Kinnevik Results Presentation Deck

Intro

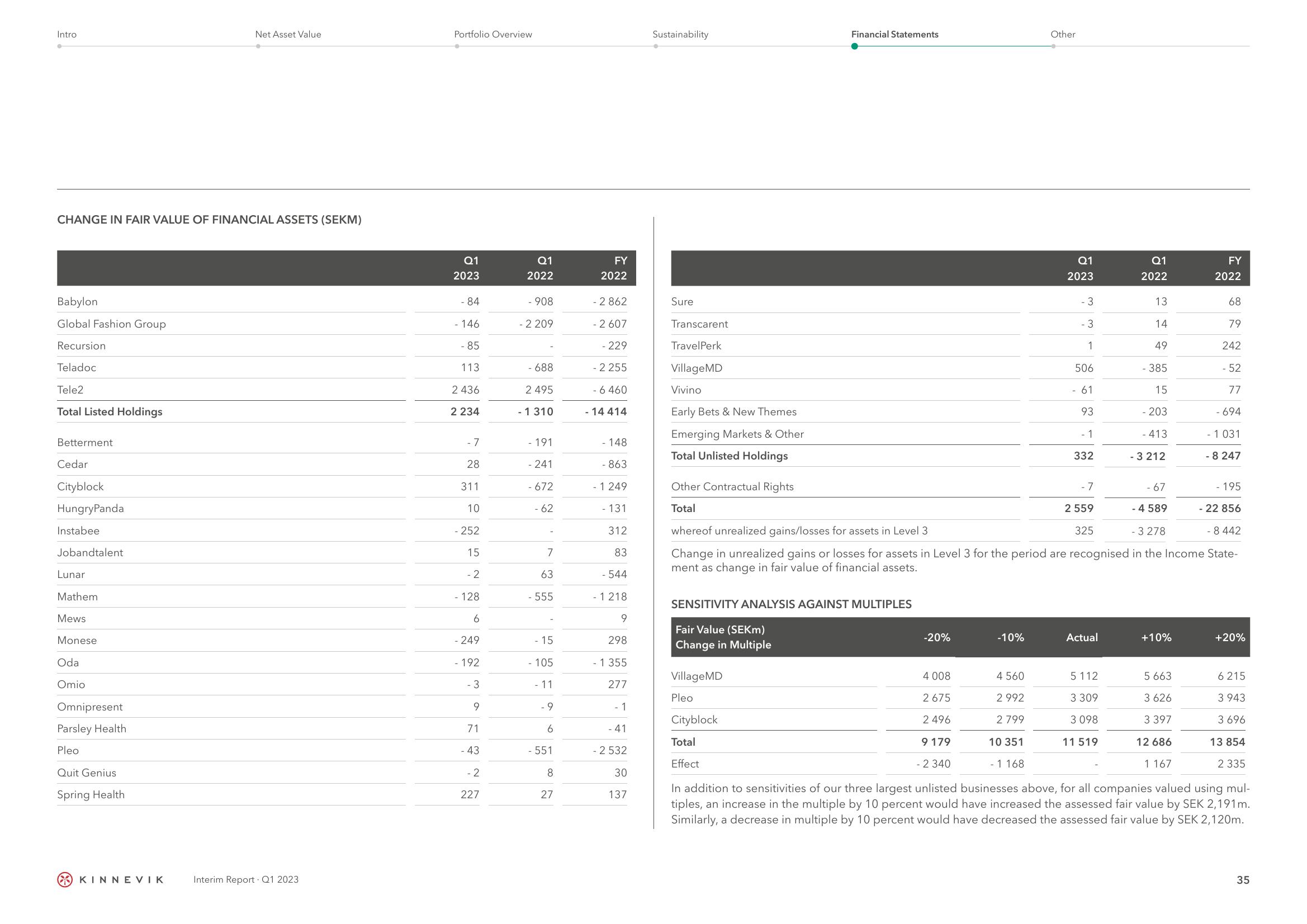

CHANGE IN FAIR VALUE OF FINANCIAL ASSETS (SEKM)

Babylon

Global Fashion Group

Recursion

Teladoc

Tele2

Total Listed Holdings

Betterment

Cedar

Cityblock

HungryPanda

Instabee

Jobandtalent

Lunar

Mathem

Mews

Monese

Oda

Omio

Omnipresent

Parsley Health

Pleo

Quit Genius

Spring Health

Net Asset Value

KINNEVIK

Interim Report Q1 2023

Portfolio Overview

Q1

2023

- 84

- 146

- 85

113

2 436

2 234

-7

28

311

10

- 252

15

- 2

- 128

6

- 249

- 192

3

9

71

- 43

-2

227

Q1

2022

- 908

- 2 209

-688

2 495

- 1310

- 191

- 241

- 672

- 62

7

63

- 555

- 15

- 105

11

-9

6

- 551

8

27

FY

2022

- 2 862

- 2 607

- 229

- 2 255

- 6 460

- 14 414

- 148

- 863

- 1 249

- 131

312

83

- 544

- 1 218

9

298

- 1 355

277

1

- 41

- 2 532

30

137

Sustainability

Sure

Transcarent

TravelPerk

Village MD

Vivino

Early Bets & New Themes

Emerging Markets & Other

Total Unlisted Holdings

Other Contractual Rights

Total

Financial Statements

SENSITIVITY ANALYSIS AGAINST MULTIPLES

Fair Value (SEKm)

Change in Multiple

Village MD

Pleo

Cityblock

Total

Effect

-20%

4 008

2

675

2 496

9 179

- 2 340

-10%

4 560

2 992

2 799

Other

10 351

- 1 168

Q1

2023

3

3

1

506

61

93

-1

332

-7

2 559

325

Actual

5112

Q1

2022

- 22 856

whereof unrealized gains/losses for assets in Level 3

- 3 278

- 8 442

Change in unrealized gains or losses for assets in Level 3 for the period are recognised in the Income State-

ment as change in fair value of financial assets.

3 309

3 098

11 519

13

14

49

- 385

15

- 203

- 413

- 3 212

- 67

- 4 589

+10%

FY

2022

5 663

3 626

3 397

12 686

1 167

68

79

242

- 52

77

- 694

- 1 031

- 8 247

- 195

+20%

6 215

3 943

3696

13 854

2 335

In addition to sensitivities of our three largest unlisted businesses above, for all companies valued using mul-

tiples, an increase in the multiple by 10 percent would have increased the assessed fair value by SEK 2,191m.

Similarly, a decrease in multiple by 10 percent would have decreased the assessed fair value by SEK 2,120m.

35View entire presentation