Selina SPAC

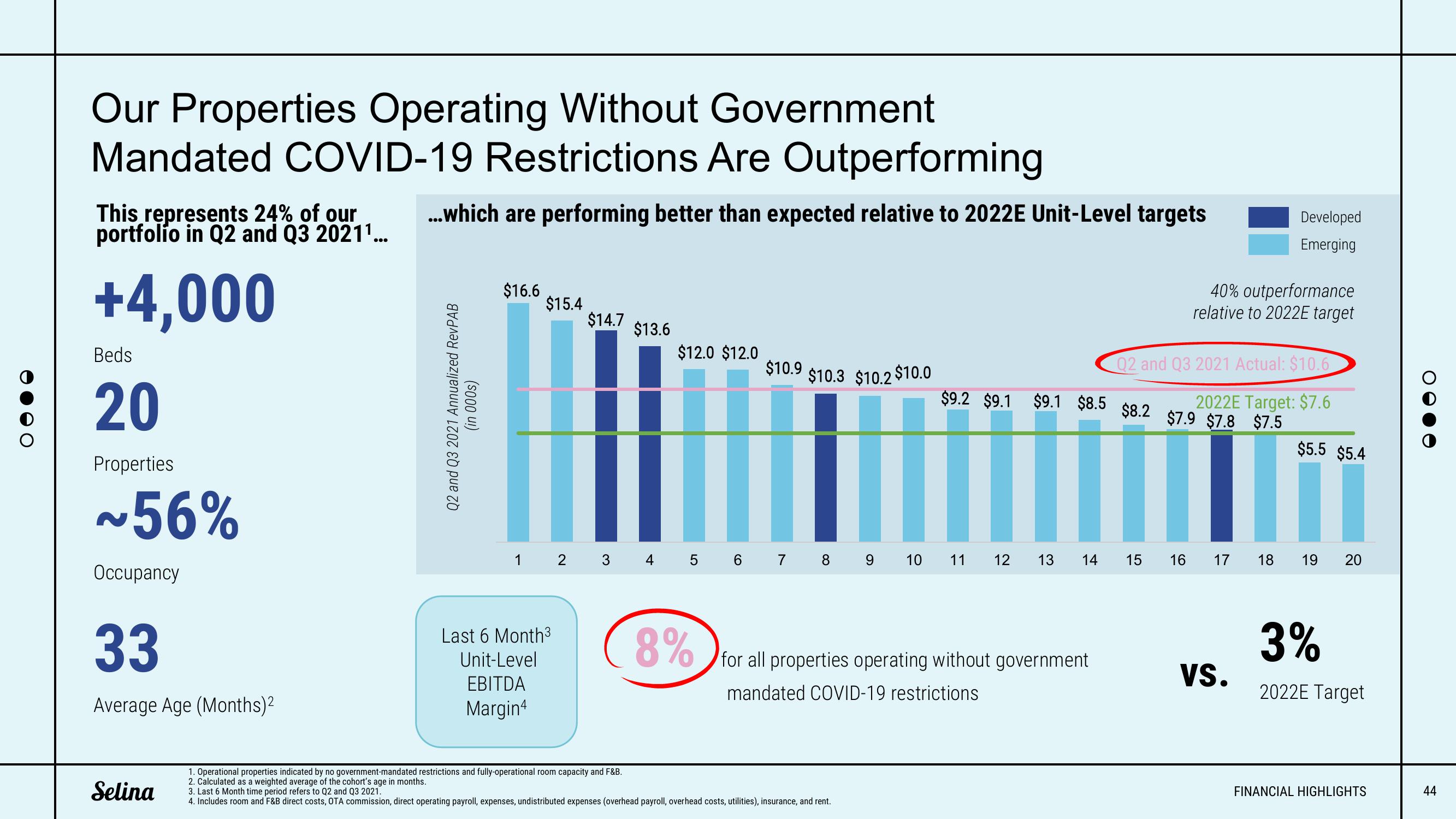

Our Properties Operating Without Government

Mandated COVID-19 Restrictions Are Outperforming

This represents 24% of our

portfolio in Q2 and Q3 20211...

+4,000

33

Average Age (Months)2

...which are performing better than expected relative to 2022E Unit-Level targets

Selina

Q2 and Q3 2021 Annualized RevPAB

(in 000s)

$16.6

$15.4

$14.7

Beds

20

Properties

~56% /////////////

Occupancy

$13.6

Last 6 Month³

Unit-Level

EBITDA

Margin4

$12.0 $12.0

$10.9

8%

$10.3 $10.2 $10.0

1 2 3 4 5 6 7 8 9 10 11

$9.2 $9.1 $9.1 $8.5

1. Operational properties indicated by no government-mandated restrictions and fully-operational room capacity and F&B.

2. Calculated as a weighted average of the cohort's age in months.

3. Last 6 Month time period refers to Q2 and Q3 2021.

4. Includes room and F&B direct costs, OTA commission, direct operating payroll, expenses, undistributed expenses (overhead payroll, overhead costs, utilities), insurance, and rent.

12

13 14

for all properties operating without government

mandated COVID-19 restrictions

$8.2

Q2 and Q3 2021 Actual: $10.6

2022E Target: $7.6

$7.9 $7.8 $7.5

15

40% outperformance

relative to 2022E target

16 17

Developed

Emerging

VS.

18

$5.5 $5.4

19

20

3%

2022E Target

FINANCIAL HIGHLIGHTS

44View entire presentation