Syniverse SPAC Presentation Deck

Proposed Transaction Summary

1

2

Valuation

▪ Pro forma enterprise value of $2.85B or 12.1x 2022E Adjusted EBITDA

1.

2.

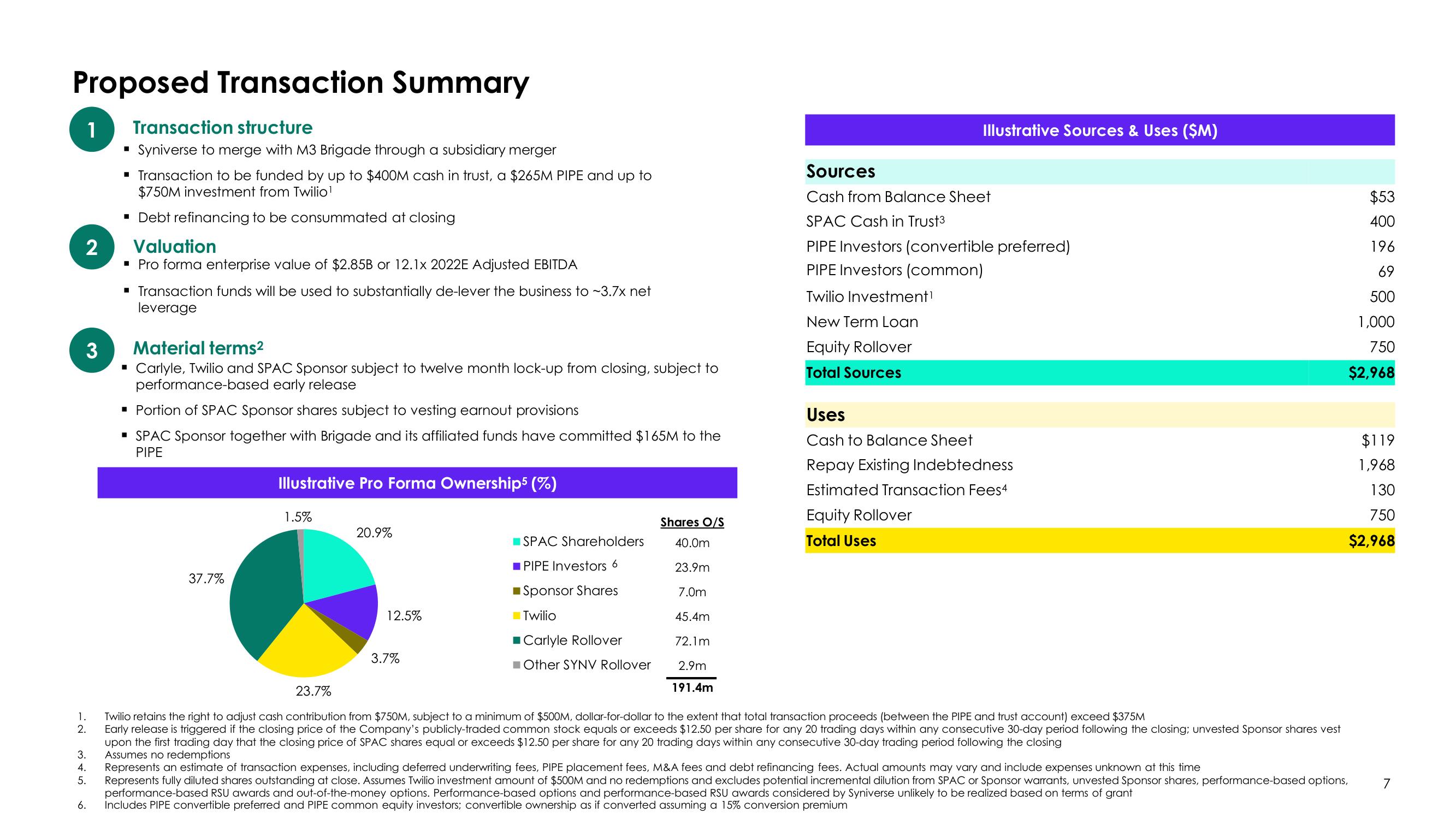

Transaction structure

▪ Syniverse to merge with M3 Brigade through a subsidiary merger

3.

4.

5.

▪ Transaction to be funded by up to $400M cash in trust, a $265M PIPE and up to

$750M investment from Twilio¹

▪ Debt refinancing to be consummated at closing

3

Material terms²

▪ Carlyle, Twilio and SPAC Sponsor subject to twelve month lock-up from closing, subject to

performance-based early release

6.

▪ Transaction funds will be used to substantially de-lever the business to ~3.7x net

leverage

▪ Portion of SPAC Sponsor shares subject to vesting earnout provisions

▪ SPAC Sponsor together with Brigade and its affiliated funds have committed $165M to the

PIPE

37.7%

Illustrative Pro Forma Ownership5 (%)

1.5%

20.9%

12.5%

3.7%

SPAC Shareholders

PIPE Investors 6

Sponsor Shares

Twilio

■Carlyle Rollover

■Other SYNV Rollover

Shares O/S

40.0m

23.9m

7.0m

45.4m

72.1m

2.9m

191.4m

Illustrative Sources & Uses ($M)

Sources

Cash from Balance Sheet

SPAC Cash in Trust³

PIPE Investors (convertible preferred)

PIPE Investors (common)

Twilio Investment¹

New Term Loan

Equity Rollover

Total Sources

Uses

Cash to Balance Sheet

Repay Existing Indebtedness

Estimated Transaction Fees4

Equity Rollover

Total Uses

23.7%

Twilio retains the right to adjust cash contribution from $750M, subject to a minimum of $500M, dollar-for-dollar to the extent that total transaction proceeds (between the PIPE and trust account) exceed $375M

Early release is triggered if the closing price of the Company's publicly-traded common stock equals or exceeds $12.50 per share for any 20 trading days within any consecutive 30-day period following the closing; unvested Sponsor shares vest

upon the first trading day that the closing price of SPAC shares equal or exceeds $12.50 per share for any 20 trading days within any consecutive 30-day trading period following the closing

Assumes no redemptions

Represents an estimate of transaction expenses, including deferred underwriting fees, PIPE placement fees, M&A fees and debt refinancing fees. Actual amounts may vary and include expenses unknown at this time

Represents fully diluted shares outstanding at close. Assumes Twilio investment amount of $500M and no redemptions and excludes potential incremental dilution from SPAC or Sponsor warrants, unvested Sponsor shares, performance-based options,

performance-based RSU awards and out-of-the-money options. Performance-based options and performance-based RSU awards considered by Syniverse unlikely to be realized based on terms of grant

Includes PIPE convertible preferred and PIPE common equity investors; convertible ownership as if converted assuming a 15% conversion premium

$53

400

196

69

500

1,000

750

$2,968

$119

1,968

130

750

$2,968

7View entire presentation