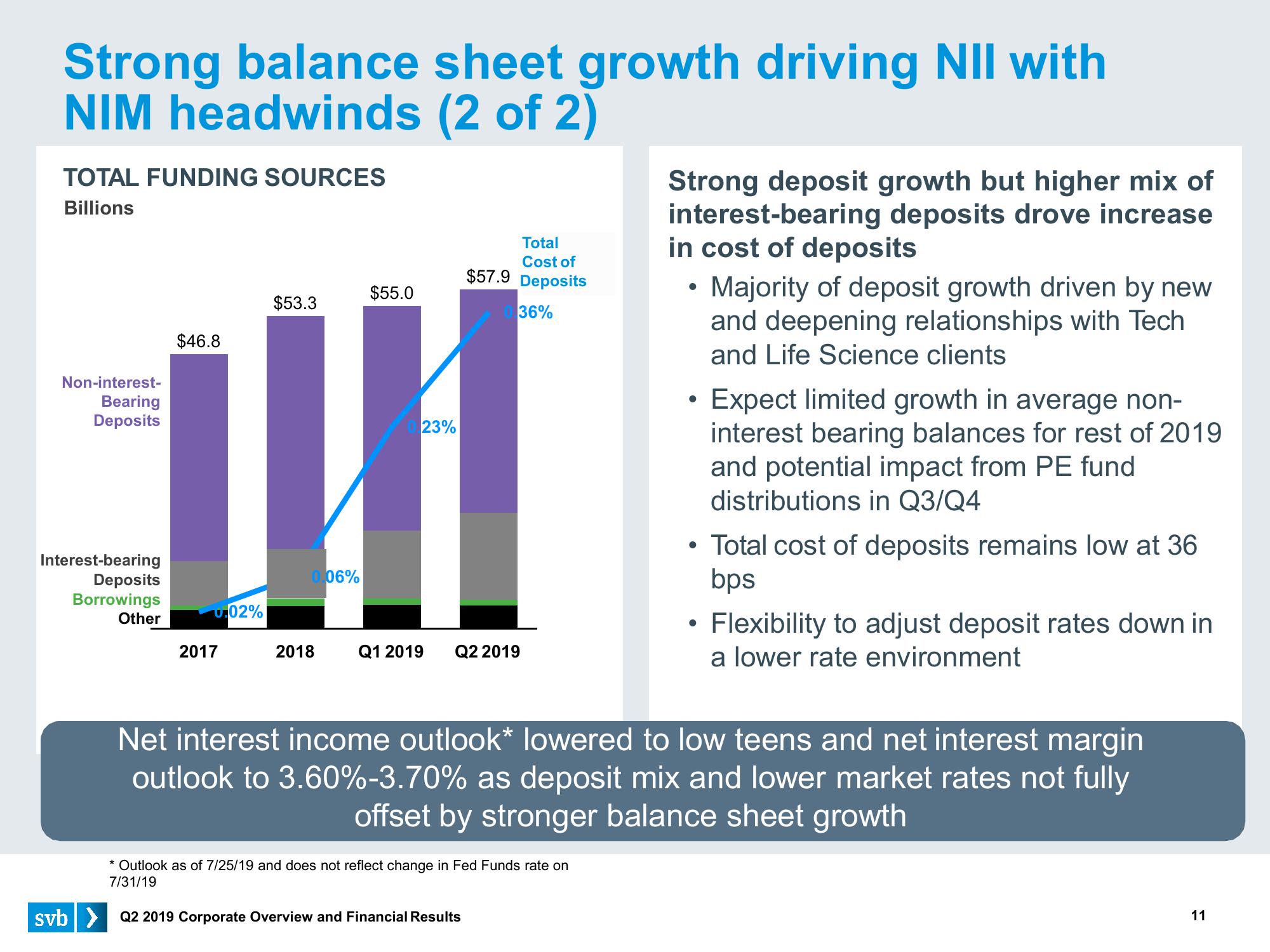

Strong balance sheet growth driving NII with

NIM headwinds

(2 of 2)

TOTAL FUNDING SOURCES

Billions

Non-interest-

Bearing

Deposits

Interest-bearing

Deposits

Borrowings

Other

$46.8

0.02%

2017

$53.3

0.06%

2018

$55.0

23%

Total

Cost of

$57.9 Deposits

36%

Q1 2019 Q2 2019

* Outlook as of 7/25/19 and does not reflect change in Fed Funds rate on

7/31/19

svb> Q2 2019 Corporate Overview and Financial Results

Strong deposit growth but higher mix of

interest-bearing deposits drove increase

in cost of deposits

●

Majority of deposit growth driven by new

and deepening relationships with Tech

and Life Science clients

Expect limited growth in average non-

interest bearing balances for rest of 2019

and potential impact from PE fund

distributions in Q3/Q4

Total cost of deposits remains low at 36

bps

Net interest income outlook* lowered to low teens and net interest margin

outlook to 3.60%-3.70% as deposit mix and lower market rates not fully

offset by stronger balance sheet growth

Flexibility to adjust deposit rates down in

a lower rate environment

11View entire presentation