Melrose Results Presentation Deck

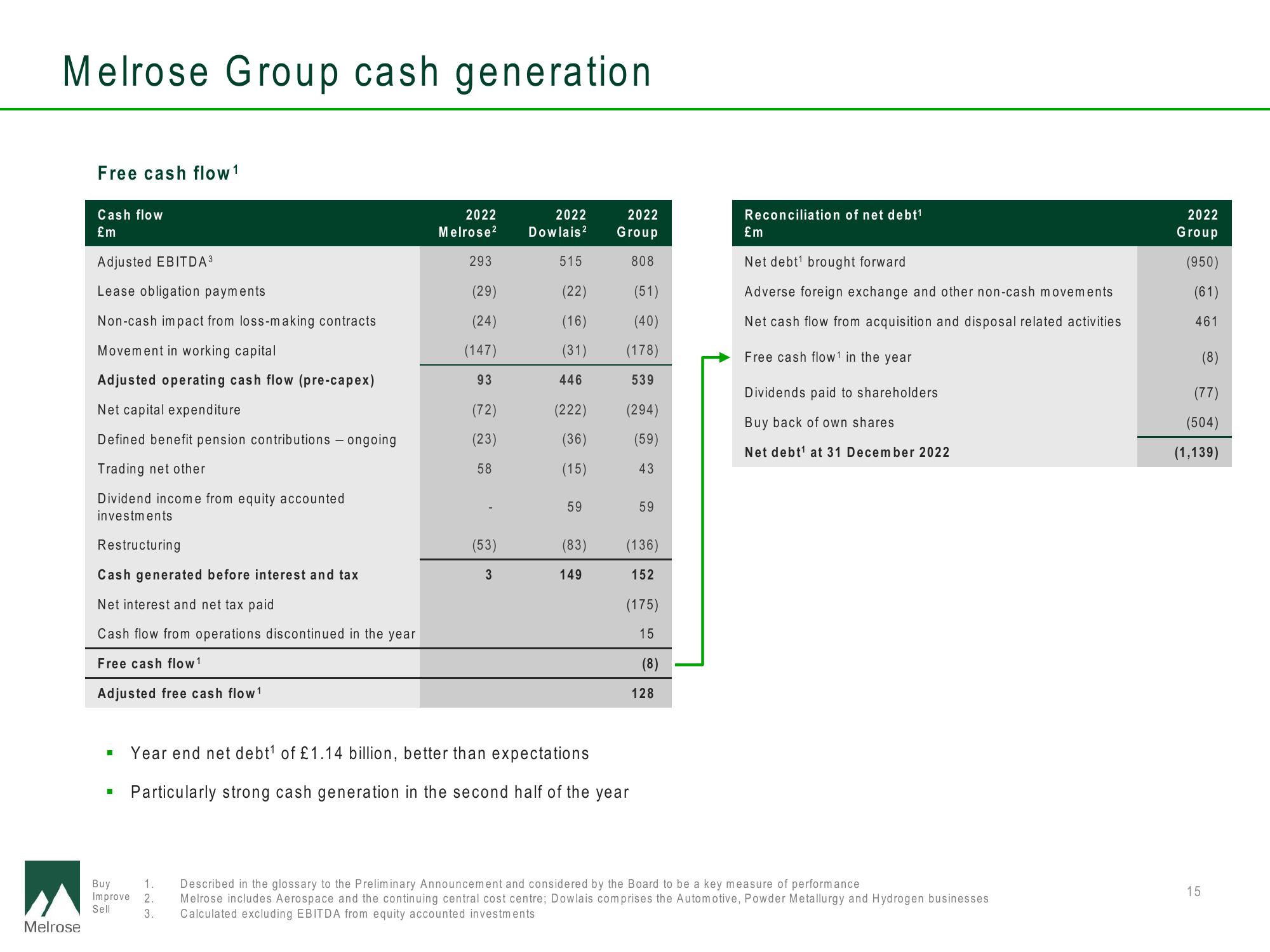

Melrose Group cash generation

Melrose

Free cash flow 1

Cash flow

£m

Adjusted EBITDA ³

Lease obligation payments

Non-cash impact from loss-making contracts

Movement in working capital

Adjusted operating cash flow (pre-capex)

Net capital expenditure

Defined benefit pension contributions - ongoing

Trading net other

Dividend income from equity accounted

investments

Restructuring

Cash generated before interest and tax

Net interest and net tax paid

Cash flow from operations discontinued in the year

Free cash flow 1

Adjusted free cash flow ¹

■

Buy

Improve

Sell

123

2022

2022

Melrose² Dowlais 2

3.

293

(29)

(24)

(147)

93

(72)

(23)

58

(53)

3

515

(22)

(16)

(31)

446

(222)

(36)

(15)

59

(83)

149

2022

Group

808

(51)

(40)

(178)

539

(294)

(59)

43

Year end net debt¹ of £1.14 billion, better than expectations

Particularly strong cash generation in the second half of the year

59

(136)

152

(175)

15

(8)

128

Reconciliation of net debt¹

£m

Net debt¹ brought forward

Adverse foreign exchange and other non-cash movements

Net cash flow from acquisition and disposal related activities

Free cash flow¹ in the year

Dividends paid to shareholders

Buy back of own shares

Net debt¹ 31 December 2022

Described in the glossary to the Preliminary Announcement and considered by the Board to be a key measure of performance

Melrose includes Aerospace and the continuing central cost centre; Dowlais comprises the Automotive, Powder Metallurgy and Hydrogen businesses

Calculated excluding EBITDA from equity accounted investments

2022

Group

(950)

(61)

461

(8)

(77)

(504)

(1,139)

15View entire presentation