Bed Bath & Beyond Results Presentation Deck

TRANSFORMATION UPDATE

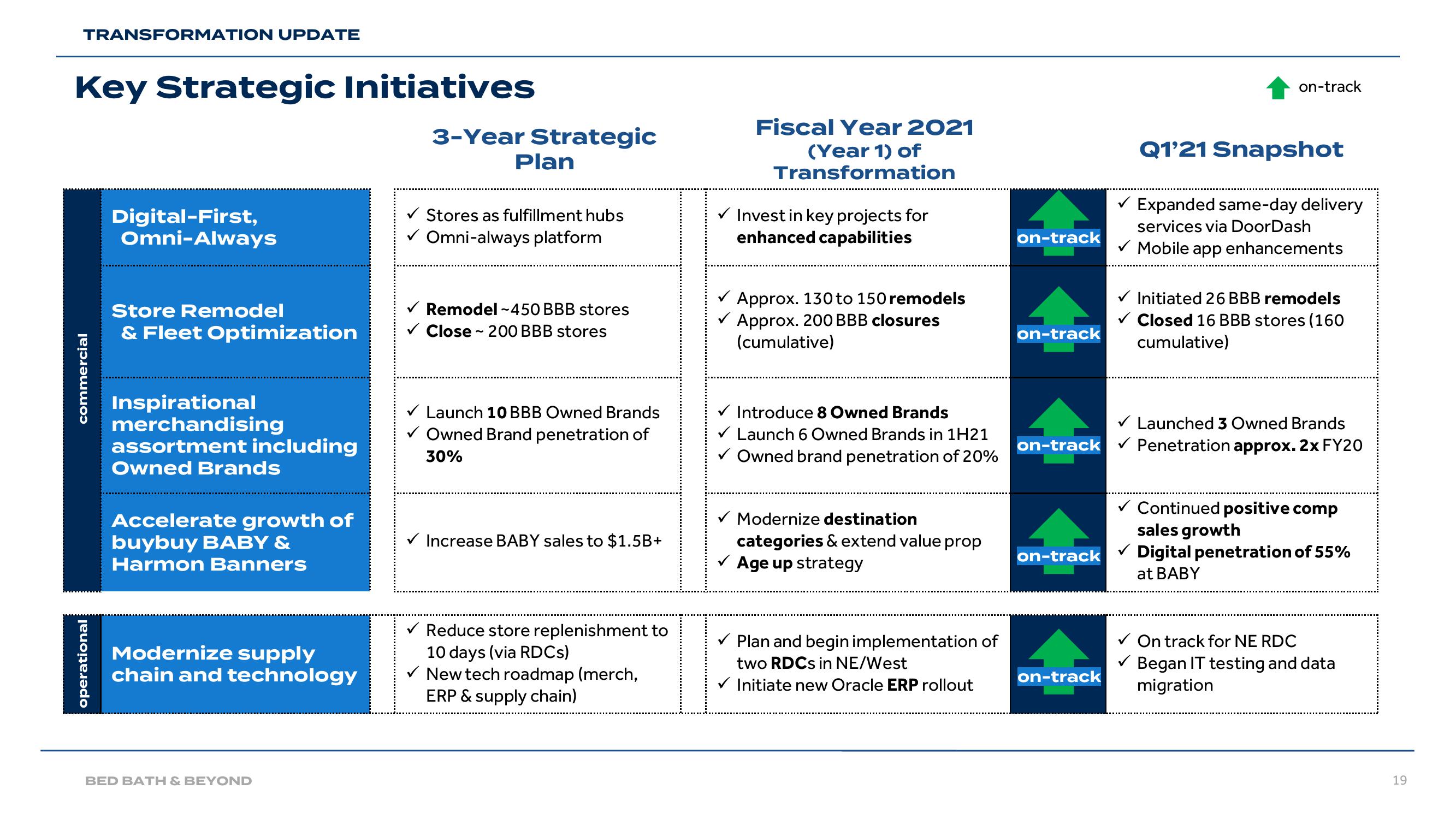

Key Strategic Initiatives

commercial

operational

Digital-First,

Omni-Always

Store Remodel

& Fleet Optimization

Inspirational

merchandising

assortment including

Owned Brands

Accelerate growth of

buybuy BABY &

Harmon Banners

Modernize supply

chain and technology

BED BATH & BEYOND

3-Year Strategic

Plan

Stores as fulfillment hubs

✓ Omni-always platform

Remodel-450 BBB stores

✓Close ~200 BBB stores

✓ Launch 10 BBB Owned Brands

✓ Owned Brand penetration of

30%

✓ Increase BABY sales to $1.5B+

✓ Reduce store replenishment to

10 days (via RDCs)

✓ New tech roadmap (merch,

ERP & supply chain)

Fiscal Year 2021

(Year 1) of

Transformation

✓ Invest in key projects for

enhanced capabilities

Approx. 130 to 150 remodels

✓ Approx. 200 BBB closures

(cumulative)

✓ Introduce 8 Owned Brands

✓ Launch 6 Owned Brands in 1H21

✓ Owned brand penetration of 20%

✓ Modernize destination

categories & extend value prop

✓ Age up strategy

✓ Plan and begin implementation of

two RDCs in NE/West

✓ Initiate new Oracle ERP rollout

on-track

on-track

on-track

on-track

on-track

Q1'21 Snapshot

Expanded same-day delivery

services via DoorDash

✓ Mobile app enhancements

Launched 3 Owned Brands

on-track✔ Penetration approx. 2x FY20

✓ Initiated 26 BBB remodels

✓Closed 16 BBB stores (160

cumulative)

V

Continued positive comp

sales growth

Digital penetration of 55%

at BABY

✓ On track for NE RDC

✓ Began IT testing and data

migration

19View entire presentation