Investing in Private Credit

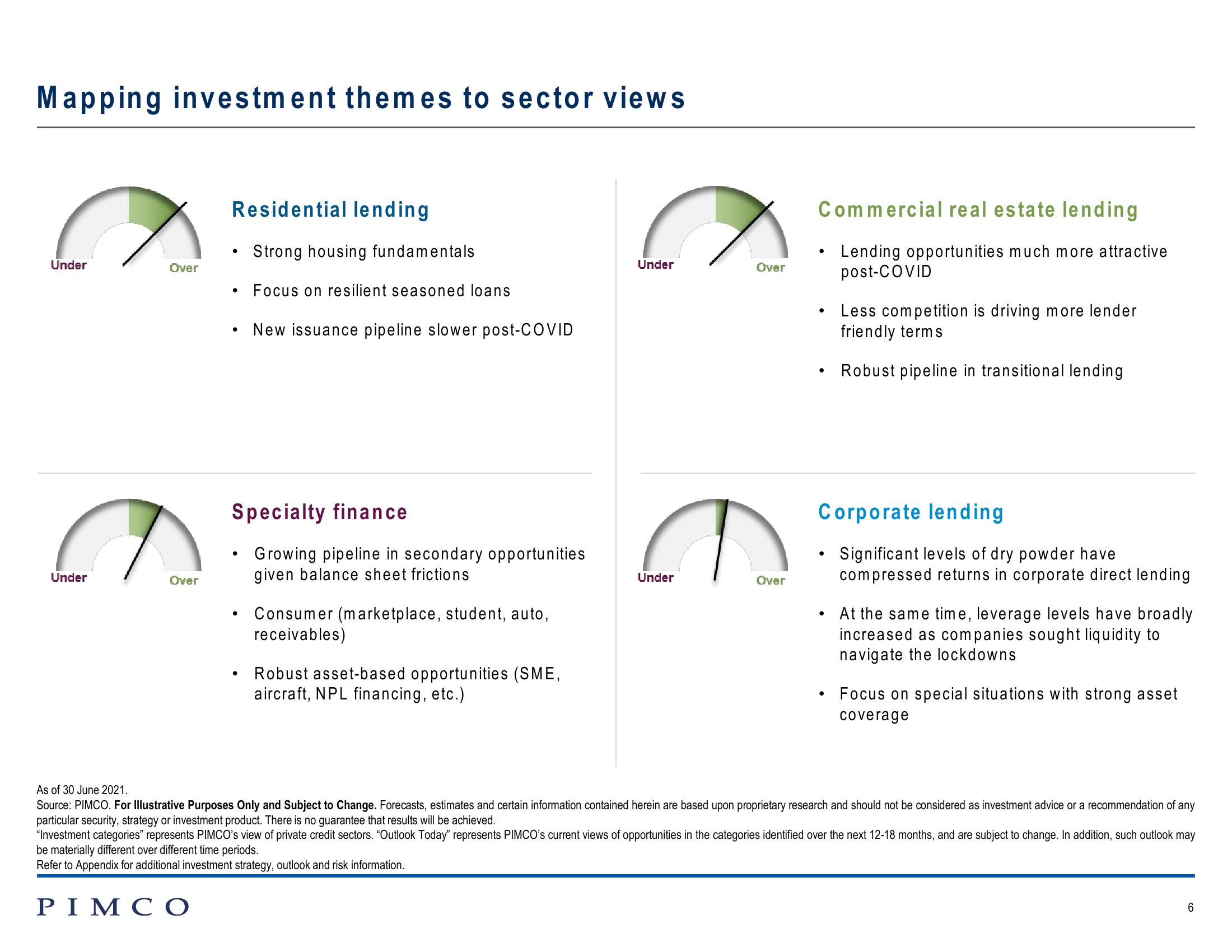

Mapping investment themes to sector views

Under

Over

€

Under

Over

Residential lending

Strong housing fundamentals

Focus on resilient seasoned loans

PIMCO

●

●

Specialty finance

• Growing pipeline in secondary opportunities

given balance sheet frictions

●

New issuance pipeline slower post-COVID

●

Consumer (marketplace, student, auto,

receivables)

Robust asset-based opportunities (SME,

aircraft, NPL financing, etc.)

Under

Under

Over

Over

Commercial real estate lending

Lending opportunities much more attractive

post-COVID

●

Corporate lending

Significant levels of dry powder have

compressed returns in corporate direct lending

●

Less competition is driving more lender

friendly terms

Robust pipeline in transitional lending

●

At the same time, leverage levels have broadly

increased as companies sought liquidity to

navigate the lockdowns

Focus on special situations with strong asset

coverage

As of 30 June 2021.

Source: PIMCO. For Illustrative Purposes Only and Subject to Change. Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any

particular security, strategy or investment product. There is no guarantee that results will be achieved.

"Investment categories" represents PIMCO's view of private credit sectors. "Outlook Today" represents PIMCO's current views of opportunities in the categories identified over the next 12-18 months, and are subject to change. In addition, such outlook may

be materially different over different time periods.

Refer to Appendix for additional investment strategy, outlook and risk information.

6View entire presentation