Ocado Results Presentation Deck

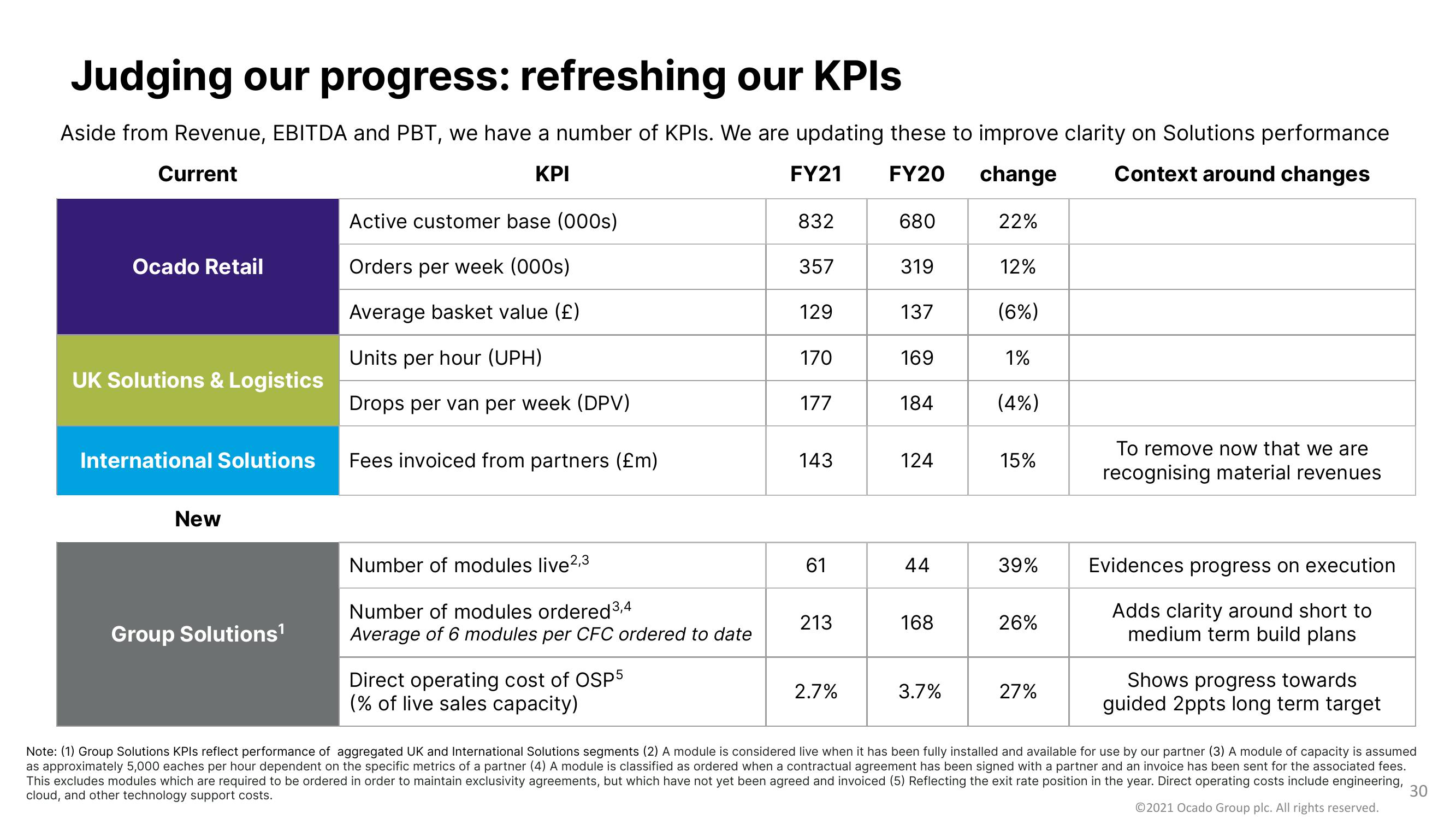

Judging our progress: refreshing our KPIs

Aside from Revenue, EBITDA and PBT, we have a number of KPIs. We are updating these to improve clarity on Solutions performance

Current

ΚΡΙ

FY21

FY20 change

Context around changes

22%

Ocado Retail

UK Solutions & Logistics

International Solutions

New

Group Solutions¹

Active customer base (000s)

Orders per week (000s)

Average basket value (£)

Units per hour (UPH)

Drops per van per week (DPV)

Fees invoiced from partners (£m)

Number of modules live ²,3

Number of modules ordered 3,4

Average of 6 modules per CFC ordered to date

Direct operating cost of OSP5

(% of live sales capacity)

832

357

129

170

177

143

61

213

2.7%

680

319

137

169

184

124

44

168

3.7%

12%

(6%)

1%

(4%)

15%

39%

26%

27%

To remove now that we are

recognising material revenues

Evidences progress on execution

Adds clarity around short to

medium term build plans

Shows progress towards

guided 2ppts long term target

Note: (1) Group Solutions KPIs reflect performance of aggregated UK and International Solutions segments (2) A module is considered live when it has been fully installed and available for use by our partner (3) A module of capacity is assumed

as approximately 5,000 eaches per hour dependent on the specific metrics of a partner (4) A module is classified as ordered when a contractual agreement has been signed with a partner and an invoice has been sent for the associated fees.

This excludes modules which are required to be ordered in order to maintain exclusivity agreements, but which have not yet been agreed and invoiced (5) Reflecting the exit rate position in the year. Direct operating costs include engineering,

cloud, and other technology support costs.

Ⓒ2021 Ocado Group plc. All rights reserved.

30View entire presentation