Inovalon Results Presentation Deck

Full Year 2019 Financial Guidance

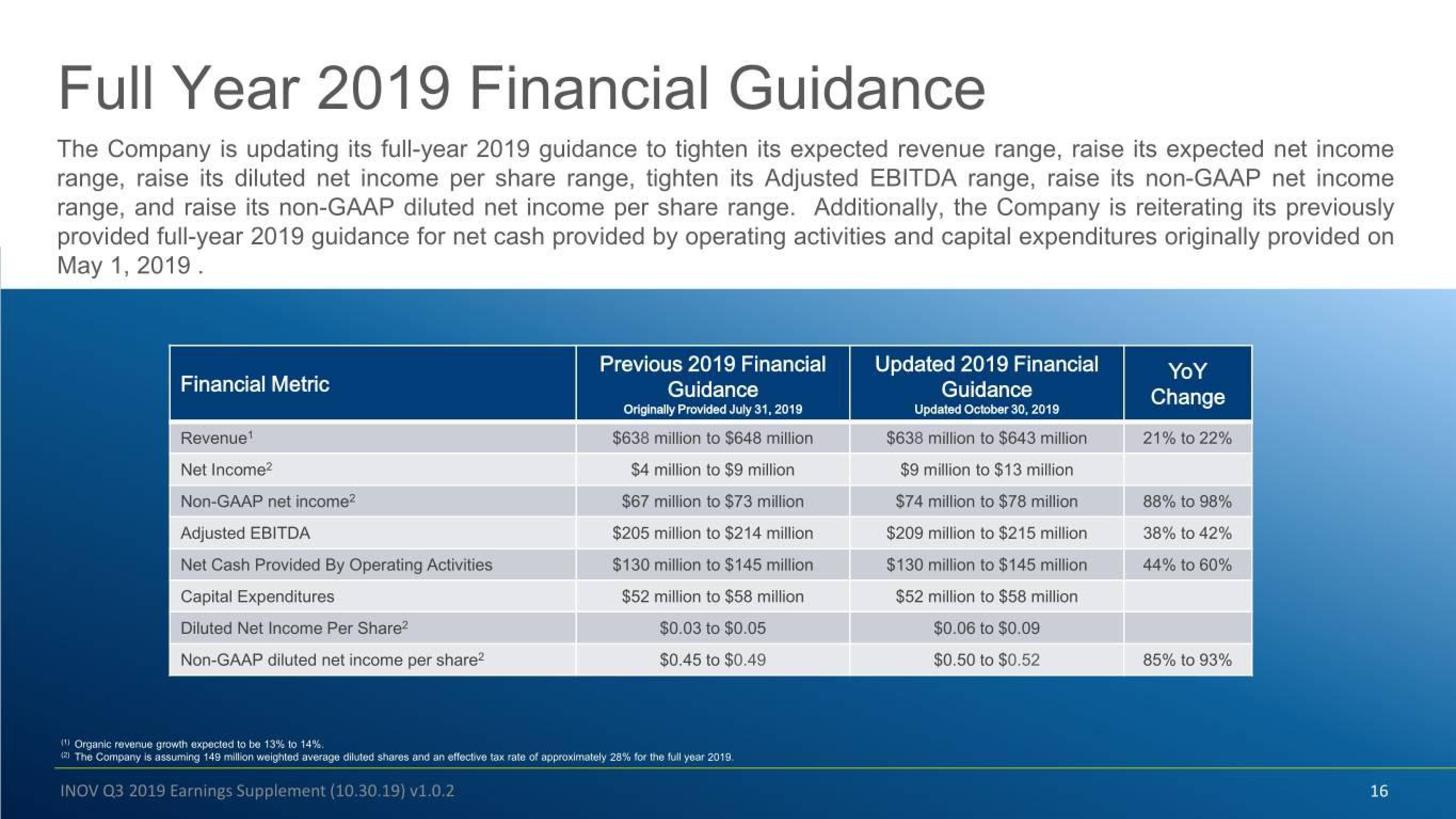

The Company is updating its full-year 2019 guidance to tighten its expected revenue range, raise its expected net income.

range, raise its diluted net income per share range, tighten its Adjusted EBITDA range, raise its non-GAAP net income

range, and raise its non-GAAP diluted net income per share range. Additionally, the Company is reiterating its previously

provided full-year 2019 guidance for net cash provided by operating activities and capital expenditures originally provided on

May 1, 2019.

Financial Metric

Revenue¹

Net Income²

Non-GAAP net income²

Adjusted EBITDA

Net Cash Provided By Operating Activities

Capital Expenditures

Diluted Net Income Per Share²

Non-GAAP diluted net income per share²

Previous 2019 Financial

Guidance

Originally Provided July 31, 2019

$638 million to $648 million

$4 million to $9 million

$67 million to $73 million

$205 million to $214 million

$130 million to $145 million

$52 million to $58 million

$0.03 to $0.05

$0.45 to $0.49

Organic revenue growth expected to be 13% to 14%.

121 The Company is assuming 149 million weighted average diluted shares and an effective tax rate of approximately 28% for the full year 2019.

INOV Q3 2019 Earnings Supplement (10.30.19) v1.0.2

Updated 2019 Financial

Guidance

Updated October 30, 2019

$638 million to $643 million

$9 million to $13 million

$74 million to $78 million

$209 million to $215 million

$130 million to $145 million

$52 million to $58 million

$0.06 to $0.09

$0.50 to $0.52

YoY

Change

21% to 22%

88% to 98%

38% to 42%

44% to 60%

85% to 93%

16View entire presentation