Credit Suisse Investment Banking Pitch Book

Summary of merger consideration

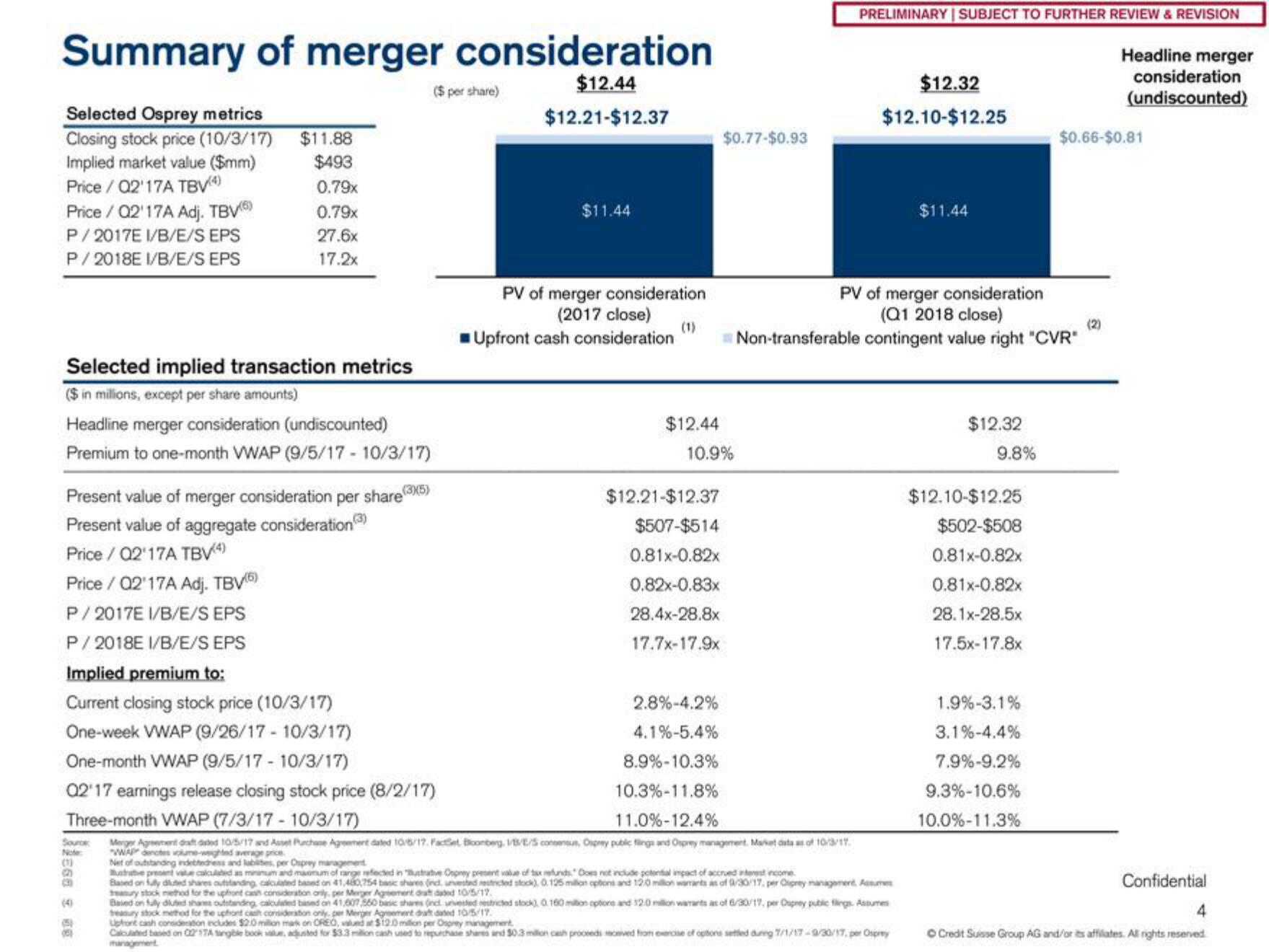

$12.44

$12.21-$12.37

Selected Osprey metrics

Closing stock price (10/3/17)

Implied market value ($mm)

Price/Q2'17A TBV(4)

Price/Q2'17A Adj. TBV(6)

P/2017E I/B/E/S EPS

P/2018E I/B/E/S EPS

$11.88

$493

0.79x

Selected implied transaction metrics

($ in millions, except per share amounts)

0.79x

27.6x

17.2x

Headline merger consideration (undiscounted)

Premium to one-month VWAP (9/5/17 - 10/3/17)

(3)(5)

Present value of merger consideration per share

Present value of aggregate consideration (3)

Price/Q2'17A TBV(4)

Price / 02'17A Adj. TBV(6)

P/2017E I/B/E/S EPS

P/2018E I/B/E/S EPS

Sourc

($ per share)

Implied premium to:

Current closing stock price (10/3/17)

One-week VWAP (9/26/17 - 10/3/17)

One-month VWAP (9/5/17 - 10/3/17)

02'17 earnings release closing stock price (8/2/17)

(5)

(0)

$11.44

PV of merger consideration

(2017 close)

Upfront cash consideration

$12.44

10.9%

$12.21-$12.37

$507-$514

0.81x-0.82x

0.82x-0.83x

28.4x-28.8x

17.7x-17.9x

$0.77-$0.93

2.8%-4.2%

4.1%-5.4%

8.9%-10.3%

10.3% -11.8%

Three-month VWAP (7/3/17 - 10/3/17)

11.0% -12.4%

Merger Agreement dat dated 10/5/17 and Asset Purchase Agreement dated 10/6/17. FactSet, Bloomberg, 1/B/E/S consensus, Osprey public flings and Osprey management Market data as of 10/3/17.

WAP denches volume-weighted average price

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

Net of outstanding indebtedness and lablites, per Osprey management

Bustrative present value calculated as minimum and maximum of range reflected in ustrative Osprey present value of tax refunds." Does not include potential impact of accrued interest income

$12.32

$12.10-$12.25

PV of merger consideration

(Q1 2018 close)

Non-transferable contingent value right "CVR"

Based on y diluted shares outstanding, calculated based on 41,460,754 basic shares (nd unvested restricted stock), 0.125 million options and 120 million warrants as of 9/30/17, per Opney management Assumes

teasury stock method for the upfront cash consideration only, per Merger Agreement dat dated 10/5/17.

Based on fully diluted shares outstanding, calculated based on 41,607,550 basic shares (incl. unvested restricted stock), 0160 million options and 12.0 million warrants as of 6/30/17, per Osprey public fings. Assumes

treasury stock method for the upfront cash consideration only. per Merger Agreement dat dated 10/5/17.

$11.44

Upfront cash consideration includes $2.0 million mark on OREO, valued at $12.0 million per Osprey management

Calculated based on 0217A single book value, adjusted for $3.3 million cash used to repurchase shares and 50.3 million cash proceeds received from exercise of options settled during 7/1/17-9/30/17, per Osprey

$12.32

9.8%

$12.10-$12.25

$502-$508

0.81x-0.82x

0.81x-0.82x

28.1x-28.5x

17.5x-17.8×

1.9%-3.1%

3.1% -4.4%

7.9%-9.2%

9.3%-10.6%

10.0% -11.3%

$0.66-$0.81

Headline merger

consideration

(undiscounted)

(2)

Confidential

4

Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation