Kinnevik Results Presentation Deck

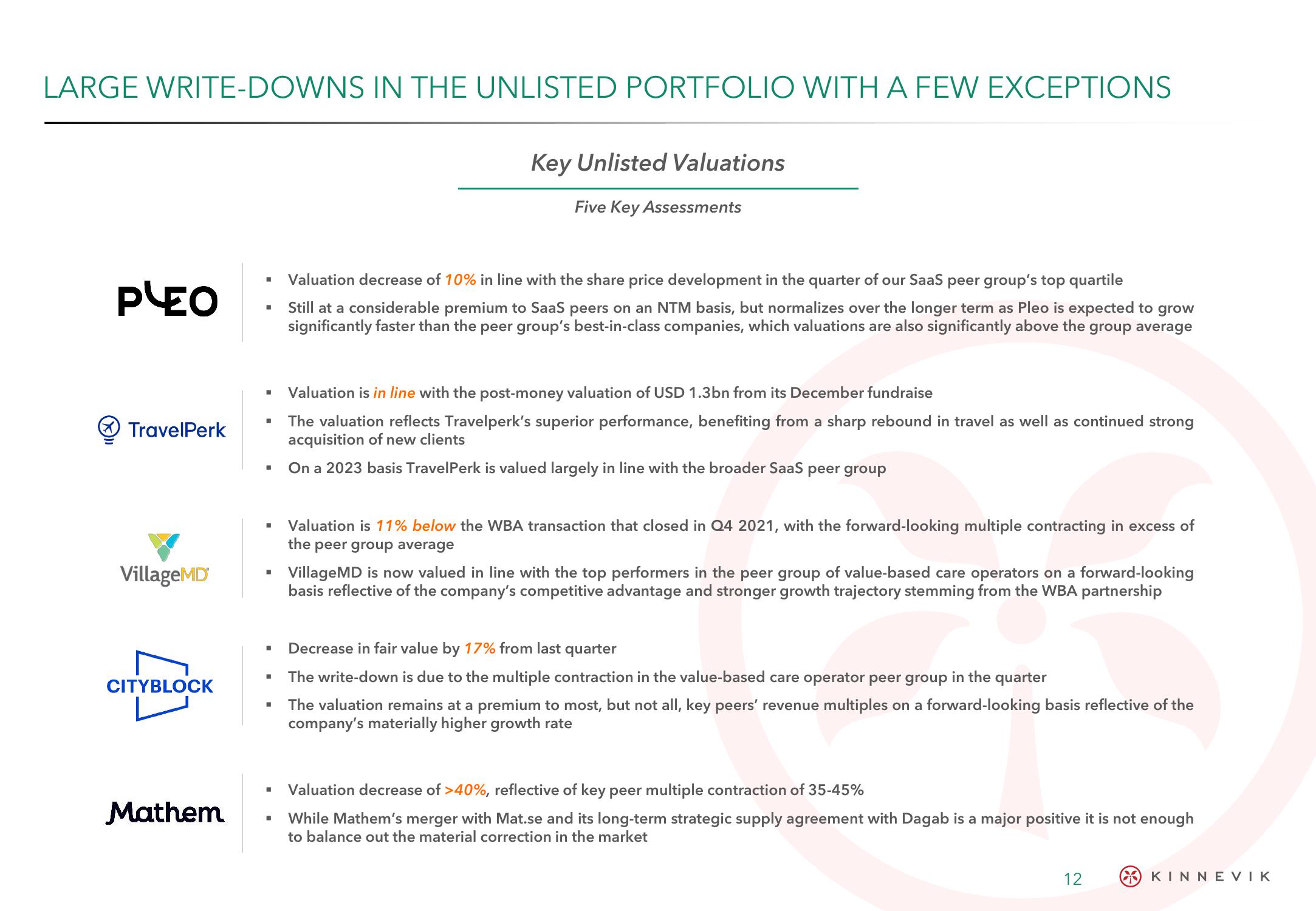

LARGE WRITE-DOWNS IN THE UNLISTED PORTFOLIO WITH A FEW EXCEPTIONS

PLEO

TravelPerk

VillageMD

CITYBLOCK

Mathem

"

"

■

■

I

I

Key Unlisted Valuations

Five Key Assessments

Valuation decrease of 10% in line with the share price development in the quarter of our SaaS peer group's top quartile

Still at a considerable premium to SaaS peers on an NTM basis, but normalizes over the longer term as Pleo is expected to grow

significantly faster than the peer group's best-in-class companies, which valuations are also significantly above the group average

Valuation is in line with the post-money valuation of USD 1.3bn from its December fundraise

The valuation reflects Travelperk's superior performance, benefiting from a sharp rebound in travel as well as continued strong

acquisition of new clients

On a 2023 basis TravelPerk is valued largely in line with the broader SaaS peer group

Valuation is 11% below the WBA transaction that closed in Q4 2021, with the forward-looking multiple contracting in excess of

the peer group average

VillageMD is now valued in line with the top performers in the peer group of value-based care operators on a forward-looking

basis reflective of the company's competitive advantage and stronger growth trajectory stemming from the WBA partnership

Decrease in fair value by 17% from last quarter

The write-down is due to the multiple contraction in the value-based care operator peer group in the quarter

The valuation remains at a premium to most, but not all, key peers' revenue multiples on a forward-looking basis reflective of the

company's materially higher growth rate

Valuation decrease of >40%, reflective of key peer multiple contraction of 35-45%

While Mathem's merger with Mat.se and its long-term strategic supply agreement with Dagab is a major positive it is not enough

to balance out the material correction in the market

12

KINNEVIKView entire presentation