Moelis & Company Investment Banking Pitch Book

STRICTLY CONFIDENTIAL

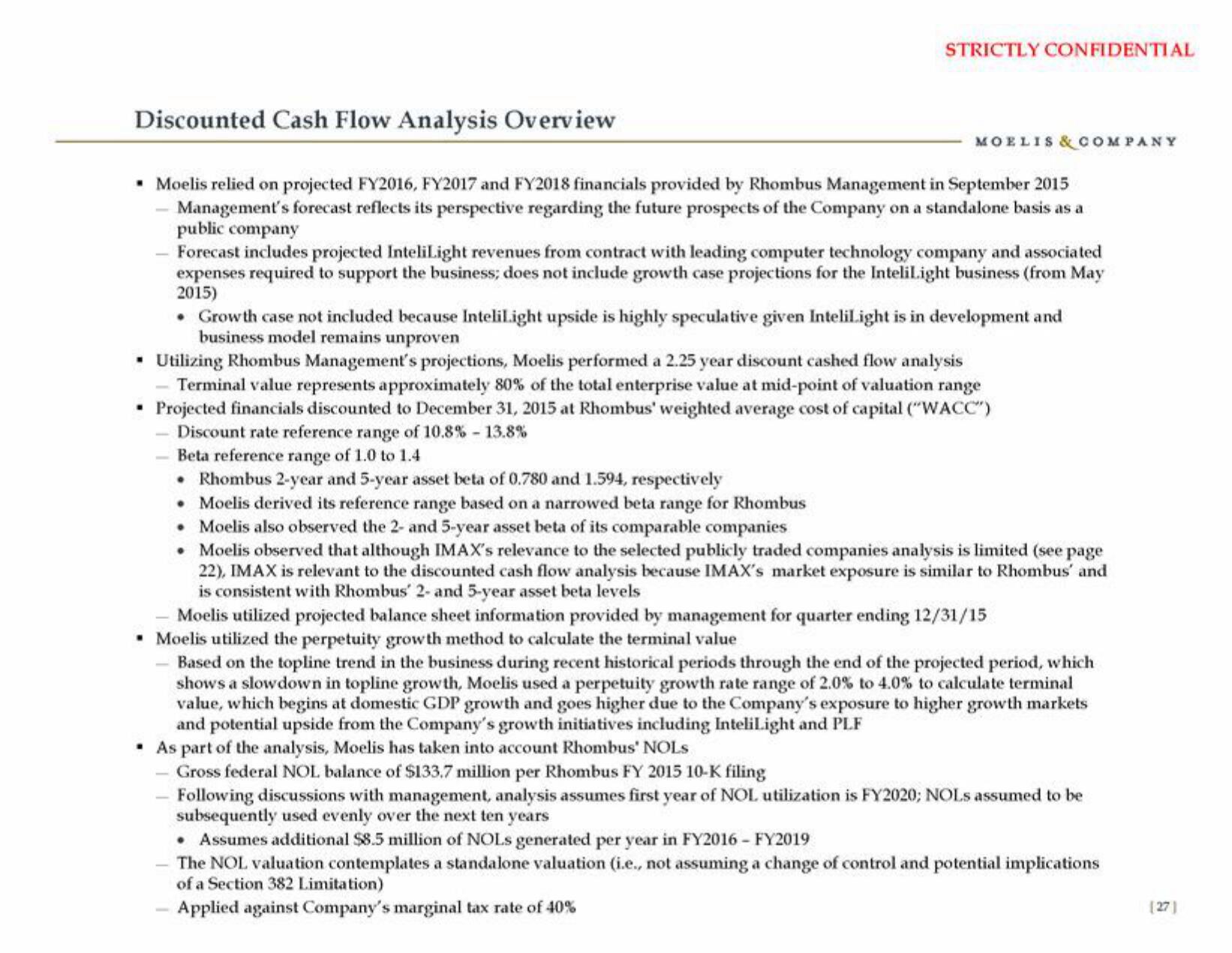

Discounted Cash Flow Analysis Overview

▪ Moelis relied on projected FY2016, FY2017 and FY2018 financials provided by Rhombus Management in September 2015

Management's forecast reflects its perspective regarding the future prospects of the Company on a standalone basis as a

public company

Forecast includes projected InteliLight revenues from contract with leading computer technology company and associated

expenses required to support the business; does not include growth case projections for the InteliLight business (from May

2015)

MOELIS & COMPANY

• Growth case not included because InteliLight upside is highly speculative given InteliLight is in development and

business model remains unproven

■ Utilizing Rhombus Management's projections, Moelis performed a 2.25 year discount cashed flow analysis

Terminal value represents approximately 80% of the total enterprise value at mid-point of valuation range

• Projected financials discounted to December 31, 2015 at Rhombus' weighted average cost of capital ("WACC")

Discount rate reference range of 10.8% -13.8%

Beta reference range of 1.0 to 1.4

• Rhombus 2-year and 5-year asset beta of 0.780 and 1.594, respectively

• Moelis derived its reference range based on a narrowed beta range for Rhombus

• Moelis also observed the 2- and 5-year asset beta of its comparable companies

• Moelis observed that although IMAX's relevance to the selected publicly traded companies analysis is limited (see page

22), IMAX is relevant to the discounted cash flow analysis because IMAX's market exposure is similar to Rhombus' and

is consistent with Rhombus' 2- and 5-year asset beta levels

Moelis utilized projected balance sheet information provided by management for quarter ending 12/31/15

• Moelis utilized the perpetuity growth method to calculate the terminal value

- Based on the topline trend in the business during recent historical periods through the end of the projected period, which

shows a slow down in topline growth, Moelis used a perpetuity growth rate range of 2.0% to 4.0% to calculate terminal

value, which begins at domestic GDP growth and goes higher due to the Company's exposure to higher growth markets

and potential upside from the Company's growth initiatives including InteliLight and PLF

. As part of the analysis, Moelis has taken into account Rhombus' NOLS

Gross federal NOL balance of $133.7 million per Rhombus FY 2015 10-K filing

- Following discussions with management, analysis assumes first year of NOL utilization is FY2020; NOLs assumed to be

subsequently used evenly over the next ten years

Assumes additional $8.5 million of NOLS generated per year in FY2016 - FY2019

The NOL valuation contemplates a standalone valuation (i.e., not assuming a change of control and potential implications

of a Section 382 Limitation)

- Applied against Company's marginal tax rate of 40%

(27)View entire presentation